That is the second half in a series about the crash within the Chinese language property market

In late 2013, the Chinese language Communist get together underneath its new chief Xi Jinping unveiled a hanging programme of reforms aimed toward rebalancing the world’s second-biggest economic system in favour of market forces and the personal sector.

Beneath its 60-point reform plan Xi’s new administration promised to eliminate obstacles that had been holding again consumer-led progress in China — together with imposing a property tax, granting extra land rights to farmers and migrant staff, and opening state-controlled sectors to personal capital.

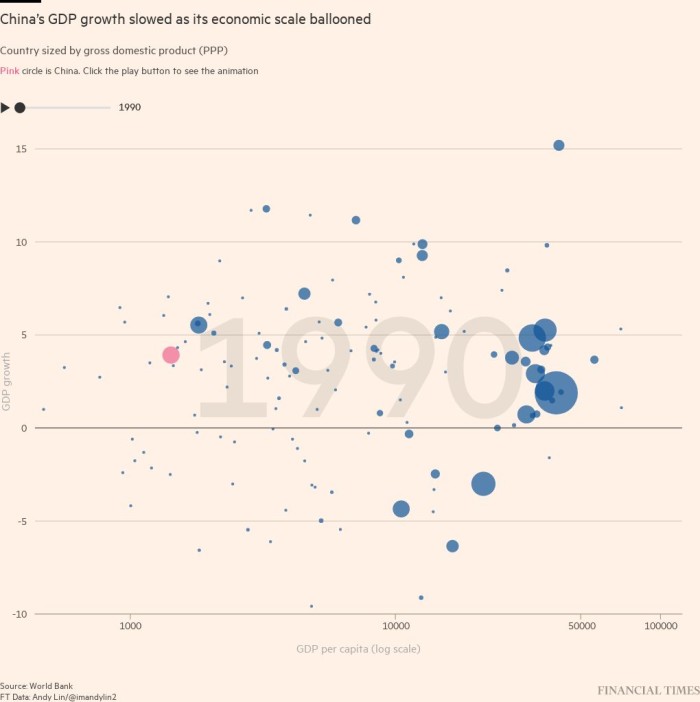

The state’s tight grip was about to ease. If carried out as deliberate, analysts predicted on the time, China might preserve 7 per cent annual gross home product progress for a minimum of the last decade to come back and make the transition into the class of high-income nations.

Nearly 10 years on, lots of these guarantees stay unfulfilled. On the similar time, the Chinese language economic system faces diminishing returns after relying for years on progress that has been propelled by a debt-fuelled actual property funding increase.

Battered by Xi’s controversial zero-Covid coverage, stiffening international financial headwinds and a slumping housing market, this yr is about to mark the primary time because the early Nineties that China’s progress fee will fall behind the remainder of the area.

As Xi approaches an unprecedented third time period in energy, he and his high lieutenants haven’t solely the fast process of orchestrating a smooth touchdown from turmoil roiling China’s property sector. They have to additionally reply to a stark query: with out property as China’s key driver, how can the economic system continue to grow?

“The 60 reforms would have largely expanded the function of consumption and personal initiatives,” says Chen Zhiwu, a professor in Chinese language finance and economic system on the College of Hong Kong. “Nonetheless, the market-oriented reform agenda has been largely sidelined . . . leading to a bigger function for the state and a shrunken function for the personal sector.”

Yixiao Zhou, an professional on China’s economic system at Australian Nationwide College, says Xi’s administration missed a “window of alternative” throughout a interval of relative financial and geopolitical stability to undertake troublesome coverage overhauls.

Beijing would possibly now be compelled to behave because the fallout from the property meltdown hammers China’s near-term progress prospects. “You want urgency, a disaster, to do it,” she says. “I might count on to see extra coverage modifications and reforms.”

