This text is an on-site model of our Unhedged e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. Generally markets transfer as a result of they study one thing new. Different occasions, they transfer as a result of they’re pressured to see what was at all times proper in entrance of them. I feel yesterday was the latter type of day. Disagree? E mail me: [email protected]

An disagreeable encounter with actuality

The market had anticipated — “hoped” could also be a greater phrase — that the benign CPI inflation studying for July could be adopted by a nonetheless extra benign one for August. As everyone knows now, this didn’t occur. In any respect. The result’s {that a} chart of month-over-month change in core CPI now reveals no considerable downtrend over the previous 12 months. Inflation is actually not rising. But it surely positive doesn’t seem like it’s falling, both:

The market responded yesterday by resetting its expectations for Federal Reserve coverage and slashing threat asset costs. The “terminal,” or estimated peak Fed coverage price, anticipated to reach early subsequent 12 months, rose 28 foundation factors, to 4.31 per cent. As of Monday, the futures market had been pricing in no probability of a 100 foundation level price improve when the central financial institution meets subsequent week. By Tuesday night it reckoned the adjustments at one in three. The brief finish of the yield curve leapt, deepening the inversion of 2- and 10-year rates of interest. Shares bought throttled. The Nasdaq misplaced greater than 5 per cent. Each sector was down huge.

An overreaction? In a way, sure: there was nothing within the August report that ought to have basically modified the steadiness of dangers going through the market. Earlier than the report, there have been sound causes to assume inflation will abate earlier than lengthy. They continue to be sound. However the market had been too optimistic about what the trail to decrease inflation would seem like, and had blithely discounted stern statements of intent from the Fed. Tuesday’s rout seems much less just like the absorption of recent info than a lack of naivety.

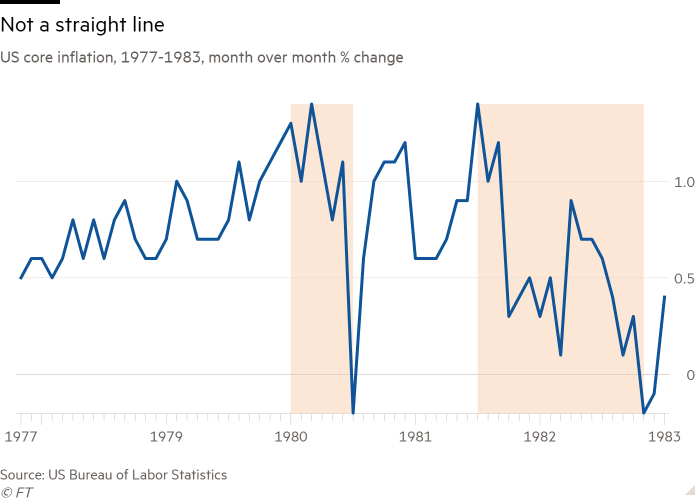

No matter occurs to inflation within the subsequent 12 months or two, numerous volatility within the worth indices is a certainty. Repeating what Unhedged has written earlier than, there is no such thing as a such factor as excessive and secure inflation. Even when inflation declines from right here, the decline won’t be clean. Here’s a chart of core CPI within the final huge inflationary episode, on the daybreak of the Nineteen Eighties. It was characterised by nauseating month-to-month swings:

This time round, the August numbers gained’t be the final shock. On the similar time, although, we all know core CPI is one thing of a lagging indicator. It’s clear, as Unhedged wrote yesterday, that housing inflation has all however abated. Certainly housing deflation is threatening. However it will likely be subsequent 12 months, in all probability, earlier than this shift reveals up within the CPI numbers. For August, shelter inflation was up .07 per cent from July, a brand new excessive for this cycle. And shelter has a 33 per cent weighting within the index.

Disinflationary flags are waving outdoors of housing, too. “We will see disinflation in all places besides within the official CPI statistics,” Paul Ashworth of Capital Economics wrote to shoppers on Tuesday. After I requested for specifics, he famous that “journey providers costs — airfares — are coming down. The greenback is hovering, delivery charges are collapsing. The normalisation of provider supply indices suggests shortages are easing, retailers are complaining about being caught with an excessive amount of stock. Used automobile public sale costs are dropping again.”

The issue — each earlier than Tuesday’s dangerous numbers, and after them — is wages, that are growing at about 6 per cent or extra (relying in your measure) towards the backdrop of a persistently tight labour market. The truth that providers inflation (excluding shelter providers) remained elevated in August is a nasty reminder of this truth. So long as wages are operating scorching the opportunity of a wage-price spiral can’t be dominated out, and the Fed can not again off.

Readers could wish to return and reread Fed chair Jay Powell’s current speech in Jackson Gap. It all of a sudden seems prescient. A number of snippets seize the tone:

Decreasing inflation is prone to require a sustained interval of below-trend progress. Furthermore, there’ll very doubtless be some softening of labour market situations . . . estimates of longer-run impartial aren’t a spot to cease or pause . . . The historic report cautions strongly towards prematurely loosening coverage . . . Our financial coverage deliberations and choices construct on what we have now realized about inflation dynamics each from the excessive and risky inflation of the Seventies and Nineteen Eighties . . . longer-term inflation expectations seem to stay nicely anchored . . . However that’s not grounds for complacency, with inflation having run nicely above our aim for a while . . . The longer the present bout of excessive inflation continues, the larger the prospect that expectations of upper inflation will change into entrenched . . . we should maintain at it till the job is completed

One CPI report, benign or malign, was by no means going to sway the Fed. Whether or not they maintain plugging at 75 or push to 100, the central financial institution is aware of it has an extended solution to go. Till wages and the costs that observe wages are means down, they don’t seem to be going to pivot. Why would they?

One good learn

In case you missed it yesterday, the FT’s “debt monsters” compendium of hyper-leveraged corporates going through scepticism from bond markets is a wealthy menu of binary bets — corporations that may both be damaged by a downturn or catapult out of it.