This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

The EU is to make it easier for member states to give tax credits to companies for green investment, according to plans seen by the FT, as it seeks to compete with US subsidies.

-

The German economy shrank unexpectedly in the fourth quarter, dragged down by the effect of soaring gas prices on its large manufacturing sector. The news put a dampener on new European Commission survey data showing EU business and consumer confidence surging in January.

-

The UK is bracing for huge public sector disruption on Wednesday, with strikes set to close schools, cancel university classes and cripple rail services while unions hold rallies to protest against anti-strike legislation and refusal to fund higher pay awards.

For up-to-the-minute news updates, visit our live blog

Good evening.

China’s stock markets reopened today after a week-long break for the lunar new year amid investor hopes that the end of “zero-Covid” will unleash a wave of pent-up consumer spending and spur global economic growth.

Oil prices rose, reflecting the new optimism. The International Energy Agency, which advises governments on energy policy, said last week that China’s reopening could drive global demand to a record high this year of 101.7mn barrels a day.

Traders are also betting on surges in demand for other commodities, with the price of base metals such as tin, zinc and copper jumping more than 20 per cent in the past three months. The impact on world trade in general will be substantial.

Asian currencies such as South Korea’s won should also benefit as exports to China pick up, as should Thailand’s baht as Chinese tourists begin to travel again. The Australian dollar is expected to climb 3 per cent on increased demand from China for commodities.

Hopes are also high for Chinese stocks. Goldman Sachs has raised its forecasts for earnings growth and boosted its outlook for Chinese listings in Hong Kong. Markets in Malaysia, Thailand and Singapore should also benefit.

Some investors are turning optimistic on tech stocks in particular as Beijing eases its long-running sector crackdown. Others however are still wary, noting that state control over private companies has been stepped up, with big names such as Alibaba and Tencent having to cede “golden shares” to state bodies, allowing officials to take board seats and veto certain decisions.

Beijing is also switching its focus to make consumption the “main driving force” of the economy, which grew by just 3 per cent last year under the weight of zero-Covid restrictions and the collapse of the property market, which has been responsible for around a quarter of GDP over the past decade.

China’s renewed embrace of the private sector and positive noises on foreign investment were also on display at the recent World Economic Forum in Davos. The FT editorial board welcomed the change in tone but argued Beijing still had more to do to rebuild the trust of investors and business.

“China should recognise that giving better treatment to the private sector and multinationals cannot be a matter of expediency,” it said. “Such policies must be long-term and sustainable if Beijing wishes to build trust. If officials travel to Davos to express fealty to a creed of open markets only to reverse course once back home, it will inflict lasting damage to China’s reputation.”

Need to know: UK and Europe economy

Our latest Big Read examines the difficulties of spinning out companies from British universities, with some founders and investors arguing the institutions are benefiting unfairly from the work of the entrepreneurs. Many UK tech start-ups are accelerating plans to expand abroad as the government cuts research and development tax credits.

The “Qatargate” graft scandal rocking the EU also gets the Big Read treatment. The affair has highlighted some uncomfortable truths about lobbying by foreign powers.

Hungary recorded the highest inflation in the EU in December at 24.5 per cent, which analysts pin on a weak forint, the phaseout of price caps and a retail tax. The country’s economic woes and the resulting public anger have been a blow to rightwing prime minister Viktor Orbán as his Fidesz party prepares for municipal and European elections in 2024.

Need to know: Global economy

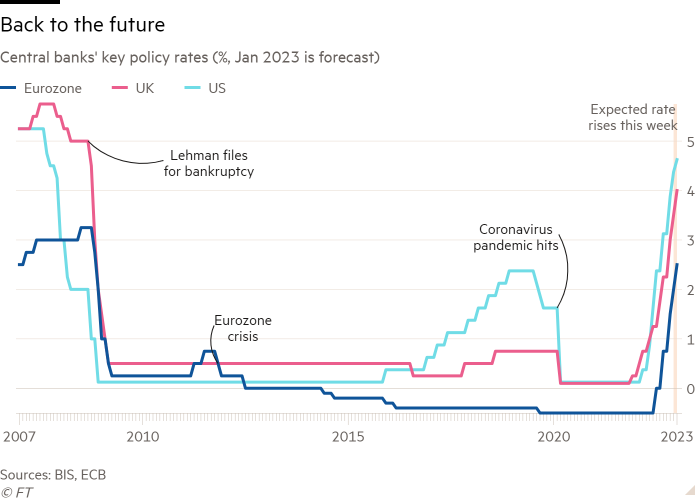

It’s a big week in central bank land with interest rate decisions from the US Federal Reserve on Wednesday and the European Central Bank and the Bank of England on Thursday. The Fed is expected to raise rates by 0.25 percentage points, and the ECB and BoE by half a point.

Rising interest rates, volatile prices and the war in Ukraine have made it much more expensive to ship raw materials such as oil, gas, sugar and gold around the world. McKinsey predicts shipping times will increase 8 per cent, energy prices three-fold, and interest costs seven-fold, between the end of 2020 and 2024, with working capital requirements for commodity trading to increase up to $500bn as a result.

Global food supplies could still be at risk despite sharp falls in fertiliser and crop prices from the highs of last year. Some experts warn the grain deal between Moscow and Kyiv could yet unravel while volatile energy prices and bad weather could hit crop production. Our Europe Express newsletter (for premium subscribers) talks to EU foreign policy chief Josep Borrell about the food propaganda war with Russia

The prime minister of Mongolia told the FT how his landlocked country, sandwiched between Russia and China, had been battered by the effect of sanctions on Moscow. The collateral damage ranges from complications in paying Russian companies on which it is “wholly dependent” for fuel, to the loss of revenues from airlines that once flew over the country.

Need to know: business

Retailer JD Sports became the latest high-profile UK company to be targeted by hackers as it warned that the data of 10mn customers could be at risk.

Ryanair returned to profit and said the rush of US and Asian tourists would boost demand for travel in Europe. The surge in passenger numbers will come too late for Flybe. The budget carrier has gone into administration for the second time in less than a year after starting to fly again after the pandemic.

Profit warnings from UK-listed companies rose 50 per cent last year as rising costs and falling consumer confidence hit British business. UK shareholders meanwhile are set for a fall in dividends this year as the global economy shrinks and a period of large one-off payments comes to an end.

US investors are increasingly targeting European football by snapping up stakes in clubs — and angering fans and regulators in the process. Clubs have been turning to investors for capital since the pandemic battered their balance sheets: governing body Fifa estimates top-division teams lost €7bn over the 2019-20 and 2020-21 seasons.

Will the end of Covid restrictions encourage the Chinese — one of the world’s biggest film audiences — to return to the cinema? Challenges include declining financing, censorship and changing tastes.

The World of Work

Management editor Anjli Raval says brutal mass lay-offs have serious long-term effects for companies as well as the individuals involved and those left behind. They need to plan for future workforce changes on an ongoing basis and ride out difficult periods, she argues.

A tougher minded approach to meetings may become a lasting benefit of the pandemic, which has forced managers to think about how and where people work best, writes Stefan Stern.

Thanks to Covid, many of us are working from home, but that doesn’t mean your boss can’t keep tabs on you. Columnist Pilita Clark looks at the world of time-tracking software — aka spyware, bossware or tattleware.

Feel like you’re being discriminated against at work on the basis of your age? Law courts correspondent Jane Croft explains the difficulties inherent in bringing your claim to an employment tribunal.

Some good news

A rare tree kangaroo has been born at Chester Zoo in the north of England for the first time. The animal is native to the rainforests of Papua New Guinea where they are under threat from hunting and habitat destruction.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you