Jamie Golombek: Ottawa says some high-income Canadians nonetheless aren’t paying sufficient revenue tax and is reviewing the choice minimal tax

Critiques and suggestions are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

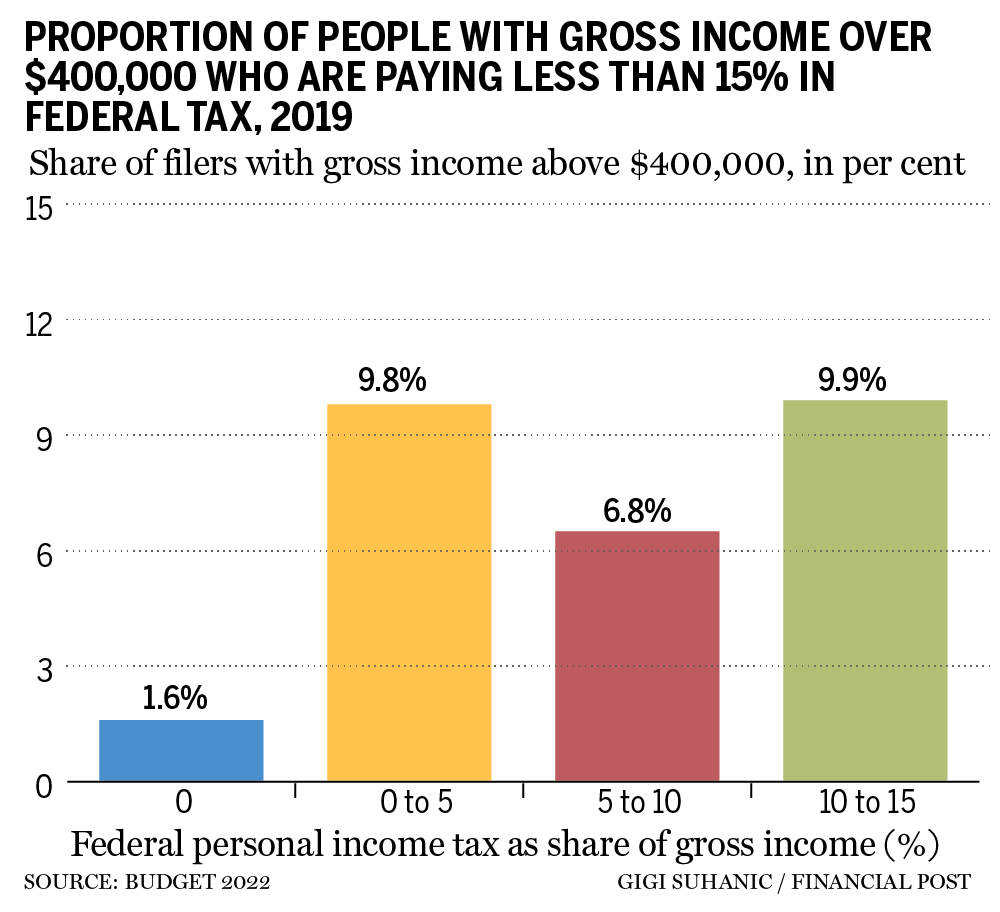

One of many extra curious objects in final week’s almost 300-page federal funds was an ominous assertion that “some high-income Canadians nonetheless pay comparatively little in private revenue tax as a share of their revenue.”

Commercial 2

Article content material

The funds doc supplied some stats, utilizing 2019 tax information, that confirmed 28 per cent of filers with gross revenue of greater than $400,000 (which was the highest 0.5 per cent of all revenue earners), or about 41,400 people, paid a median federal tax price of 15 per cent or much less by utilizing a wide range of tax deductions and tax credit. Extra granularly, the info present that just about 18 per cent of these prime revenue earners (about 27,000 Canadians) paid lower than 10 per cent in federal tax. And apparently 1.6 per cent (2,400 filers) paid zero federal tax.

The information was printed as a means of introducing the federal government’s overview of the choice minimal tax (AMT), the outcomes of which is able to come out within the fall financial replace. However are these numbers really a priority? Is there something nefarious about such a low efficient price? Or are taxpayers merely following the regulation in accordance with the well-accepted Duke of Westminster principle that states “taxpayers are entitled to rearrange their affairs to reduce the quantity of tax payable.” Based mostly on a 1936 tax case in the UK, this precept was confirmed most not too long ago by Canada’s Supreme Court in a November 2021 decision.

Commercial 3

Article content material

It’s a query price exploring. To start, bear in mind the funds stats solely appeared on the federal tax price and never the mixed federal/provincial price. Presently, there are 5 federal revenue tax brackets for 2022: zero to $50,197 of revenue (15 per cent); greater than $50,197 to $100,392 (20.5 per cent); above $100,392 to $155,625 (26 per cent); over $155,625 to $221,708 (29 per cent); and something above $221,708 is taxed at 33 per cent.

