This text is an on-site model of our Commerce Secrets and techniques publication. Join here to get the publication despatched straight to your inbox each Monday

Welcome to Commerce Secrets and techniques. I do know. I KNOW. I promised you and myself that regardless of shifting to London in the summertime I wouldn’t get pulled into writing often in regards to the UK. However come on, it’s compulsive stuff for worldwide financial system watchers. Even my publication comrades on the glorious Unhedged, who are inclined to eschew commentary on topics not American (versus un-American, that’s a distinct factor) succumbed on Friday. I’m taking a world perspective on the UK’s excuse for its forex fall (now reversed) and bond meltdown (very a lot not reversed), ie that it’s an area manifestation of a world drawback. Charted waters is about sterling’s historic week.

Get in contact. Electronic mail me at [email protected]

The Truss fund that’s operating out of capital

One thing to have a good time for Liz Truss: as of at the moment, October 3, she’s survived 27 days in workplace. That’s 3 times longer than the 9 days clocked up in 1553 by Girl Jane Gray, England’s shortest-reigning monarch, although nonetheless in need of the report brevity of 118 days as prime minister, managed by George Canning in 1827 (Canning at the very least had a superb excuse, dying immediately whereas in workplace).

From aspirant worldwide exemplar for reform-led development to international cautionary story in a month is kind of the narrative arc. Truss’s authorities has tried in charge the worldwide scenario for its troubles, an excuse used earlier than by prime minister Gordon Brown (two years, 318 days), who saved intoning that the banking meltdown in 2008 “began in America”. So every week after the “mini” Budget and its unfunded tax cuts, let’s stand again, have a look at the worldwide scenario and ask: is that this excuse affordable? Are all superior economies in hassle with currencies and sovereign debt, with the UK simply the primary to go?

Rising US rates of interest and the power shock on high of pandemic-related spending has actually made it tough for everybody. The European Systemic Danger Board, tasked with macroprudential fretting about monetary stability within the EU, not too long ago issued a generalised warning about heightened threat. As Adam Tooze summarises here, there’s loads of justified concern about bond markets globally.

However whereas the UK had a troublesome hand like everybody else, handing out unfunded tax cuts and promising extra to come back was ham-fisted ideological incompetence. Even chancellor Kwasi Kwarteng’s announcement on Monday that he was reversing the choice to scrap the highest fee of tax following Conservative MPs’ protests is not going to, I feel, restore buyers’ confidence in Truss’s administration sufficient. The scale even of the remaining tax reduce bundle in creating a way of fiscal irresponsibility will stay.

The simultaneous falls in sterling and authorities bond costs final week had individuals calling the UK an rising market. However the UK’s structural benefits each render the comparability a bit foolish and underline how astonishing and pointless the crash was. Opposite to fashionable perception that it’s now not a reserve forex (for what being a “reserve forex” is price, which is debatable), IMF data present that sterling makes up nearly 5 per cent of world overseas change reserves. That’s a better share than the Swiss, Australian and Canadian currencies put collectively, means greater than the Chinese language renminbi, barely beneath the yen’s allocation and positively above the UK’s share of current-value world GDP at round 3 per cent (the euro’s equal numbers had been 15 per cent and nearly 19 per cent). The UK borrows in sterling: depreciation doesn’t enhance the debt burden. It has by no means defaulted on its sovereign debt. The markets have historically reduce it loads of slack.

Following the worldwide monetary disaster, David Cameron’s authorities (which appeared fairly unhealthy to me on the time however was a crack squad of Platonic philosopher-kings in contrast with this lot) made the other mistake to Truss’s, embarking on a completely pointless fiscal tightening, claiming that the UK was heading into debt hassle because of elevated borrowing to deal with the banking issues within the GFC. The truth that it missed these fiscal targets and but markets had been fully unfazed, as with each superior financial system which borrowed in and managed its personal forex (therefore not Greece), signifies this alarmism was completely misplaced.

