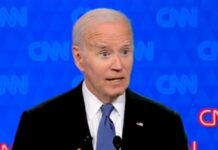

President Biden is rumored to make a long-awaited announcement on his plans to push ahead with pupil mortgage “forgiveness” and an anticipated extension on the federal pupil mortgage cost pause set to run out on the finish of this month.

Nevertheless, this announcement comes with combined opinions from his get together, who all the time appear to need extra.

The announcement is rumored to ivolve the cancellation of $10,000 in federal pupil loans for debtors who make lower than $125,000 a yr. (Sure, $125,000!)

Nevertheless, many needed varied plans that included $50,000 versus $10,000 with no revenue cap, to finish pupil mortgage forgiveness throughout the board.

So what would the ramifications be within the doubtless occasion that Uncle Joe forgives pupil loans? First, let’s see what this ‘present’ would price Individuals.

The function of presidency is to not be your mum or dad, it’s not be your monetary security web & it’s not be your spiritual compass.

Re-evaluate what roles we’re permitting authorities to regulate.— Josh Aikens NJ🇺🇸 ™️ (@Aikens_Josh) August 24, 2022

Bear in mind The Poorly-Named Inflation Discount Act?

Whereas I do know monetary ideas and economics aren’t everybody’s cup of tea, notably those that work within the White Home, it’s important to know some fundamental ideas when trying to manipulate. The most important lesson you possibly can educate your kids about economics and life, usually, is that nothing is ever “free.”

Scholar mortgage ‘forgiveness’ or ‘cancellation’ doesn’t do both. It merely transfers the legal responsibility to a different get together – on this case, the American taxpayer as a complete. It’s not as if there’s a cash tree in D.C. that sprouts greenback payments that may be plucked indefinitely. (Truly there may be – the Federal Reserve. However that free cash printing is inflation.)

Help Conservative Voices!

Signal as much as obtain the most recent political information, perception, and commentary delivered on to your inbox.

In accordance with the Penn Wharton budget model, the rumored plan of $10,000 would price the taxpayers $300 billion. The Committee for a Responsible Federal Budget believes that the plan would eat almost ten years of deficit discount and eradicate any disinflationary advantages from the Inflation Discount Act (IRA).

Not that this issues a lot since, overwhelmingly, specialists argued that the Inflation Discount Act wouldn’t scale back inflation. However then once more, Group Biden isn’t identified for financial acumen; maybe they need to’ve phoned a good friend on this one.

RELATED: Pandemic Triggers 89% Increase, $53 Billion, In Food Stamp Spending

Larry Summers And Nancy Pelosi Rain On The Parade

Larry Summers, former Treasury Secretary underneath President Clinton and financial advisor to President Obama, will not be a fan of pupil mortgage forgiveness. As the money man says:

“Scholar mortgage debt reduction is spending that raises demand and will increase inflation.”

However, Larry, how can that be?

For example how this ‘forgiveness’ would result in inflation, Arthur Laffer, who served on President Reagan’s financial coverage advisory board, explains:

“[Forgiving student loans] will scale back the variety of items, which is inflationary. It can improve the dimensions of the financial base, which can also be inflationary.”

Mr. Summers went on to say in regards to the plan:

“Each greenback spent on pupil mortgage reduction is a greenback that might have gone to assist those that don’t get the chance to go to school.”

I hate to let you know this, Larry; the Democrats not are the get together of the middle-class, blue-collar employees; they’re the get together of the elite. So who will profit from this ‘forgiveness’?

And there’s one other query we not ask on this nation: The place on this planet does the President get the authority to cancel pupil mortgage debt?

Is there a piece of Article II of the Structure written in invisible ink?

Proving that even a damaged clock is true as soon as each 82 years, Home Speaker Nancy Pelosi told reporters last July that Biden has no such authority to unilaterally “cancel” pupil mortgage debt.

“That’s not even a dialogue,” Pelosi mentioned.

So we will count on Congress to place a cease to this, proper?

— Scott Lincicome (@scottlincicome) August 24, 2022

RELATED: Senate Dems Want $21B for Covid-19, Other Viruses

What About The 80%?

