This dish is dear: annuities bought by profit-seeking insurance coverage firms should not low-cost, knowledgeable says

Critiques and suggestions are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by hyperlinks on this web page.

Article content material

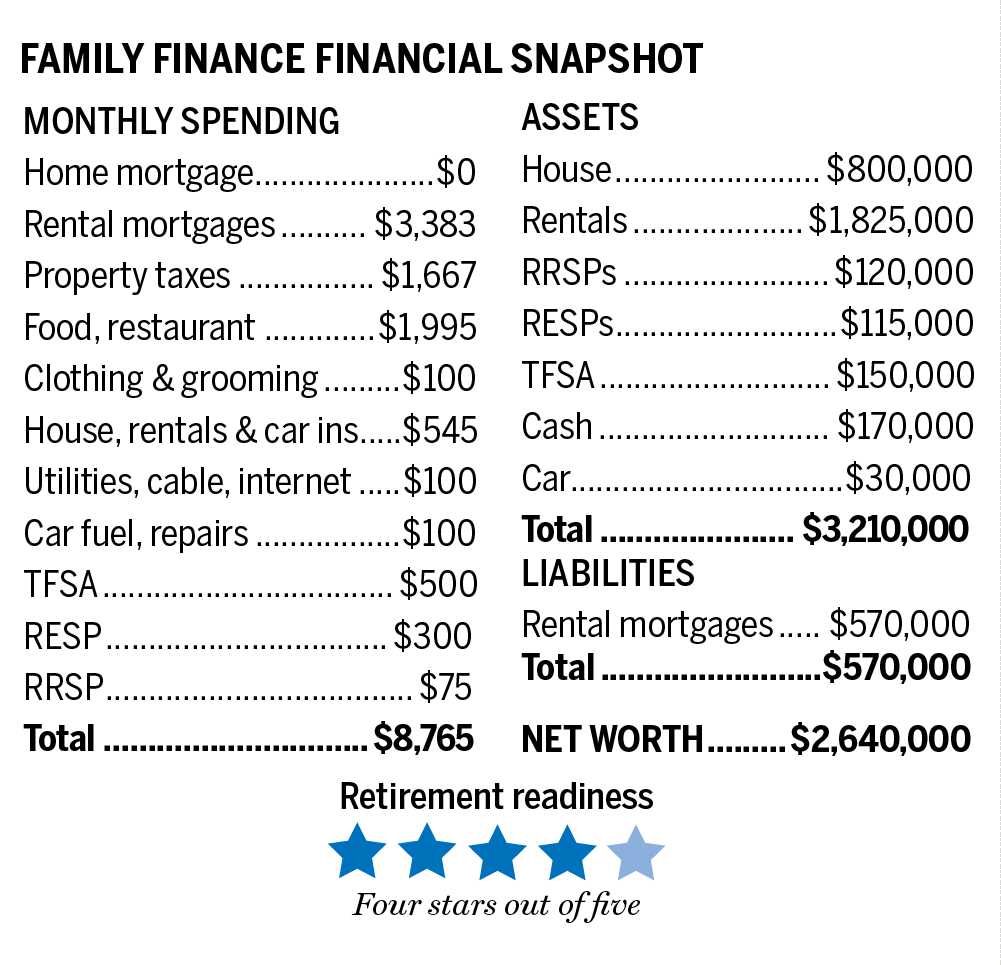

In Ottawa, a lady we’ll name Lucille, 48, works for the federal authorities. She has three kids, all of their teenagers with ample RESPs, a home price $800,000, three leases with an estimated complete worth of $1,825,000 and $570,000 of debt for the leases.

Commercial 2

Article content material

Lucille needs to retire subsequent 12 months, at age 49, and she or he is contemplating taking the commuted worth of her pension. That’s the amount of cash wanted to generate anticipated pension revenue, which might be $48,000 per 12 months at age 55, the earliest 12 months she will begin receiving revenue. With rates of interest nonetheless low, it takes some huge cash to generate promised pension revenue. Thus it’s a good time to be pondering over whether or not to money out and take the commuted worth. Lucille earns $116,000 per 12 months and has $49,217 web rental revenue. After her common tax charge, 36.39 per cent, reflecting $60,043 tax, she has $105,174 revenue per 12 months or $8,765 per thirty days.

Article content material

e-mail [email protected] for a free Household Finance evaluation

The commuted worth of Lucille’s federal pension stands at $852,000 for 20 years of labor. She would make investments it for what she thinks can be a better return than the same old excessive single-digit-returns federal pensions generate. The foundations of the method are that she must settle for $342,000 locked right into a retirement account, a LIRA, and stroll away with about $510,000 of taxable money. Tax would take about half of that sum, leaving her with about $255,000 for her personal investments.