Because of the graduated, progressive charges on the primary $221,708, the federal tax for 2022 on $400,000 of strange revenue can be about $109,000 for a median federal tax price of about 27 per cent, earlier than contemplating tax-preferred revenue and numerous different deductions and credit.

Commercial 4

Article content material

Capital positive aspects are solely 50-per-cent taxable, that means that a person who realizes a one-time achieve on the sale of their cottage of, say, $400,000, would have gross revenue of $400,000, however taxable revenue of $200,000, as a result of solely half the achieve is taxable. Absent another revenue, the federal tax invoice can be about $43,000 and the common federal tax price can be 10.8 per cent on capital positive aspects. However is the cottage vendor, who had one year of very elevated income, truly a “high-income” earner on which the federal government must cost an AMT?

A fast take a look at the 2019 Canada Income Company revenue statistics for the 2017 tax yr (the newest publicly obtainable information) reveals that 51 per cent of the returns by the very best revenue earners (outlined for these statistics as these making greater than $250,000), about 312,000 Canadians, reported a taxable capital achieve, with the common being simply over $125,000, which might possible point out the common capital achieve was about $250,000.

Commercial 5

Article content material

Subsequent, let’s take into account an investor who earns $400,000 in Canadian-eligible dividends. Due to the dividend tax credit score, equal to twenty.73 per cent of the particular dividends acquired, the federal tax on $400,000 of eligible dividends would solely be $76,000 for a median federal tax price of 18.9 per cent, which might additionally decrease the common tax price from the anticipated price. Two-thirds of the very best revenue earners in 2017 reported some Canadian dividends, with the common quantity being greater than $100,000.

In fact, tax deductions may cut back your common tax price. The highest three deductions (by complete greenback worth) claimed in 2017 by the very best revenue earners, have been the registered retirement financial savings plan (RRSP) deduction, lifetime capital positive aspects exemption (LCGE) and the worker stock-option deduction.

Commercial 6

Article content material

Canada Income Company information for 2017 reveals 60 per cent of prime revenue earners claimed an RRSP deduction (common declare of $38,730, that means some taxpayers have been clearly catching up on unused RRSP contribution room). And whereas the stock-option deduction for workers was taken by solely 4 per cent of the very best revenue earners, the common deduction was nearly $152,000. (This may possible begin to go down in future years because the rules limiting the benefits of the stock-option deduction have been modified as of July 1, 2021).

-

Jamie Golombek: Here’s how the federal budget impacts your wallet

-

Jamie Golombek: What tax changes might be coming up in the federal budget

-

Better double-check your tax return if you’ve been using the CRA’s Auto-fill

-

You’ve got questions about the CRA’s principal residence exemption, we’ve got answers

Commercial 7

Article content material

In 2022, the LCGE eliminates taxes on $913,630 of capital positive aspects from the sale of qualifying small-business shares, and $1 million of capital positive aspects on the sale of certified farming or fishing property. The CRA information present that just about 18,000 of the very best revenue taxpayers in 2017 claimed LCGE deductions valued at $4.6 billion, with the common declare coming to about $260,000, which is the equal of $520,000 of tax-free capital positive aspects. This may possible clarify the zero tax price for some taxpayers within the 2022 funds doc.

Lastly, on the credit score aspect, are charitable donations. A high-income earner who makes a big donation of, say, $100,000 to charity, can be entitled to a federal donation tax credit score of 33 per cent. The tax payable on $400,000 after contemplating the donation tax credit score for a $100,000 donation can be about $75,000 for a median federal tax price of 18.9 per cent. The CRA information present that 64 per cent of the very best revenue earners in 2017 reported a charitable reward, with the common reward being $17,389. Charitable presents, relying on the quantum, can considerably cut back your common tax price.

Commercial 8

Article content material

We have already got a federal AMT at a 15-per-cent price. If the federal government needs to protect the total advantages of charitable giving, maintain integration intact by permitting the dividend tax credit score designed to reduce the double taxation of company revenue, and keep the decrease capital positive aspects inclusion price or the LCGE on the one-time sale of a cottage, enterprise or farming or fishing property, there’s little tax income left to reap in an up to date AMT, significantly given the modifications already launched final yr on worker inventory choices.

Jamie Golombek, CPA, CA, CFP, CLU, TEP is the managing director, Tax & Property Planning with CIBC Non-public Wealth in Toronto. [email protected]

_____________________________________________________________

For extra tales like this one, sign up for the FP Investor e-newsletter.

______________________________________________________________