There are an estimated 45 million Individuals who’ve pupil mortgage debt. Of those, about one-third owe lower than $10,000, and greater than half owe lower than $20,000. It doesn’t sound all that crippling to me once you evaluate these quantities to mortgage loans, bank card debt, and automotive loans.

My favorite statistic, nonetheless, is the proportion of Individuals with pupil mortgage debt. There are about 250 million grownup Individuals. So for those who do the maths (which I do know the White Home doesn’t love to do), meaning about 20% of Individuals have pupil mortgage debt.

So meaning 80% of Individuals who don’t have pupil loans both as a result of they have been adults and paid them off or didn’t go to school for varied causes get to foot the invoice for the opposite 20%. Moreover, the common college-educated pupil earns a better revenue than Individuals who didn’t attend school.

Have you learnt what that’s known as? Wealth distribution. Add to that the President’s expectation to increase the moratorium on pupil mortgage funds. Those that will profit would be the well-to-do.

Don’t consider me? Take Mr. Summers’ word for it:

“The worst thought could be a continuation of the present moratorium that advantages amongst others extremely paid surgeons, legal professionals and funding bankers.”

With the median household income in the United States sitting round $67K, having the revenue cap for mortgage forgiveness twice that quantity means a variety of well-off Individuals will reap the rewards of this ‘cancellation.’ A lot for serving to to boost those that are most in want.

Harvard has a $42 billion endowment. Yale’s is $31 billion. However Biden will tax truck drivers and plumbers to pay the scholar loans that constructed these empires.

— Matt Rinaldi (@MattRinaldiTX) August 23, 2022

Adulting Is Laborious, I Know

You’d assume the idea of paying one’s money owed and private duty wouldn’t be so exhausting to know. Because the Boston Herald editorial board so completely mentioned on the topic:

“…adults who assume debt are speculated to be accountable and pay for the issues they buy.”

They are saying that pupil mortgage forgiveness is a “slap within the face to all who sacrificed and labored additional jobs to repay their pupil loans.” Even the New York Times editorial board received in on the motion, stating:

“Such a transfer is legally doubtful, economically unsound, politically fraught and educationally problematic.”

I may need to take my temperature as a result of I agree with the New York Instances! The article quoted above discusses one thing I believe many dad and mom like myself want the main target could be on; making school extra inexpensive and value it.

my mortgage identifies as a pupil mortgage

— Andy Swan (@AndySwan) August 23, 2022

I’m a mum or dad of two kiddos. I believe a part of my job as a mum or dad is to need to work exhausting to supply the absolute best future for my youngsters. It needs to be difficult, but it surely shouldn’t be inconceivable.

And I’m not going to work myself to the bone to avoid wasting up for my child’s school training to allow them to be brainwashed by professors who need to inform them they’re oppressors as a result of they’re white or not the gender they have been born in.

RELATED: Democrats Try To Portray Themselves As ‘Independent’ From Party, Biden In Campaign Ads

What About Me?

Former White Home Press Secretary turned political commentator Dana Perino requested on Fox Information’ “The 5”:

“So what occurs to the man who took out a mortgage to get an F-150 in order that he might take his instruments round?”

Effectively, Dana, he will get to repay the scholar loans of the docs, legal professionals, and gender research graduates with greater taxes. She brings up a fantastic level, although.

I’m a school graduate, however I by no means had a pupil mortgage. My dad and mom couldn’t afford to ship me to high school, so I joined the navy.

It took me at the least twice as lengthy to get my school training as a result of I needed to juggle serving within the navy and college work and household. That meant late nights, weekends, and far schoolwork accomplished in battle zones.

With navy recruitment struggling, maybe the DOD and the White Home ought to take a look at incentivizing school graduates to placed on the uniform for some time to repay their loans. Additionally, I hear the navy has glorious housing and medical advantages.

Now could be the time to assist and share the sources you belief.

The Political Insider ranks #3 on Feedspot’s “100 Greatest Political Blogs and Web sites.”