You is likely to be questioning if $2 million {dollars} value of life insurance coverage is an excessive amount of. Nicely, it could possibly be.

However if you’re making an attempt to guard a big property and want a large lump sum to cowl funeral bills, property taxes, and different bills within the case of your eventual loss of life, you then perceive that significance and value isn’t a problem.

The Value of Such a Coverage

The idea of a $2 million life insurance coverage coverage may appear unaffordable. And this is likely to be the case when you have severe well being circumstances – what life insurance coverage firms would contemplate “excessive threat”.

However in the event you recognized a transparent want for the sort of life insurance coverage protection, you owe it to your self and your loved ones to not less than discover all of your choices.

This, in fact, comes with the advantage of figuring out your loved ones is safe within the occasion one thing unlucky occurs.

Bigger plans value extra will cowl better bills, however have better month-to-month coverage prices in change. To be clear, you possibly can anticipate to pay anyplace between $105 and $223 {dollars} in your insurance coverage coverage.

How A lot Life Insurance coverage Do You Want?

It’s best to plan forward when contemplating such a severe choice, although plans for insurance policies as much as two million {dollars} could be bought underneath the correct circumstances. The month-to-month value for the sort of coverage will doubtless be not less than a number of hundred {dollars} a month, so funds properly.

When you compare different life insurance companies, you’ll doubtless discover a fee you possibly can afford every month. Doing this may can help you get provides from a number of suppliers so you don’t find yourself paying greater than it is best to.

Consulting with your loved ones prior to creating any severe buying selections ought to enable you the prospect to clarify what is going to occur within the occasion this coverage is acted upon.

It’s an unlucky scenario after they have to be turned in, however it may occur so talk about the whole lot with the individuals you care about. The speed you pay now will guarantee your family members are protected, so that you and the people near you’ve got the peace of thoughts you actually want.

Pattern Charges for a $2 Million Greenback Time period Coverage

How a lot your $2 million greenback coverage will value will depend upon a wide range of elements equivalent to age, well being, time period, and the corporate you select.

Under are some pattern charges of 20-year time period insurance policies for each women and men.

$2 million time period life charges for males

| Intercourse | Age | $2,000,000 20 12 months Time period |

|---|---|---|

| Male | 30 | $66.12/mo |

| Male | 40 | $104.40/mo |

| Male | 50 | $299.28/mo |

| Male | 60 | $846.90/mo |

| Male | 70 | $3,191.13/mo |

$2 million time period life charges for girls

| Intercourse | Age | $2,000,000 20 12 months Time period |

|---|---|---|

| Feminine | 30 | $55.68/mo |

| Feminine | 40 | $88.74/mo |

| Feminine | 50 | $216.27/mo |

| Feminine | 60 | $577.61/mo |

| Feminine | 70 | $2,093.44 |

The above figures ought to offer you an approximate vary of how time period premiums can enhance by age and likewise by gender.