Commercial 3

Article content material

Household Finance requested Derek Moran, head of Smarter Monetary Planning Ltd. in Kelowna, B.C., to work with Lucille.

Evaluating pensions

Lucille has achieved a low double-digit return on her financial savings and is a formidable investor. Nevertheless, beating a totally listed federal pension isn’t just about returns. An outlined-benefit pension is ageless. The beneficiary can not outlive it. It’s bulletproof within the sense that it’s diversified far past what a person can obtain and assured to not lose worth to any stage of inflation. The draw back is that the capital in any DB pension doesn’t belong to the beneficiary. It belongs to the Authorities of Canada on this case.

The distinction between leaving the DB pension and taking the cash is whether or not she wants the doubtless larger return she would possibly earn on the commuted worth, with the understanding that the return might be decrease as nicely. The essence of the distinction between a authorities DB pension and a personal funding is certainty. No inventory market flop can depreciate the Authorities of Canada Public Service pension plan.

Commercial 4

Article content material

What’s extra, the payouts are listed, so if inflation soars, retirees are protected. Nevertheless, if Lucille takes the commuted worth, the cash is hers to make use of for collateral for loans or to switch by will to household or charities. Furthermore, her personal cash from commutation might be used to purchase a life insurance coverage annuity which may run till her loss of life even when she lives to 100 or extra. It is a option to have her cake — management of at the least a few of her property — and to eat it. However this dish is dear: annuities bought by profit-seeking insurance coverage firms should not low-cost.

Matching returns

Taking the commuted worth seems to be a life or loss of life resolution, partly. If she lives to age 90, she must obtain a median annual return of eight per cent after inflation however earlier than tax to beat the DB pension, Moran estimates. Giving up her federal DB pension may reduce different advantages akin to dental and medical out there in public service of Canada pensions.

Commercial 5

Article content material

Lucille has current web price of $2.64 million aside from her pension. After deducting mortgage capital reimbursement from leases, her carrying value is lower than one per cent. Her largest funding dedication is to 3 leases, all environment friendly investments. The $1,825,000 property worth of the leases much less the $570,000 of mortgage debt leaves $1,255,000 fairness. After taxes, condominium charges, curiosity solely on the mortgages, upkeep and accounting, she has web hire of $49,217. The hire is taxed as strange revenue at a marginal charge of fifty.23 per cent in her bracket, however she would possibly pay simply 35.87 per cent in her tax bracket on Canadian shares after software of the dividend tax credit score. That makes shares extra environment friendly in tax phrases and far much less hassle by way of upkeep, breakage, or non cost of hire by tenants, Moran notes.

Commercial 6

Article content material

Estimating retirement revenue

Earlier than age 55 and the beginning of her DB pension, Lucille’s RRSP would supply $4,976 per 12 months. Her TFSA would add $6,220 per 12 months, taxable funding revenue $19,050 per 12 months, and web rents $49,217 per 12 months. That may be a complete of $79,463. After 20 per cent common tax, she would have revenue of $5,297 per thirty days. That’s in need of current bills much less financial savings. Some half time work can be wanted.

From 55 to 65, she may add her $48,000 pension to spice up revenue to $127,463. After 25 per cent common tax, her revenue can be $95,597 per 12 months or $7,970 per thirty days. That will cowl current bills with out financial savings

-

B.C. couple has five rentals but doesn’t own their own home — and that’s a problem for retirement

-

This B.C. couple in their 40s has $3.1 million in assets, but is it enough to retire in five years?

-

This Ontario woman may need to downsize, work part-time to meet her retirement goals

Commercial 7

Article content material

From 65 onward, she may add $9,389 estimated Canada Pension Plan and $7,707 OAS revenue for complete revenue of $144,560. She would pay 25 per cent common tax. The clawback which begins at $79,054 and taxes revenue at 15 per cent over that quantity would take again all of her OAS. Her last revenue at 65 can be $108,420 per 12 months or $9,035 per thirty days, greater than sufficient to cowl her bills.

The impact of an election to take the commuted worth of her pension is so as to add uncertainty. The higher restrict of her financial savings together with commuted worth might be a return of 10 per cent per 12 months earlier than tax. Or extra. The decrease restrict might be complete lack of her commuted pension.

Lucille can select certainty and no management over a lot of her retirement financial savings or commute, pay hefty tax, and attempt to beat the returns of the federal listed outlined profit pension. She would possibly, however there are shocks to the most effective laid plans. In a market meltdown, she would possibly want robust nerves. If she retains the DB pension, she may yawn and return to no matter she likes to do.

4 Retirement Stars **** out of 5

Monetary Publish

e-mail [email protected] for a free Household Finance evaluation