Instantly after concluding his first month-to-month financial coverage assembly as chancellor and elevating rates of interest by 1 / 4 level to six.25 per cent, Gordon Brown dropped a bombshell. The primary financial coverage assembly of the brand new Labour authorities with Financial institution of England governor Eddie George was additionally to be its final.

From that second on Could 6 1997, the BoE could be impartial to set rates of interest by means of its newly created Financial Coverage Committee. Now, 25 years later, the independence of the central financial institution has not been severely questioned below 5 prime ministers and 6 chancellors of the exchequer.

“It’s superb how [BoE] independence has grow to be a part of the [UK’s] institutional furnishings,” Ed Balls, then Brown’s adviser and architect of the plan, informed the FT.

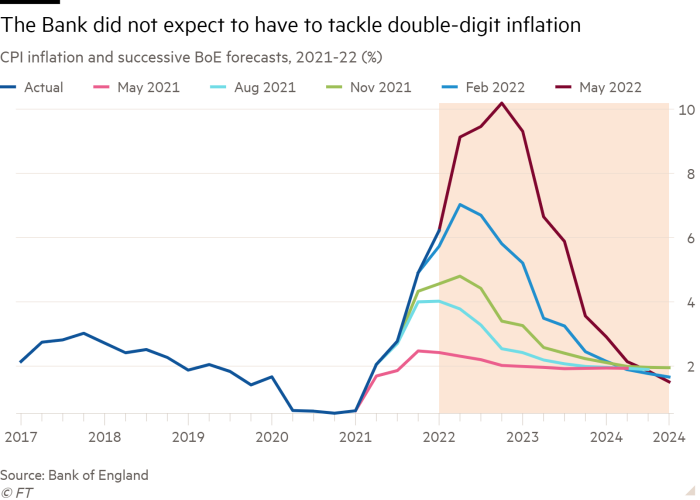

However with UK costs prone to rise at their quickest charges in over 40 years as sustained double-digit inflation turns into attainable for the primary time for the reason that Nineteen Seventies, former officers and economists say the impartial BoE faces challenges that it has not encountered the previous quarter of a century.

These embrace stopping inflation from spiralling uncontrolled; avoiding distraction by trendy ambitions, resembling tackling local weather change and inequality; guaranteeing clear coverage debate; and sustaining the legitimacy of its unelected officers to take the steps wanted to defend the soundness of the monetary system.

Lord King, governor between 2003 and 2013, insisted that the method of granting the central financial institution extra autonomy from the early Nineties to full independence to set rates of interest in 1997, was successful and enabled the BoE “to have an impartial voice and one for which it was accountable”.

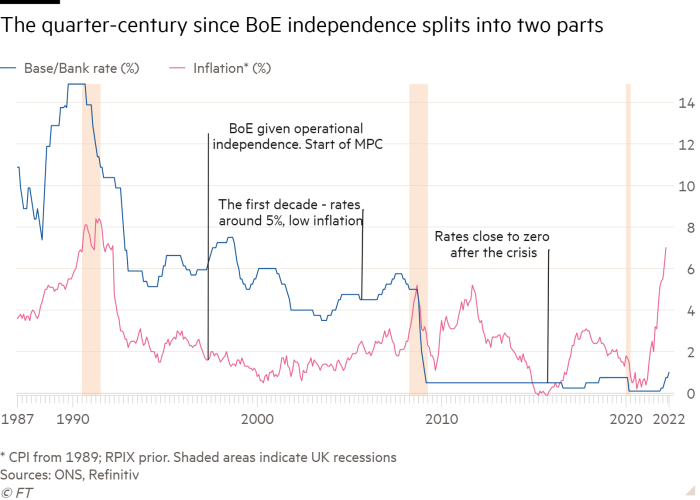

The central financial institution’s post-independence historical past splits into two broad durations. The primary decade was considered one of obvious triumph, with monetary markets’ reassured that New Labour wouldn’t be profligate with the general public’s cash and generate inflation.

Authorities borrowing prices declined, giving Brown extra room to lift spending on social welfare and different priorities, whereas financial development was robust and inflation stayed inside 1 share level of the BoE’s inflation goal.

Such was the power of the financial system that Brown regularly boasted of not returning to “growth and bust”. On the tenth anniversary of independence in 2007, King stated, “it isn’t, I imagine, credible to dismiss [the good economic performance] solely as the results of luck”.