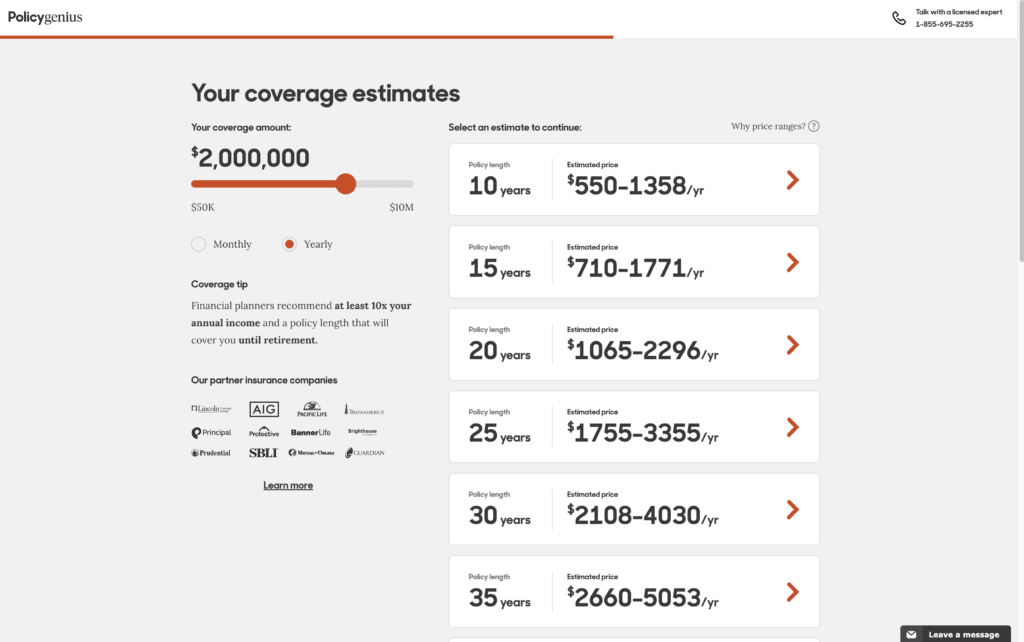

I used to be curious to see how a lot a $2 million coverage value for a male in good well being and determined to make use of one in every of our companions, Coverage Genius, as my guinea pig.

When you click on on their hyperlink, you’ll be taken to this web page:

You’ll then undergo a number of prompts that ask you key questions to find out what your targets are by buying such a big insurance coverage coverage.

Don’t rush by means of these questions. It’s necessary for them – and also you! – so you already know you’re getting precisely what you want.

After answering all the invention questions, I used to be in a position to get an approximate value for a $2 million coverage.

As soon as once more I entered info for a 40-year-old male in good well being and you’ll shortly see just a few issues:

- Coverage Genius provides as much as $10 million of life insurance coverage – that’s quite a bit!

- You possibly can select a shorter time period of solely 10 years.

- You may also select a 35-year time period coverage.

The massive takeaway right here is you’ve got choices!

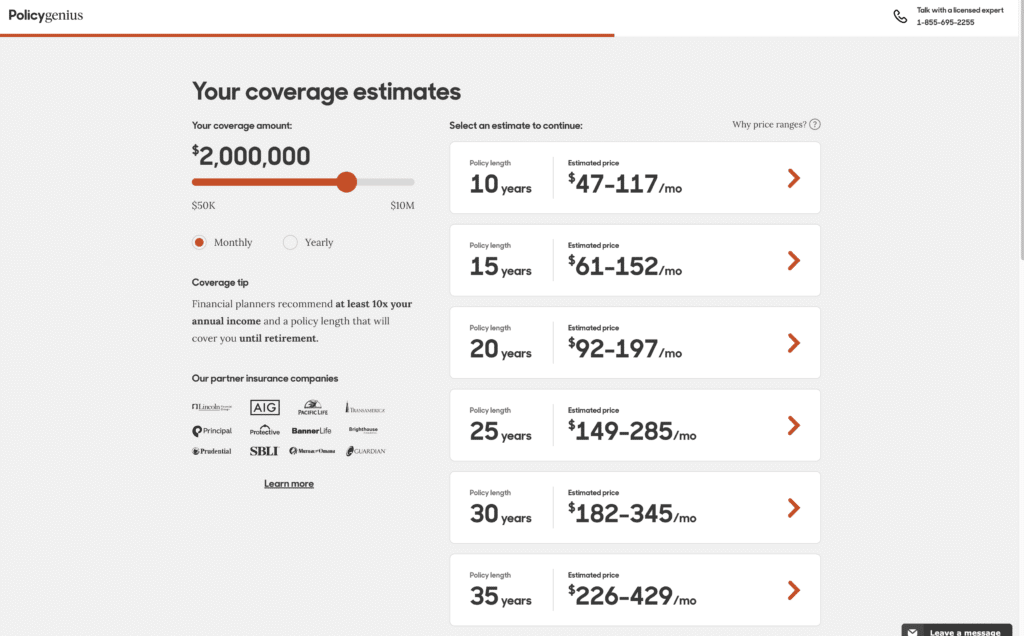

However in the event you can’t afford the annual premiums it’s also possible to select month-to-month pay as I present right here:

