Skilled says they should promote some leases and purchase a house of their very own

Evaluations and proposals are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made via hyperlinks on this web page.

Article content material

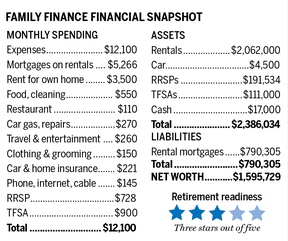

A pair we’ll name Ralph, 64, and Lucy, 60, dwell in British Columbia. Ralph is a tutorial, specializing in English literature, and Lucy is a sculptor. Collectively, they personal 5 leases, that are all worthwhile, however they don’t personal their very own dwelling, an ironic state of affairs with important tax implications. Their month-to-month earnings after tax is $12,100. Their aim is to retire in 5 years with $7,000 in after-tax retirement earnings.

Commercial 2

Article content material

E-mail [email protected] for a free Household Finance evaluation

Household Finance requested Derek Moran, head of Smarter Monetary Planning Ltd. in Kelowna, B.C., to work with the couple.

About that actual property…

The primary order of enterprise is their actual property holdings, Moran says. Their standing as homeless landlords means they need to pay $3,500 lease every month for their very own digs. But they don’t have the tax benefit of having the ability to promote a principal residence — if that they had one — with no tax on good points.

Article content material

Furthermore, as tenants they need to cowl landlord prices — together with property taxes — which might be a part of bills tenants finally pay. However they might defer paying property taxes on a B.C. dwelling of their very own at a value of 1 per cent per 12 months, although it could rise a bit, with reimbursement when their very own home is offered. There isn’t a comparable property tax deferral for landlords or tenants. In the meantime, the rents they acquire after bills are taxable.

Commercial 3

Article content material

“They should promote some leases and purchase a house of their very own,” Moran says.

The core difficulty is rationalization of the properties, for when one will get to the retained earnings after deductions, mortgage paydowns and all taxes, there may be simply $263 monthly earnings from $2,062,000 of leases. “It’s a very tax-inefficient scenario,” he provides.

The financial savings equations

Subsequent, the couple should deal with retirement financial savings. Of their tax brackets, RRSPs are extra advantageous than TFSAs.

Lucy presently has $144,534 in her RRSP and $90,000 in contribution room. Ralph has $47,000 in his RRSP and a further $47,000 of area, and will instantly contemplate transferring cash in from his TFSA, to present them extra tax reduction.

If he does so, their present complete of $$238,534, rising at three per cent after inflation per 12 months, will develop into $276,532 in 5 years and assist listed, splitable and taxable RRSP earnings of $13,698 per 12 months to Lucy’s age 95.

Commercial 4

Article content material

Aside from the switch, Ralph mustn’t add to his RRSPs. The federal Pension Adjustment, which caps RRSP room for individuals already contributing 18 per cent of earnings, will block additional RRSP contributions.

The TFSAs, presently with a $111,000 steadiness, will thus have a post-transfer steadiness of $64,000.

They’ve been paying down an additional $39,000 per 12 months to the rental mortgages. In the event that they put that into the TFSAs as a substitute for 5 years and develop it at three per cent over inflation, it ought to develop into $287,461 in 2022 {dollars}, Moran calculates. That capital would assist non-taxable payouts of $14,238 for the 30 years to Lucy’s age 95.

Enhancing future earnings

Squeezing retirement earnings out of the leases is more durable than simply pension arithmetic. The properties generate $64,613 per 12 months of web lease however a lot of this has to go to paydown of principal, which isn’t tax deductible. Deciding on which of 5 is hard. The criterion to make use of must be minimizing capital good points. Two models have appreciated comparatively little over their prices. A sale would liberate about $800,000 of money they might use to purchase a house.

Commercial 5

Article content material

With two offered, web lease would decline to $23,506 per 12 months. We’ll use this determine. Whole prices of dwelling possession would in all probability be lower than the $42,000 per 12 months the couple presently pays for lease. Over the following 5 years, that might be a financial savings of $210,000 lease paid with after-tax {dollars}. They might forego $22,000 per 12 months or $100,000 complete for 5 years for models offered of taxable earnings, Moran estimates, so they’d be $100,000 forward over 5 years.

Ralph will probably be eligible for full $7,707 annual OAS plus a deferral bonus of seven.2 per cent per 12 months — if he begins at age 69, that might be $9,926 per 12 months. Lucy may have an OAS profit at 65 based mostly on 38 years residence in Canada out of 40 required for full advantages, web $7,322 per 12 months. That’s a complete of $17,284 per 12 months.

Commercial 6

Article content material

In retirement beginning when Ralph is 69 and Lucy is 65, their base money circulate will probably be Ralph’s $1,200 month-to-month or $14,400 yearly outlined profit pension. He’ll get CPP pension earnings of $19,300 per 12 months based mostly on a profit enhance of 8.4 per cent per 12 months for 4 years work after age 65. Lucy may have $7,332 CPP earnings. They’ll add $13,698 RRSP earnings, $14,238 TFSA money circulate, $17,284 mixed OAS, and $23,506 rental earnings for complete retirement earnings of $109,623 earlier than splits.

Summing up retirement earnings

After splits of eligible taxable earnings (not together with TFSA earnings) and 13 per cent common, they’d have about $97,000 per 12 months to spend or $8,100 monthly.

With lease they presently pay, $3,500 monthly, eliminated, their current month-to-month allocations, $12,100, would fall to $8,600. As effectively, $1,628 would not go to RRSP and TFSA financial savings. They might successfully save a complete of $5,128 monthly.

Commercial 7

Article content material

-

This B.C. couple in their 40s has $3.1 million in assets, but is it enough to retire in five years?

-

This Ontario woman may need to downsize, work part-time to meet her retirement goals

-

A kitchen reno put a dent in this Alberta teacher’s TFSA. Now she has to play catch up for retirement

A few of their financial savings may go to financing their new home after a down cost based mostly on money harvested from sale of the 2 rental models.

They might pay no lease for his or her dwelling, be capable of promote their owner-occupied dwelling with out capital good points tax and even postpone cost of property taxes through a B.C. program that enables seniors to defer such taxes for one per cent slightly than compounding curiosity, however maybe a little bit extra as rates of interest rise with deferred taxes payable when their house is offered.

Rationalization of dwelling possession and switch of the lease they pay for his or her dwelling to mortgage funds, postponement of retirement to Ralph’s age 69 and Lucy’s age 65, and utility of the B.C. property tax postponement credit score, will permit the couple to exceed their $7,000 month-to-month after-tax retirement earnings goal, Moran concludes. “It is a case the place much less is extra. Simplicity is clearly its personal reward.”

Retirement stars: Three *** out of 5

Monetary Put up

E-mail [email protected] for a free Household Finance evaluation