Do you keep in mind the primary time you wrote a test for $100?

The primary $100 test I wrote was for my cellphone waaayyy again in 1997. Whoa…that brings again recollections. At that time, it hadn’t even occurred to me to invest the 100 dollars – I used to be simply glad to have my cellphone!

What about your first $100 test? Or your first $1,000 test? I guess you weren’t questioning how to invest $1,000 dollars then, had been you? Even higher, your first $10,000 test?

The primary time I wrote a test for $10,000 was to repay my scholar mortgage debt. That was, by far, the most effective test I ever wrote! For me the selection was clear, however the place to speculate $10K isn’t all the time a straightforward determination. I’m right here to assist!

By far the quickest and best solution to arrange a diversified portfolio of shares with $10,000 is thru Robinhood – our prime investing choose.

Here are 17 great ideas on how to smartly invest $10,000.

Top 17 Best Ways to Invest $10K in 2022

- High Yield Savings or CD

- Auto-Pilot Investing

- Real Estate

- Buy Bitcoin

- DIY Stock Market

- Your Home

- Inflation Hedge

- Coaching Program

- Professional Designation/Certification

- Go Back to School

- Online Courses

- Start a Business

- Start a Blog

- Launch a Podcast

- Resell Products on Amazon FBA

- Buy Sports Cards

- Pay Off Debt

Should you’re wanting particularly for short-term investment ideas, now we have solutions for these, too. Or, you probably have extra to speculate, try the best ways to invest $20,000 dollars!

1. Spend money on a Excessive Yielding Financial savings Account or CDs

If you wish to be fully secure, you possibly can make investments the cash in high-yielding CDs or a high-interest savings account. Nowadays the most effective charges are coming from on-line banks.

For instance, CIT Financial institution provides its Financial savings Builder Account. You may open an account with a minimal of $100, and safe an APY of as much as 0.95%.

On-line banks have all the benefits of conventional banks, together with debit playing cards and ATM entry.

Your deposits are coated by FDIC insurance coverage for as much as $250,000. And you’ve got all the advantages of coping with a good financial institution as a result of that’s precisely what these on-line banks are.

2. Auto-Pilot Investing

If you wish to put your cash right into a digital autopilot state of affairs, a robo-advisor could also be precisely what you’re in search of.

M1 Finance

M1 Finance is a brokerage the place you possibly can put money into inventory and ETFs for no charges. This provides them the most important variety of no-fee shares and ETFs of any brokerage on-line.

What places them within the Robo-Advisor class is that they’ve pre-made and managed portfolios the place you possibly can make investments your cash, nonetheless with no charges, robotically. You may as well create your personal auto investments, making M1 Finance one of many extra versatile methods to auto-invest.

Betterment

What is Betterment? It’s a web based funding administration platform, also known as a robo advisor, as a result of the whole lot is dealt with robotically for you. Funding choice, asset allocation, rebalancing, tax-loss harvesting – it’s all achieved for you, and at very affordable charges.

For instance, the annual administration charges are simply 0.35% – or $35 – on an account as much as $10,000. And it drops to 0.25% once you exceed $10,000, all the best way right down to 0.15% once you attain $100,000.

$10k received’t purchase you a lot in the best way of diversification with particular person shares, however it will likely be loads with Betterment.

3. Actual Property

Actual property is a wonderful funding, little doubt about it. However $10,000 isn’t sufficient to make a down cost on the acquisition of an funding property lately, not in most markets (until your my buddy that’s mastered buying real estate with no money down). However that doesn’t imply which you can’t put money into actual property.

One solution to do it’s via actual property funding trusts (REITs). These investments have a number of benefits over proudly owning property outright, together with:

- Excessive liquidity – you should buy and promote shares in REITs a lot the identical approach you commerce shares

- Diversification – REITs characterize a portfolio of business properties or mortgages, relatively than in a single piece of property or mortgage

- Excessive earnings – the dividends paid by REITs are normally properly above the dividend yields on shares, and in a distinct stratosphere in comparison with certificates of deposit

- Tax benefits – REITs don’t promote properties practically as regularly as mutual funds promote shares; the online result’s a lot decrease capital features

- You don’t must get your arms soiled – anybody who has ever owned an funding property can recognize this benefit

There are many REITs to select from on the market. The web has made it very simple to get began in REITs.

Some of the widespread is Fundrise. If you wish to get investing in actual property, Fundrise is hands-down the best solution to do it.

They stroll you thru the applying course of after which help you flick through all the attainable investments you possibly can put your cash in.

They’ve a $500 minimal funding, which is the smallest you’ll discover. With simply $500, you will get use their Starter Portfolio. With this portfolio, your cash can be put into a number of REITs. It’s a good way to get on the spot diversification.