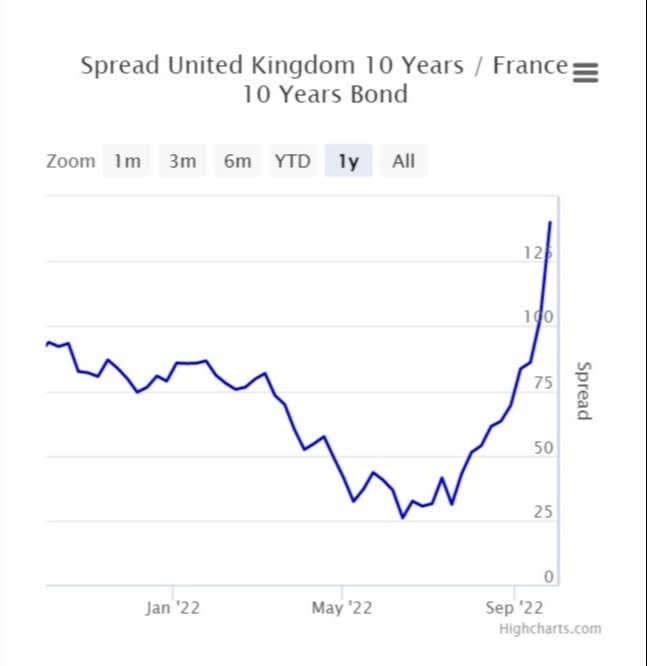

Truss used up that slack — in all probability decreased from the lack of credibility from the mishandling of Brexit, however absolutely nonetheless substantial — and went far additional. The UK’s boneheaded actions created worldwide bond market contagion final week, which might not have occurred with out underlying issues. However a easy have a look at bond spreads in opposition to not simply US Treasuries however German and French debt, charted by Worldgovernmentbonds.com, confirms that it’s the UK that has the intense challenge.

Over the previous two weeks France, Eire and the Netherlands delivered budgets. France’s, in particular, contained vital new spending regarding the power shock. None precipitated a market meltdown. And so far as coverage contagion goes, let’s face it, if another superior economies had been pondering of asserting unfunded tax cuts, they actually aren’t now.

The UK has a excessive however not crippling debt-to-GDP ratio — it’s comfortably lower than in France. What the previous few many years recommend are that markets are considerably forgiving of one-off increments to debt, be that to pay for the GFC financial institution bailouts, earnings help through the coronavirus pandemic or cushioning the price of the power shock to households and companies. What freaks them out is the sense that the federal government doesn’t have a reputable path in direction of fiscal stability nor the political consensus to determine one. This was the identical cause the UK, once more alone of the superior economies, needed to borrow from the IMF in 1976.

The excuse about worldwide traits is feeble. The UK in some methods has some benefits over different superior economies, and positively over rising markets, and it’s nonetheless managed to make a hash of a mini-Finances. A cheerful 27-day anniversary to Liz Truss. If she survives three days into the brand new yr, by my reckoning, she’ll handle to limp previous Canning’s 118-day report. Women and gents, place your bets, please.

In addition to this text, I write a Commerce Secrets and techniques column for FT.com each Wednesday. Click on right here to learn the newest, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

It was a historic week for the British pound, and what might be the beginning of a spiralling disaster of credibility for the Truss administration.

Kwarteng’s announcement of a debt-funded £45bn bundle of tax cuts despatched sterling to a report low of $1.035 in opposition to the US forex final Monday — the bottom for the reason that decimalisation of the pound in 1971 — earlier than recovering barely on Friday. That was decrease than when it fell to a 31-year low after the 2016 Brexit vote, because the chart beneath exhibits.

What spooked markets essentially the most was not simply the brand new borrowing proposal, however the cavalier means during which Kwarteng and Truss have sidelined huge establishments designed to guard the financial system, such because the Financial institution of England and the Workplace for Finances Accountability.

All of this, critics say, provides as much as proof that the government has bungled its big economic moment, my colleague George Parker explains. (Jennifer Creery)

Commerce hyperlinks

The World Commerce Group’s annual public discussion board, someplace between an educational convention and a enterprise conference for the commerce coverage world, befell final week in Geneva. The total programme, with video and audio for lots of the periods, is here.

Buyers have withdrawn a report $70bn from rising markets this yr, additional proof of the strain being placed on indebted international locations from larger US charges and the sturdy greenback.

A uncommon apparent example of worldwide co-operation on crucial items provide chains noticed within the wild as Japan promised to subsidise the US chip producer Micron to spend money on its plant in Hiroshima.

Brazil has been voting for a brand new president, with implications for South America’s perspective to commerce and commerce agreements. If the leftwing challenger Luiz Inácio Lula da Silva wins as anticipated, the EU ought to be extra keen to finalise its draft commerce cope with Mercosur however Lula might want changes to the mental property and authorities procurement provisions.