So in the event you’re a 40-year-old male and are curious how a lot a 20-year $2 million time period life insurance coverage coverage prices you possibly can assume it will likely be someplace within the vary of $92-$197.

Customise Your Life Insurance coverage Plan

Every plan could be custom-made to the person who obtains it, so when speaking with the individuals who find yourself issuing it to you be sure you absolutely perceive the small print. Generally there could be areas not fully understood that if ignored could trigger issues.

The individuals you speak with about these plans may also help you study concerning the nuisances concerned, equivalent to your present well being standing, and even monetary state.

You’ll doubtless find yourself with an awesome plan in the event you do the analysis wanted for the correct life insurance coverage coverage.

What’s Lined Underneath a $2 Million Greenback Coverage?

For some individuals, such a big coverage may appear ridiculous and a waste of month-to-month premiums, however there are lots of people that ought to contemplate a big coverage.

If it’s simply you and your partner with no kids, then these plans in all probability aren’t the most suitable choice, however when you have a number of younger kids and hundreds of {dollars} in debt, it is best to take a severe have a look at your life insurance policy.

If in case you have a number of kids, particularly younger kids, that time period life insurance coverage coverage that you just purchased 15 years in the past in all probability isn’t sufficient. Consider the entire bills that will be left behind in the event you had been to move away.

Mortgage funds, automobile loans, bank card payments, scholar loans, your kids’s scholar loans sooner or later, it’s all beginning to add up fairly shortly, isn’t it? Happily, most $2 million insurance policies are usually not as costly as one might imagine.

Saving Cash in your $2 Million Coverage

As a result of the coverage is so giant, the month-to-month premiums will value extra, however try the following pointers to be able to get higher charges and maintain more cash in your pocket.

Once you’re making use of for the coverage, the corporate goes to take a look at your age and well being, in addition to any harmful hobbies that you just may need. So long as you aren’t a skydiver or excessive rock climber, most hobbies received’t depend towards you.

The place most individuals trigger their charges to go up is within the well being division. Getting the gymnasium just a few months earlier than making use of in your coverage ought to be a aim.

This implies reducing your ldl cholesterol, reducing your blood strain, and dropping just a few further kilos. Being chubby or overweight can add lots of or hundreds of {dollars} to your month-to-month premiums. Preserve regular at hitting the treadmill and watching your carbs.

Other than hitting the gymnasium and skipping the additional dessert, tobacco utilization is the subsequent largest issue that may trigger your premiums to undergo the roof. Being thought of a smoker could cause your charges to routinely double or triple. Whilst you can nonetheless get a policy if you’re a smoker, it’s going to value you.

A easy factor you are able to do to save cash in your life insurance coverage is to kick the cigarettes. Not solely are they unhealthy in your lungs, however they’re horrible in your checking account. Give up smoking and your physician and pockets will thanks.

Shopping for $2 Million Greenback Life Insurance coverage

However the best methods to save cash is to buy round before you purchase a coverage. As a result of every firm is completely different, every of them could have completely different charges for his or her insurance policies and all of them will have a look at your well being in a different way.

Greater than doubtless, the primary firm that you just contact isn’t going to have the bottom charges accessible. It’s necessary to get quotes from dozens of life insurance coverage firms so those you like essentially the most are fully lined.

Some firms have extra expertise than others with bigger insurance policies, these firms may also help be sure that you’re completely covered for an affordable price.

We are able to prevent hours of time, frustration and value. Merely click on on the map above and the quotes will come to you!