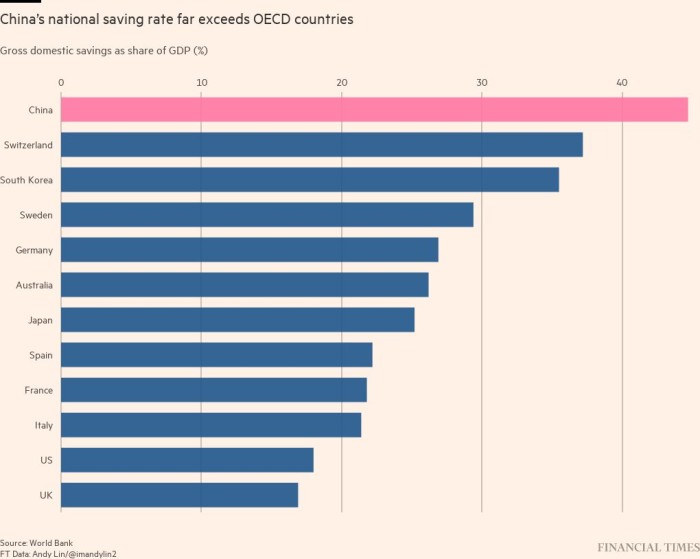

Given the comparatively modest function that consumption performs in its economic system, the IMF has described China has a “international outlier”. The nation’s gross home financial savings as a share of GDP is 44 per cent, in contrast with a median of twenty-two.5 per cent amongst OECD members. Over the long run, a lot of that is believed to be precautionary financial savings, money put apart for housing, training, healthcare and retirement.

China’s property crash

In a two-part sequence, the FT appears at how the stoop in home costs is inflicting a pointy slowdown in China’s economic system

Earlier story: ‘a slow-motion financial crisis’

That is proof, in line with critics, that whereas China’s economic system has been rising, it has didn’t construct up the form of pension system and different types of social security web that may make folks snug about spending extra of their revenue.

Bert Hofman, a former Beijing-based nation director for China on the World Financial institution, is satisfied that suppressed client demand might be unlocked “comparatively shortly”. This could require a sequence of coverage modifications focused at assuaging the anxieties that drive Chinese language family to save lots of at charges far higher than most international locations.

“It truly is the family financial savings that offers you low consumption . . . China is on the degree of revenue the place different international locations have constructed security nets and due to this fact, they thrived in additional home demand,” he says.

The IMF estimates that “if Chinese language households consumed comparably to Brazilian households, their consumption ranges can be greater than double”.

Nonetheless, many consultants consider that the very reforms that would propel — and maintain — China into a brand new period of progress run counter to Xi’s quest for higher management and defence of the pursuits of the ruling CCP.

“China is a middle-income economic system, it has an extended technique to go earlier than it turns into a high-income economic system,” says Nancy Qian, a Shanghai-born professor of economics at Northwestern College. “I don’t assume China goes to turn into a developed economic system or a wealthy nation any time quickly”.

The street not taken

As he spearheaded China’s reforms within the Nineteen Eighties and Nineties and set the nation on a path to prosperity, Deng Xiaoping’s determination to “let some folks get wealthy first” appeared to vary without end the contract between the Chinese language Communist get together and the folks underneath its rule.

Personal property markets turned an necessary a part of the brand new compact. With the state now not the only real developer and landlord, building boomed. The sweeping housing privatisation led to residence possession charges hovering from 20 per cent within the late Nineteen Eighties to greater than 90 per cent by 2007.

The interval marked the beginning of a homeowning center class, which swelled from fewer than 3 per cent of the inhabitants in 2000 to over half the inhabitants, greater than 700mn folks, by 2018. Actual GDP per capita grew virtually ten-fold within the 30 years from 1990 whereas wages within the cities quintupled.

Brad Setser, a senior fellow on the Council on Overseas Relations, a overseas coverage think-tank, says that China has sustained unusually excessive ranges of funding relative to the dimensions of its economic system, each in actual property and infrastructure, for longer than many critics thought potential.

“China hasn’t made the pivot [to a consumer-led economy] as a result of it hasn’t needed to,” says Setser, a former financial coverage official within the Obama and Biden administrations.

In tracing the origins of China’s “exceptionally excessive financial savings and low consumption” fee at present, the IMF notes “insufficient social spending” in addition to earlier modifications such because the one-child coverage and the “gradual dismantling of the social security web” within the Nineteen Eighties and Nineties.

The IMF additionally factors to quickly rising home costs — forcing folks to save lots of extra to cowl down funds and mortgages. Beneath Xi, the common worth within the Chinese language capital elevated about 166 per cent.

Rio Liu, a Beijing native and basic supervisor of a home liquor firm, is emblematic of the challenges now going through many in China’s center class.

Six years in the past, Liu’s mom required a hip substitute. When the household was knowledgeable of the upfront price — about Rmb200,000 ($28,000)— Liu was struck by how naive he had been in regards to the sum of money he would want to have stashed away to safe his household’s future.

“Authorities medical insurance coverage solely coated a small portion of the charges, and we would have liked to pay prematurely as nicely,” says the 37-year-old. “In the long run we went to a different hospital, the entire process price about Rmb50,000, insurance coverage coated perhaps Rmb15,000.”

Earlier than the pandemic, China’s well being expenditure as a share of GDP stood at 5.4 per cent, lower than half the OECD common of 12.5 per cent and 16.7 per cent within the US. And whereas state pension plans now attain about 1bn folks, in line with China Labour Bulletin, a Hong Kong-based NGO, the advantages “are very restricted” and lots of of hundreds of thousands of individuals — largely migrant staff and people with out safe jobs — stay uncovered.