One of many key advantages of utilizing Fundrise is the low charges. Most buyers pay 0.30 to 0.50 of their invested capital in charges yearly. It is a nice solution to make investments your cash with out your returns being eaten by charges.

Should you want to personal property, you possibly can think about pooling your $10,000 with a number of different buyers, and shopping for an funding property outright.

4. Purchase Bitcoin

Whether or not you’re crypto curious or suppose that cryptocurrency is the longer term now may be the proper time to lastly purchase into Bitcoin.

I was a crypto doubter however lastly relented when Bitcoin dropped to $7,000. Fortunately, each Bitcoin buy I made within the first couple of years has made me some good earnings.

After reaching a report excessive of $68,000 Bitcoin has traded up and down ever since. for a lot of hardliners this has solely created a shopping for alternative to get in on a dip.

So you probably have been on the sidelines ready on your likelihood to lastly personal some Bitcoin (or another cryptocurrency for that matter) it’s time to open your account on a crypto change and make that first buy.

5. DIY Inventory Market

Most individuals appear to want to speculate their cash in mutual funds, notably when it’s a comparatively small sum of money. However if you happen to’ve been exhibiting real ability to make money buying and selling shares by yourself, this may be a chance to take that as much as the subsequent stage.

You may open a web based low cost brokerage account via corporations like E*Trade and TD Ameritrade. These platforms have all of the instruments that you could develop into a complicated investor – together with instructional assets if you happen to want them.

And, the low charges are a godsend once you’re buying and selling particular person shares. In case you are excited about taking the subsequent step with a web based brokerage see our list of the best online brokerage accounts for every type of buyers.

6. Your House

Based on CEIC data, house values have elevated as a lot as 18.4% over the previous 5 years. Different areas like have seen much more progress similar to Nashville, TN, which has seen a 30.6% enhance in house costs.

With the price of supplies nonetheless at report costs, the housing market doesn’t appear to be slowing down anytime quickly.

So how are you going to benefit from this? A technique is by investing in your house. This might be a fundamental transform or discovering a intelligent approach so as to add sq. footage.

This clearly is smart solely in case you are trying to both promote or refinance your present mortgage. It additionally is smart if you realize the worth of your house. Listed here are some free websites that will give you a good idea of how much your home is worth.

Let’s say that you’ve got the power so as to add 1,000 sq. ft to your present house and a contractor is keen to do the job for $50,000. By including 1,000 sq. ft to your house let’s say your house presently attracts a $150 per sq. foot valuation, you’ve simply added $150,000 of potential fairness into your house.

Pretty easy solution to triple your cash!

When you’re achieved and also you’re excited about refinancing, remember to store round for the best mortgage refinance.

7. Inflation Hedge

Inflation hasn’t been a giant concern for many buyers over the past a number of years. However after lately the Authorities handed a number of financial reduction applications many concern that top inflation is simply across the nook.

There are a number of investments that offer an inflation hedge however the one which has develop into the preferred with buyers is the Sequence I Bond.

Sequence I Financial savings Bonds are a low-risk funding issued by the US Treasury that supply safety from inflation. These bonds earn curiosity by combining a set charge with a charge immediately tied to inflation as measured by the CPI (Client Priced Index).

These are provided immediately at Treasurydirect.gov and you should buy as much as $10,000 of those bonds every calendar 12 months.

And don’t be alarmed once you go to the web site, as a result of it does appear like it was created when the Web was:

That’s the Treasury.gov web site – I promise! 😂

For any investor that wishes the least quantity of danger attainable, Sequence I Financial savings Bonds ought to be on the prime of your listing.

Head on over to Treasurydirect.gov to seek out out what the most recent rate of interest is.

8. Teaching Applications

After we consider investing, we typically consider placing cash into property with the hope of getting a return on the funding. However the most effective funding which you can make are the sorts that you simply make in your self. Something that you are able to do to enhance your information and expertise – that may both allow you to dwell higher or to earn extra money – is a real funding.

One of many methods to do that is to place a few of your cash into teaching applications. That is particularly invaluable in case you are about to tackle a brand new enterprise, however don’t have a lot in the best way of related expertise.

Should you can sign-up for a training program with somebody who is definitely doing what it’s you want to enter, it is going to prevent a variety of time, effort, and cash. Because the saying goes, by no means attempt to reinvent the wheel. There are totally different teaching applications overlaying nearly any space you possibly can consider.

And whereas we’re on the subject, try my Strategic Coaching program to see what it could do for you. I completely find it irresistible!

