Arkansas Sanctions Clinton Basis’s Auditor in Landmark Case

Visitor submit by Bob Bishop

The Clinton Basis is America’s largest unprosecuted racketeering and charity fraud case. Investigations of the Clinton Basis, shelved by the corrupt and partisan DOJ, FBI, and IRS management, display a two-tier justice system with exemptions for the political elite.

The one remaining pathway for due course of was petitioning the Arkansas State Board of Public Accountancy to implement AICPA skilled requirements towards the Basis’s former nationwide audit agency BKD, LLP (BKD has since merged with one other nationwide agency forming Forvis, LLP).

TRENDING: BREAKING: Italy Elects Its First Female and Populist Leader in History – Giorgia Meloni

BKD issued slapdash audits and tax returns (below penalties of perjury) for 13 years. By dismissing AICPA skilled requirements and IRS compliance, the agency created a veneer of legitimacy for the Clinton Basis. BKD’s primary fiduciary obligation is to serve and shield public interest, not the Clinton Basis.

I filed a criticism with the Arkansas Board towards BKD, LLP. The criticism (59 allegations), counting on public paperwork, charged BKD with skilled misconduct and failure to adjust to the next AICPA requirements and the IRS Code. The criticism’s main focus is the Clinton Basis’s 2011 amended IRS Kind 990 tax return dated November 16, 2015, and the underlying 2011 audited monetary statements.

The agency filed a condescending and indefensible response dismissing the allegations and smearing me as a “conspiracy theorist.” The reply crossed a bright-line together with a veiled menace of AICPA disciplinary motion towards me. BKD’s Chief Working Officer Eric Hansen served on the time because the AICPA Chairman.

Rampant Irregularities

The criticism coated substantial irregularities and documented a tradition of deceit, with the extra flagrant irregularities abstracted under.

Trustee Oversight & Management Failures

The Basis’s Board of Trustees engaged Simpson Thacher & Bartlett, LLP, to assessment its “decadal” (Or is it decadent?) governance. Their report was issued in late December 2011. WikiLeaks launched the draft doc extensively coated in media outlets. The governance assessment discovered extreme organizational and inside management weaknesses jeopardizing the Basis’s tax-exempt standing. Why did BKD ignore the flashing warning indicators?

Materials Errors and Omissions in 990 Tax Returns

Hillary Clinton’s 2016 Presidential run precipitated the Basis to guage, amend, and refile its tax filings for 2010, 2011, 2012, and 2013 on November 16, 2015. The justification was to reveal international authorities grants and the Clintons’ paid speeches on behalf of the Basis as a result of the few traces on the returns had been beforehand left clean. Basis President Dr. Donna Shalala’s issued a logic-defying press release that the Basis exceeded all authorized tax necessities and “that the errors didn’t require us to amend our returns.” The accounting charges for 2015 had been a staggering $2.7 million counsel in any other case.

I in contrast the unique returns line-by-line to the amended returns. The reconciliations discovered in depth and materials revisions of over 200 gadgets annually. Substantial adjustments occurred within the reporting classes within the Stability Sheet, Assertion of Practical Bills, and Income Assertion. These adjustments required the Basis to reissue the consolidated monetary statements or obligatory for BKD to rescind its audit opinions; nonetheless, neither occurred. The Basis routinely restated its monetary statements; as an example, the reissuance of 2010 resulting from offsetting marginal errors of simply 2.2% of income and expense.

“Attorneys and accountants ought to be the pillars of our system of taxation, not the architects of its circumvention” – Former IRS Commissioner Mark Everson

Marked Up CF 2011 990 Tax Return by Jim Hoft on Scribd

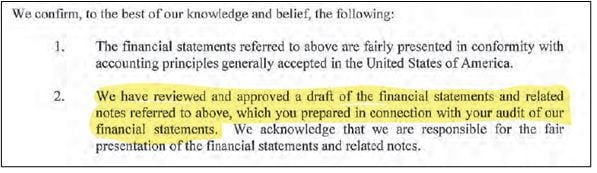

BKD Ready and Audited Basis’s Monetary Statements

The Basis’s Administration Illustration Letter included a disclosure that BKD ready the monetary statements. BDK violated independence, integrity, and objectivity moral requirements by compiling and auditing the Basis’s monetary statements.

Huge Accounting Errors

The Basis’s settlement with the World Well being Group’s Unitaid was to buy reduced-priced medicines as an agent. The Basis’s Clinton Well being Entry Initiative (CHAI) subsidiary negotiated for reduced-priced medication with Unitaid advancing funds to CHAI to pay for the purchases shipped abroad by pharmaceutical firms.