After his mom’s hip was changed, Liu targeted on build up his private financial savings, aiming to keep up a float of a minimum of Rmb250,000 in money and liquid belongings ought to “uncertainties” once more befall him or his household. Whereas he pays to lift an toddler of his personal and fund his mortgage, he nonetheless strives to extend that financial savings pool.

“If we will save Rmb1,000 a month then that’s higher than nothing,” he says, including: “I’m not even excited about pension cash . . . Authorities pensions? You may’t rely on that.”

Whereas Beijing has made strikes to spice up the uptake of personal pensions and medical health insurance, Xi’s administration appears reluctant to tackle the form of structural reforms economists have known as for.

Final October in an essay printed within the CCP’s flagship journal Qiushi, Xi wrote that China ought to “enhance the pension and medical care assurance techniques . . . [and] progressively increase the extent of fundamental pension”. However, he added, the “authorities can’t care for all the pieces” and warned towards “falling into the lure of nurturing lazy folks via ‘welfarism’”.

In accordance with Setser, the healthiest path for China to return to a interval of sustained progress can be for the buyer engine to interchange, partly, the contribution as soon as supplied by actual property.

“That basically means . . . giving households confidence that they’ll reduce their precautionary financial savings,” he says.

Stephen Roach, an professional on China at Yale College, says that over years of asking senior Chinese language officers, together with former premier Wen Jiabao, why that they had not moved quicker to construct out a greater security web, “the solutions had been by no means passable”.

Hofman says that Chinese language officers have expressed concern over being “too beneficiant” in social providers provision.

“We all know from the worldwide proof that you must be excessively beneficiant earlier than you even have labour market results from social safety — they’re so far-off from that they don’t want to fret about it,” he provides.

“Programmes to spice up consumption and the necessity to ‘improve’ consumption are mentioned in Xinhua and Individuals’s Day by day just a few instances each week, and through financial coverage speeches they at all times promise to make consumption a way more necessary driver of progress sooner or later,” says Michael Pettis, a finance professor at Peking College. “However there nonetheless is a number of confusion about how you can do it.”

Unleashing the animal spirits

Whereas the stress on China’s progress mannequin has been constructing for years, these cracks have turn into wider in latest months.

Determined property builders in Henan, central China, marketed that they’d settle for shares of garlic as down funds on new residences from farmers, as a wave of rural-to-urban migrants slowed to a trickle. In cities throughout the nation 1000’s of individuals have began protesting by refusing to make mortgage funds on unfinished residences as builders go bust.

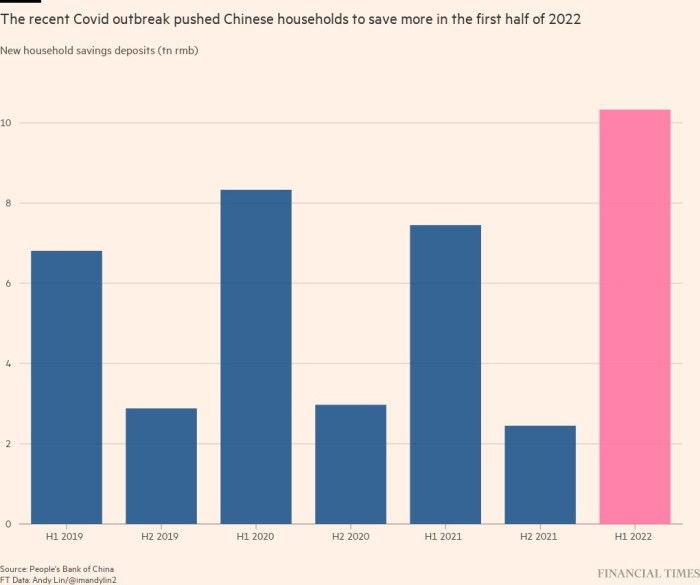

Souring sentiment has compelled home costs into retreat — eroding the worth of many households’ most necessary asset. Nervousness has been exacerbated by China’s relentless lockdowns and mass testing campaigns underneath Xi’s zero-Covid coverage.

Financial savings charges have elevated additional in response. Within the first half of 2022, households’ new financial savings deposits jumped greater than a 3rd yr on yr, to a document Rmb10.3tn ($1.4tn) and exceeding the Rmb9.9tn for all of 2021.

Beijing has in latest weeks ramped up policy-easing measures to assist cash-strapped property builders. However some consider that whereas Xi’s administration has been targeted on averting near-term financial shocks, it’s drifting farther from the coverage overhauls wanted to unlock totally the potential for client spending.