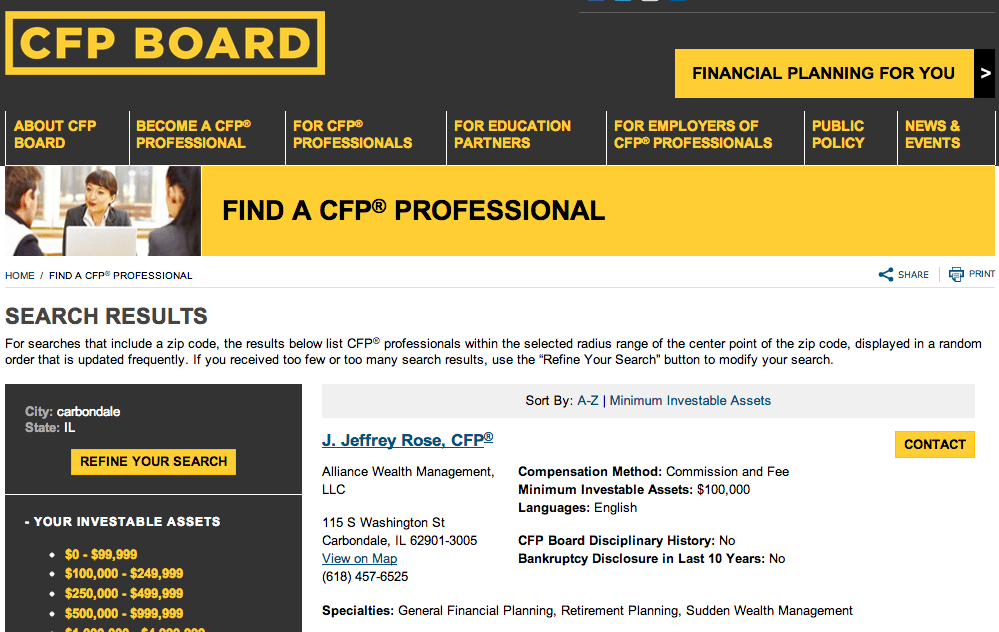

9. Getting a Designation

That is one other instance of investing in your self. No matter your profession is, you have to be wanting so as to add any essential designations on your discipline.

They’ll increase your visibility, your credibility, and the willingness of shoppers and purchasers to do enterprise with you.

I acquired my certification as a CFP® or Licensed Monetary Planner, and it enabled me to launch a completely new and rewarding profession.

Discover out what certifications characterize the highest of your discipline, and make investments some cash getting a designation for your self.

10. Going Again to Faculty

Should you really feel that your profession is stagnating, and lots of people do lately, going again to high school might be the most effective funding of money and time that you simply ever make. $10,000 received’t get you a graduate diploma at a reputation college, nevertheless it might cowl a lot and even most of the price of getting an affiliate’s diploma at your area people school.

This cash might current the proper alternative to retool into a brand new profession and one that’s much more related in as we speak’s economic system. Based on the National Association of Colleges and Employers’ 2019 Job Outlook survey, US employers plan to rent over 16% extra class of 2019 grads than they did 2018 grads. NACE’s knowledge means that 2019 holds essentially the most promising hiring outlook for brand spanking new school grads in over 10 years.

11. On-line Programs

If the thought of returning to high school to get a brand new diploma doesn’t enchantment to you, or in case you are at a degree in your life the place it’s just too inconvenient, you need to look into taking on-line programs. There are all types of programs obtainable that may allow you to transfer into a brand new profession or enterprise.

12. Beginning Your Personal Enterprise

That is one more instance of investing in your self. By beginning your personal enterprise, you set your self able to take most benefit of your information, expertise, and skills. That will increase the chance of your incomes a excessive earnings.

Leaving my previous brokerage agency and starting my own financial planning practice ranks as probably the greatest enterprise selections I’ve made. It undoubtedly had its scary moments, however the rewards have been wonderful.

Due to the Web, it’s very attainable to begin your personal enterprise with only a few thousand {dollars}. Heck, I began this weblog for lower than $500! Select the enterprise that you simply wish to go into, examine how one can market the enterprise via the Web, then provide you with a marketing strategy. $10K ought to be greater than sufficient to get began with.

In reality, you higher not begin out with greater than a $5,000 investment for a web based enterprise. There are many methods to begin a home-based business that require little or no upfront capital.

Yet one more level in beginning a enterprise. Whenever you put cash right into a given funding, you’re doing so with the concept it will likely be value extra money sooner or later. However when you could have a enterprise, it could offer you an earnings for the remainder of your life. That’s extra invaluable than simply about another funding which you can make.

13. Beginning a Weblog

This could be a successful concept on so many ranges, and also you in all probability received’t want wherever close to $10,000 to make it occur. Select a broad subject space – careers, know-how, finance, investments, actual property, or absolutely anything you’re excited about and have no less than above-average information – and construct a weblog round it.