Nevertheless, the nice occasions didn’t final. Financial development per capita, which averaged 2.2 per cent a yr within the UK over the primary decade of BoE independence, has slumped to common simply 0.4 per cent a yr since.

The financial system suffered large recessions following the worldwide monetary disaster in 2008-09 and the coronavirus disaster in 2020, which sandwiched years of grinding austerity because the UK confronted as much as being poorer than everybody hoped. Now, it faces a fourth shock following Russia’s invasion of Ukraine, which is pushing inflation increased and creating a cost of living crisis.

Inflation has been rather more unstable than within the first decade, briefly spiking above 5 per cent in 2008 and 2011 and threatening deflation after 2014 earlier than climbing to 7 per cent in March this yr. Worth rises are actually heading in direction of double-digit charges not seen for the reason that oil value shocks of the Nineteen Seventies.

Mark Carney, governor between 2013 and 2020, stated uncertainties over how far productiveness development had fallen — and whether or not this was everlasting — made financial coverage rather more troublesome to handle.

“The extent [productivity growth] went away was an open query . . . after which we had a potential provide shock due to the Brexit choice that was related for financial coverage over our forecasting horizon,” he stated.

Over the 25 years as a complete, nevertheless, the inflation file is sweet, in accordance with Jagjit Chadha, director of the Nationwide Institute of Financial and Social Analysis. “Nevertheless you measure it, [MPC members have] hit their inflation goal and this must be remembered amid all of the criticisms — it tells us one thing in regards to the worth of getting specialists concerned,” he stated.

King famously described the UK’s financial efficiency within the 10 years to 2003 because the “good decade”, which he stated was a warning that the nice occasions couldn’t final. “If we’d not had independence, there would nonetheless have been a worldwide monetary disaster,” he informed the FT.

However the central financial institution did face critical criticism within the wake of the disaster. George Osborne, chancellor between 2010 and 2016, believed that the UK authorities’ failure to oversee its monetary system adequately earlier than 2007 required the BoE to have extra energy to manage banks and the monetary system, and a brand new governor, Carney, not tainted by the crash.

With poor financial efficiency, accusations of flip-flopping steerage on rates of interest and allegations of politicisation within the Scottish and Brexit referendums, scrutiny of the BoE has solely elevated in recent times.

However it’s Andrew Bailey, the governor since 2020, who faces essentially the most troublesome activity of main the central financial institution by means of a interval of renewed inflation, in accordance with former officers and exterior analysts.

After the Lords’ financial affairs committee final yr accused the BoE of getting a “harmful dependancy” to quantitative easing and pumping up spending every time issues seemed troublesome, the central financial institution must resolve how shortly to withdraw stimulus to rein in inflation.

“I feel this can be a massive second for [central banks] as a result of they actually should show that they’re decided to revive value stability,” stated King. “It’s too late to argue that we’ve bought a couple of months of excessive inflation and it’ll go away — it’s extra a query of some years,” the previous governor stated.

Adam Posen, president of the Peterson Institute for Worldwide Economics and a former member of the MPC, believes the BoE has little choice but to raise interest rates even when it generates a recession at a time family incomes are squeezed by increased power costs.

“If real-income [declines] drove inflation cycles, we wouldn’t want financial coverage,” he stated. “The entire cause you want a financial policy-induced recession — most likely essential within the UK — is that the real-income impact doesn’t diminish inflation except and till labour market situations ease.”

Paul Tucker, former deputy governor and creator of Unelected Energy, a e book that questioned whether or not central banks have been given too broad a remit, thinks the BoE can tackle the problem of upper inflation if it sticks to its core function.

“Independence was successful, which wasn’t blown away by the worldwide monetary disaster,” he stated. “However the BoE does now have to be targeted on controlling inflation and stability of the broader banking system and that’s it.”

However there’s concern that the BoE is shying away from holding the identical open and public debate about troublesome financial points it did when it first grow to be impartial, probably undermining public confidence that its impartial officers will tackle robust decisions in methods politicians would keep away from.

When inflation is heading in direction of double digits, Chadha stated, “the MPC is way too quiet” about airing the large points in public. Balls agreed that “over time, the [monetary policy] debate has grow to be extra muted” and that it might profit the general public to see the variations between specialists aired in public.

However because the impartial central financial institution hits its 25-year anniversary, there are nearly no calls for presidency to take again management and few suppose politicians would threat eradicating independence.

“You may by no means take something with no consideration,” stated Carney. “However I feel the construction of the MPC — enshrined in laws, with specific processes and private accountability — vastly reduces that threat”.