Pointing to the rising reassertion of party-state management over giant swaths of the economic system underneath Xi’s banner of “widespread prosperity”, many China watchers consider that Xi dangers not simply capping China’s progress, however dismantling a number of the financial dynamism that has lasted since Deng.

On the coronary heart of that resignation is a perception that Xi, China’s strongest chief since Mao Zedong, will prioritise the get together above all else.

Roach, who’s a former Morgan Stanley chief economist, says the form of individualism {that a} stronger client economic system requires goes towards the Chinese language system underneath Xi.

“To actually unleash the ‘animal spirits’ of a consumer-led society, you could take a look at the traits of what which means in different nations: it’s an aspirational mindset, upward mobility, freedom of communication, shared values that regularly change and transfer into new areas,” he says. “To a nation targeted on management, it’s antithetical to them.”

Dexter Roberts, a senior fellow with the Atlantic Council, says Xi, who has centralised authority throughout his decade in energy, has performed a essential function in “slowing down” social reforms once they threaten get together management.

He factors to 2 examples. First, guarantees to liberalise guidelines for rural land homeowners to freely purchase and promote property. And second, reforming the hukou family registration system, a core establishment that blocks China’s large migrant inhabitants — of just about 400mn — from some key providers.

“Xi Jinping believes these legacy establishments ought to have a key function, as a result of he believes that the get together ought to have a key function all through society,” says Roberts. “In the end, he’s not snug with the concept of free migration across the nation.”

Nonetheless, some longstanding China observers consider the rebalancing of the economic system in the direction of a consumer-led progress has made extra progress than critics enable.

Andy Rothman, an funding strategist at Matthews Asia, factors out that consumption and providers have been largest element of the economic system in every of the previous 10 years.

China, he provides, has progressively raised the brink for revenue beneath which individuals don’t need to pay any tax in any respect, which has basically meant near 100mn folks have dropped off the tax roll in recent times and have more cash to spend. Whereas progress on social reforms has not been adequate to chop the family financial savings fee, he says, as soon as the zero-Covid coverage is scrapped households can be left “sitting on an unlimited pile of money.”

The management in Beijing, he says, is underneath no phantasm that the years of constant double-digit progress are over.

“One of many causes they’re snug with that’s that’s the base impact: final yr, regardless that GDP progress was half the speed it was a decade in the past, the incremental growth within the dimension of China’s GDP was the largest in historical past.”

Mendacity flat

On the coronary heart of the talk over whether or not China can discover a new progress mannequin is a query over the boundaries of creativity, dynamism and innovation underneath authoritarian techniques.

Proof because the second world warfare, says Chen of HKU, reveals that “the upper the federal government’s management of a rustic’s economic system, the decrease the function for personal consumption in its financial mannequin”.

And there are some indicators that seeds of pessimism are taking maintain, particularly amongst youthful Chinese language.

Late final yr — months earlier than the brutal Shanghai lockdowns — the variety of candidates for China’s civil service examination, generally known as the guokao, elevated greater than a 3rd to 2.1mn, from 1.6mn in 2020, as youthful Chinese language sought the relative safety of presidency jobs. The tempo of progress in new small- to medium-sized companies in China has additionally began to sluggish.

Tina Yang is amongst a rising variety of younger Chinese language beginning to have doubts about her future. With a gaggle of pals she began a small impartial type design home when she was 19 and nonetheless learning trend at a college in Guangzhou, southern China.

“Seeing your designs being mass-produced and changing into one thing that clients put on each day could be very thrilling for a dressmaker,” the 25-year-old says.

Nonetheless, gross sales on her Taobao platform have been weaker for the previous few years as progress slowed. “There have been eight of us initially, 5 have left, 4 of them have gone again to their hometowns to work as civil servants . . . I’m apprehensive that if I don’t personal the enterprise, I received’t actually have a job anymore,” she says. “I feel I’ve hit a time when it’s too laborious for entrepreneurs.”

Roberts says except there’s a course correction and financial reforms are revived, China faces the distinct prospect of following the trail of nations resembling Russia, South Africa and Brazil which have struggled to realize the standing of a high-income nation.

Nonetheless, Rothman believes that the economic system nonetheless retains many strengths. Consumption will increase when a post-Covid rebound takes place. And lots of exterior China finally “misunderstand” Xi’s goals.

“He isn’t anti-markets, anti-private sector. His focus is on ensuring that as companies and folks get wealthy, they don’t problem the political management of the get together,” he says. “However he nonetheless needs them to get wealthy and drive the economic system.”

Further reporting by Nian Liu in Beijing, Qianer Liu in Hong Kong and Thomas Hale in Shanghai