The renminbi’s sharp fall over the previous week began after regulators advised merchants they had been stress-free casual international alternate buying and selling limits, in keeping with folks aware of the matter.

The State Administration of Overseas Change steadily makes use of casual “window steerage” to handle the alternate price, generally discouraging participation in renminbi-dollar buying and selling with a view to sluggish depreciation of the Chinese language forex.

However two folks aware of the matter stated SAFE officers privately communicated a rest of the casual limits on transactions in China’s interbank market to international alternate brokers on Wednesday final week, within the wake of the Fed’s rate of interest rise of 0.75 share factors.

The transfer to calm down earlier curbs on transactions was made as a result of policymakers “believed it was the right time to let the renminbi depreciate a bit,” one of many folks stated.

SAFE didn’t instantly reply to a request for remark.

The easing of casual buying and selling limits marks an inflection level for the tightly managed renminbi. The forex is topic to intensive capital controls and its greenback alternate price can not transfer greater than 2 per cent in both path of a day by day buying and selling band midpoint set by the Folks’s Financial institution of China.

Lower than per week after the transfer by SAFE, nevertheless, high officers started making public statements that pushed again in opposition to sharp falls for the renminbi. This about-face displays what merchants and strategists stated was Beijing’s deal with preventing runaway depreciation that would threaten monetary stability and spur extra capital outflows, as Chinese language policymakers try to spice up lagging financial progress.

Within the highest-profile feedback from a authorities official for the reason that forex dropped under Rmb7 in opposition to the greenback final week, Liu Guoqiang, vice-governor of the Folks’s Financial institution of China, struck out on Wednesday at merchants betting on continued losses for China’s forex.

“Don’t wager on both one-way depreciation or appreciation of the alternate price,” he warned, at a gathering held by the business physique answerable for self-regulating China’s international alternate markets. “The longer you wager, the larger the prospect you’ll lose.”

The feedback helped bolster the renminbi, which rose 1.1 per cent in opposition to the greenback after the PBoC additionally launched an announcement late on Thursday afternoon in Beijing vowing to “strengthen expectation administration and keep the fundamental stability of the renminbi alternate price at an affordable and balanced stage”.

However international alternate merchants, economists and markets strategists stated Liu’s warning was unlikely to show the tide in favour of the renminbi, which is down virtually 11 per cent in opposition to the dollar this 12 months at about Rmb7.13 and on course for a record yearly fall.

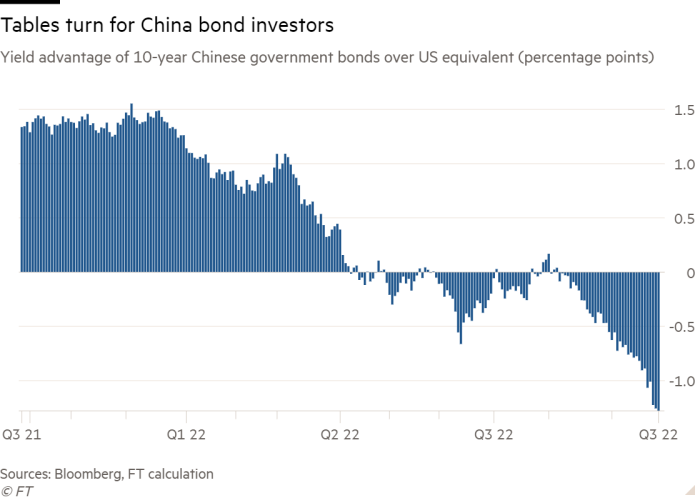

Merchants in Shanghai stated losses for the renminbi this 12 months had been primarily pushed by a widening coverage divergence between a hawkish Fed and a dovish PBoC working to shore up flagging progress.

The upshot is that Chinese language authorities debt’s longstanding rate of interest benefit has been reversed, eradicating a key driver of worldwide investor inflows. Knowledge from Hong Kong’s Bond Join programme present international outflows of just about Rmb530bn (about $73bn) from China’s renminbi bond market through the first eight months of 2022.

One more reason Beijing has taken a relaxed perspective in the direction of the renminbi’s depreciation is that alternate charges have remained comparatively secure in opposition to a broader basket of worldwide friends. The CFETS Renminbi index measuring the forex in opposition to China’s largest buying and selling companions is down lower than 5 per cent from its most up-to-date peak in March.

“I might say this time the PboC gained’t should promote a number of international reserves,” stated Wei He, an analyst at consultancy Gavekal Economics in Beijing, who pointed to the capability of home monetary establishments to step in when known as upon by the state.

And with price rises by the US Federal Reserve boosting returns on greenback debt increased, as Chinese language policymakers proceed easing to assist progress, expectations are rising amongst analysts that the almost certainly cause for a halt within the renminbi’s fall could also be a US recession.

“If the US goes into recession, the Fed would possibly truly pivot and begin reducing rates of interest — that might assist the renminbi as a result of the rate of interest unfold [between the two countries’ bonds] would chop,” stated Steve Cochrane, chief economist for Asia Pacific at Moody’s.

However he added that whereas this might assist stabilise the renminbi’s alternate price, “from the perspective of exports, a US recession would weaken the Chinese language financial system”, as exterior demand for items from China waned.

Till the Fed stops elevating charges, the PBoC is unlikely to burn by way of the nation’s international alternate reserves making an attempt to defend any particular stage for the renminbi’s greenback alternate price, in keeping with analysts.

As a substitute, many anticipate China to proceed a drip feed of measures like these seen this week. On Monday, the PBoC launched measures to discourage bets in opposition to the renminbi by way of the nation’s derivatives markets. Such strikes are sometimes launched in China during times of forex depreciation.

One Shanghai-based international alternate dealer with a European financial institution stated the transfer on Monday “may be counted as a gesture, as an alternative of actually a recreation changer for the market’s path”.

One other main issue within the renminbi’s trajectory is how China manages its anticipated loosening of strict zero-Covid insurance policies over the approaching quarters. Some strategists anticipate {that a} swift and complete opening that permits for outbound tourism can be detrimental for the renminbi — however others warn that this state of affairs is unlikely.

“If China’s opening is staggered in the best way we anticipate, with none outbound tourism, that might be risk-on and good for the home financial system, which is able to ship the renminbi increased in opposition to the greenback,” stated Danny Suwanapruti, head of Asia rising markets international alternate and charges technique at Goldman Sachs.

Nonetheless, Suwanapruti added that due to low liquidity within the offshore marketplace for the renminbi in Hong Kong, merchants would deal with different currencies within the area that always function proxies for the renminbi’s alternate price, following the Chinese language forex increased when it rallies.

“The South Korean gained is simply cleaner than making an attempt to play the dollar-offshore renminbi,” he stated.