China has enlisted tech giants Alibaba and Tencent to aid its efforts in designing semiconductor chips, as Beijing braces for further US-led sanctions aimed at suppressing Chinese computing power.

The Chinese government has set up a consortium of companies and research institutes, including the Chinese Academy of Sciences, to create new chip intellectual property. Beijing wants to reduce its dependence on SoftBank-owned Arm, whose technology underpins the majority of semiconductors around the world.

The group is using Risc-V — pronounced “Risc-five” — an open-source chip design architecture created in 2010 by the University of California, Berkeley. Risc-V has emerged as a competitor to Arm in recent years.

Open-source code can be produced, accessed, used and enhanced by anyone.

Beijing’s interest in Risc-V has grown as Washington has increased the pressure on China’s tech sector by limiting access to cutting-edge chip components and machinery.

The US has been lobbying allies, including the Netherlands and Japan, to cut Chinese tech companies out of their supply chains, as it did with Huawei in 2019. This has led China to prepare for further disruption of the semiconductor supply chain.

Arm, which is headquartered in the UK but has significant operations in the US, is seen as vulnerable to any ramping-up of US sanctions targeting Beijing because it supplies its designs to Chinese tech companies.

One Chinese official said the government-led effort to pool resources on Risc-V-based chip design would put China on the “right track”. The official added that the fragmented nature of Risc-V’s development — hundreds of different companies use its open-source software architecture — was slowing the replacement of Arm’s designs.

“Under the escalating US export controls, we need to prepare for the worst,” the official added.

The government-backed consortium — known as the Beijing Open Source Chip Research Institute — has developed “Xiangshan”, a high-performance Risc-V computer-processing chip aimed at matching Arm’s IP and boosting the development of a Chinese chip design market.

The idea behind Risc-V was sparked by other open standards and software that have revolutionised the digital world.

As the open architecture began to gain traction outside of academic circles, the Risc-V Foundation moved its headquarters from the US to Switzerland in 2019 to solidify its geopolitically neutral position in the chip ecosystem.

Before Beijing’s push to combine resources, Chinese tech giants Alibaba and ByteDance had already set up teams using Risc-V architecture to develop high-performance chips that power AI algorithms and data centres, according to five employees who spoke to the Financial Times.

“Our goal is to develop Risc-V [chips] to replace the existing Arm ones in our most advanced products,” said a senior engineer at T-head, Alibaba’s chip arm.

However, one executive said this aim was still years away from becoming reality given that T-head has to contend with limited funding as a result of falling profits at its parent company.

ByteDance said its work was in a preliminary stage, while Alibaba said its development capability was mainly in the Internet of Things sector.

Risc-V has gained traction in the west since 2020, when the proposed $66bn sale of Arm to US chipmaker Nvidia sent shockwaves through the semiconductor industry and pushed several companies to start looking more seriously at alternatives to Arm. The deal later collapsed and SoftBank, which owns the chip designer, is now planning to list Arm in New York next year.

Earlier this year, US chip giant Intel invested part of a $1bn innovation fund into Risc-V, and said that its foundries would be able to build chips based on the three main chip design architectures: Arm, Intel’s own X86 and Risc-V.

Rene Haas, Arm’s chief executive, acknowledged that Risc-V is a “very real threat to our business” in an interview with the FT earlier this year.

However, he said Arm has a significant advantage because it offers software alongside its designs and has a community of 50mn developers that make it “increasingly difficult to move things away from Arm”.

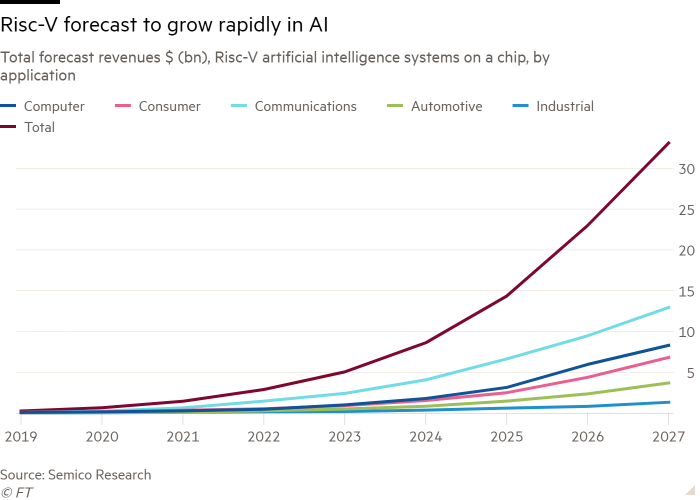

Semico Research forecasts that 62.4bn chips based on Risc-V will have shipped by 2024.

Semico estimates that Risc-V only accounted for $80mn of the total $2.2bn IP market for computer processing unit cores in 2020. However, it expects this to grow to $687mn by 2027 — taking its share of the global market from 1 per cent to 16 per cent.

“Risc-V started out as a curiosity next to Arm, then it became an alternative, and now it’s a competitor,” said Richard Wawrzyniak, an analyst at Semico Research.

In a further sign of growing interest, Apple has moved some of its embedded cores, which power technologies such as WiFi, Bluetooth and touchpad control, from Arm processors to Risc-V, according to two people briefed on its plans. Apple has also posted a number of jobs ads in recent months looking for engineers familiar with Risc-V.

Companies interested in developing Risc-V designs have two options: build a team in-house using the open-source architecture, or license from one of the companies that sell chip designs using Risc-V. These include SiFive in the US, Codasip in Europe, and Andes Technology in Taiwan. T-head, Xiangshan and ByteDance are all developing Risc-V chips in-house.

So far, Risc-V has predominantly been adopted to do tasks that are relatively simple, in parts of a device that are hidden from sight, also known as “embedded” processes, as well as for IoT applications.

But it has also recently started to gain traction in a few markets for chips that enhance the performance of a device or can enable “intelligence”, including data centre server processors and artificial intelligence chips.

“Risc-V has no limits. Whatever preconceptions you have . . . are wrong. It’s going to be everywhere, doing everything,” said SiFive cofounder Krste Asanović in September.

Ron Black, chief executive of Codasip, said his company has raised money to design high-end processors “because many of our customers tell us we need to have an alternative to Arm”.

Intel said Risc-V “has traction in embedded markets, and is expected to make inroads into IoT, automotive, mobile and datacentre markets in the next 3-5 years”.

The US chipmaker added that the open-source architecture is “still in its infancy and needs the support of the ecosystem to further innovate and drive market adoption”.

However, several of Arm’s biggest customers are not yet convinced about Risc-V’s potential.

Cristiano Amon, chief executive of Qualcomm, told the FT this year that the company had started working on Risc-V designs for its low-power embedded processors as a “defensive move” but said the open architecture was not yet sophisticated enough to be used for high-performance functions.

In China, the incentives to use Risc-V are stronger.

“You don’t know when the next round of US restrictions will come . . . using Arm’s architecture is too risky now, it’s like exposing your biggest weakness to the enemy,” said a Tencent engineer working for the Xiangshan project.