Accounting rules required the funds to be held in an escrow account; nonetheless, CHAI booked the Unitaid advances as charity income and funds as program bills. CHAI changed BKD in 2012 with Meyers Hoffman McCann P.C.. Meyers agency corrected the flagrant accounting error for 2011 by restating CHAI’s monetary statements and tax return. BKD ignored the restatement when it compiled and audited the 2011 and 2012 consolidated monetary statements.

The accounting error from 2006 by way of 2011 totaled a whopping $483 million overstatement of income and expense. The Basis and BKD by no means disclosed the monumental blunder, which grossly overstated its consolidated charitable actions and presumably hid the diversion of funds.

CHAI Restatement for Accounting Error by Jim Hoft on Scribd

Gross Overstatement of Library’s Development Price

The reported historic building price of the Clinton Library is $171.3 million or $1,332 per gross sq. foot. The Library price is scandalously excessive when in comparison with equal high-quality Little Rock business buildings. The Heifer International and Arkansas Study Institute building price per gross sq. foot is $198 and $238, respectively, a flashing warning signal of doable building fraud.

Failure to Audit Clinton International Initiative

The Clintons have resurrected the disreputable Clinton International Initiative (CGI) six-year hiatus. Final week it held an annual conference in New York Metropolis coinciding with the UN Normal Meeting. Vampires require a number.

Blackrock CEO Larry Fink and Invoice Clinton hyping the false advantage of ESG.

Display Seize: CGI 2022 web site

In accordance with the 1023 Utility for Recognition of Exemption Beneath Part 501(c)(3), BKD suggested CGI “in complying with related legal guidelines, laws, and requirements.” It didn’t audit the pay-for-play subsidiary that made up over 20% of the consolidated income. Quite a few states, together with Arkansas, required CGI to be audited.

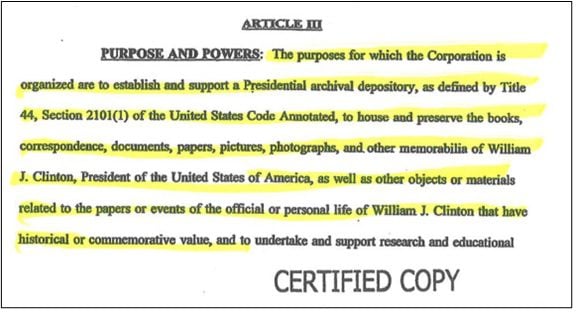

Failed the IRS Twin Take a look at for Tax-Exemption

The Dual Test requires {that a} nonprofit be organized and operated in line with its constitution. The Basis was organized completely as a Presidential Library, however exploded into quite a few unrelated actions, together with working in international international locations, deviating from its Articles of Incorporation goal. The Basis failed the Twin Take a look at as a tax-exempt group that may make it topic to Federal and state taxation.

Arkansas Consent Order

BKD signed the Arkansas State Board of Public Accountancy Consent Order acknowledging that it didn’t “train due skilled care within the efficiency {of professional} companies,” and {that a} licensee who performs auditing, assessment, compilation, administration consulting, tax or different skilled companies shall adjust to skilled requirements as outlined in Board Rule 8.2.”

BKD additionally acknowledged it was first licensed with Arkansas in 2003, that means it operated unlawfully for greater than two years whereas offering companies to the Clinton Basis.

Kudos to the Arkansas Accountancy State Board for pursuing and disciplining BKD, however the agency’s acknowledgment with out extreme penalties is inadequate. Ethically, BKD ought to have pulled its audit opinions.

C18-068 Consent Order Signed by Jim Hoft on Scribd

Lack of IRS Nonprofit Oversight

The chance of a nonprofit being audited by the IRS is .1%.The trivial audit charge is because of the lack of the IRS assets to implement the nonprofit tax code, making a haven for fraud and graft. It locations a rare burden on the CPA career to make sure consumer tax code compliance and shield the general public’s curiosity.

CPA Career Wants Sufficient Funds and Regulatory Overhaul

State accounting boards’ restricted employees and budgets (sometimes round one to a few million {dollars} yearly) are hamstrung to self-discipline nationwide and world accounting companies. Deloitte, for instance, has annual revenues of over $50 billion, which may purchase one of the best authorized protection.

The CPA career desperately wants an overhaul of the regulatory equipment to deal with high-profile instances involving giant companies and nonprofits with political affiliations. The Nationwide Affiliation of State Boards of Accountancy ought to develop its authority to deal with these instances.

Jason Goodman, Charles Ortel, and Bob Bishop mentioned the landmark case on Crowdsource the Truth on Sunday morning, September 25, 2020.

Bob Bishop is a forensic investigator who held a CPA license for over 30 years. His social media accounts are – YouTube and Twitter