That’s what I did with my weblog. As a monetary planner, it’s been straightforward for me to deal with private finance and monetary planning-related articles on an ongoing foundation.

My spouse had a distinct starting with her blog. It began as a solution to doc our rising household, however after she realized she might make extra money blogging she began specializing in issues that she was enthusiastic about motherhood, vogue, house decor, and our pending adoption. I’m nonetheless in amazement at how usually her house tour web page has been shared on Pinterest – over 1 million instances!

The thought is to create a web site with invaluable content material that may draw guests to it. And because it grows, you should have alternatives to monetize it via promoting, affiliate preparations (primarily, promoting different individuals’s merchandise), or as a platform to promote your personal services.

This might be a approach of building a side business, relatively than taking the plunge right into a full-time enterprise. You are able to do it as a sideline till you’re able to ramp it as much as full-time. And you’ll transfer at no matter tempo is comfy for you. However when you get going, a weblog could be an unbelievable supply of latest and thrilling alternatives – in addition to earnings.

14. Launching a Podcast

Podcasts are mainly weblog articles set to audio, however they’ve the benefit that they may also be positioned on different web sites for higher publicity. And simply as is the case with a weblog, there are methods which you can monetize podcasts.

The only approach is to do a sequence of podcasts and solicit listener donations. This could work fantastically you probably have a loyal following. You may as well get promoting sponsors, in a lot the identical approach that you’d for a weblog, who would pay for a point out in your podcast, or on the positioning the place the podcast seems.

John Lee Dumas from the top-rated podcast on iTunes has made a reputation for himself together with his podcast, Entrepreneur on Hearth. John launched his podcast in 2012 and since then has made virtually $3 million in income! The very best half is that he publishes his tremendous extremely detailed earnings experiences month-to-month for those who wish to chart his progress. To start with, a lot of his income was from advertisers and since then he has provided varied programs and merchandise for these excited about monetizing their merchandise. This man is really on fireplace! 🙂

15. Resell Merchandise on Amazon FBA

When you’ve got a expertise for locating bargains however have by no means had the inclination to promote a few of these bargains for revenue, Amazon FBA might be essentially the most hassle-free solution to do it.

FBA stands for Fulfillment by Amazon, and that’s precisely what they provide. You ship the objects you wish to promote to Amazon after which market them on the positioning.

As soon as they’ve been bought – within the regular approach that gross sales happen on Amazon – the corporate will deal with the delivery for you. It’s one of many best methods to run a web based enterprise.

16. Your Outdated Passion: Sports activities Playing cards

Do not forget that previous shoebox you’ve had stuffed in your closet with all of your baseball playing cards from once you had been a child?

It’s time to drag them out as a result of you could have a collectible {that a} sports activities fanatic is keen to pay prime greenback for.

After the pandemic, the sports activities card trade blew up. Playing cards from after I was a child, like Michael Jordan’s rookie card, had been promoting for report costs similar to this one for $840,000.

I used to be a collector as a child however didn’t suppose a lot in regards to the interest till my older boys began amassing. That’s what I found how a lot cash was pouring into sports activities playing cards.

Earlier than you dive in and begin throwing lots of if not 1000’s of {dollars} opening packs or looking for uncommon rookies, educate your self on how a lot sports activities playing cards are value finish the place is the most effective place to park your cash.

17. Pay Off Debt

That is essentially the most risk-free solution to make investments $10K – or any sum of money – and it supplies a nearly assured charge of return.

Let’s say that you’ve got a bank card with an impressive stability of $10,000, that has an annual rate of interest cost of 19.99%. By paying off the bank card, you’ll not solely get rid of the debt completely, however additionally, you will lock in what’s successfully a 19.99% return in your cash.

No, it received’t imply that you simply’ll be amassing a 19.99% charge of curiosity as a money earnings in your cash, however it is going to imply that you’re now not paying it – which is nearly the identical factor.

Right here’s one other plus: the 19.99% that you’ll earn in your cash (by not having to pay it out yearly) is earnings that you’ll not must pay any tax on. Should you had been receiving 19.99% on $10,000 immediately, a big chunk of the earnings must go to pay earnings taxes yearly.

The Backside Line

With inflation, $10K to speculate could not look like some huge cash lately, nevertheless it’s loads if you wish to get into some attention-grabbing and imaginative investments.

You should utilize them as a chance to develop your nest egg into one thing a lot, a lot bigger. It’s even sufficient so that you can get into three or 4 of those funding concepts, which offers you a chance to essentially develop your cash.

Give a few these a attempt to see in the event that they’ll give you the results you want!