Jamie Golombek: Staff might find yourself paying tax on varied non-cash employment advantages

Critiques and suggestions are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

Staff are taxable on their salaries, bonuses and another sort of direct compensation they could obtain, however they might additionally find yourself paying tax on varied non-cash employment advantages or perquisites.

Commercial 2

Article content material

Beneath the Earnings Tax Act, staff should embrace of their earnings the worth of any advantages of any sort obtained by the worker “in respect of, in the midst of, or by advantage of his or her employment.” In figuring out whether or not an worker should embrace the worth of a profit obtained, the Canada Revenue Agency appears to be like at three figuring out elements: Does the profit give the worker an financial benefit? Is the profit measurable and quantifiable? And does it primarily profit the worker or the employer?

Two current CRA technical interpretation letters, every launched prior to now month, mentioned whether or not sure employer-provided advantages could be thought of taxable. The primary involved employer-provided COVID-19 testing, and the second was employer-provided id theft safety companies. Let’s check out what the CRA mentioned about each.

Commercial 3

Article content material

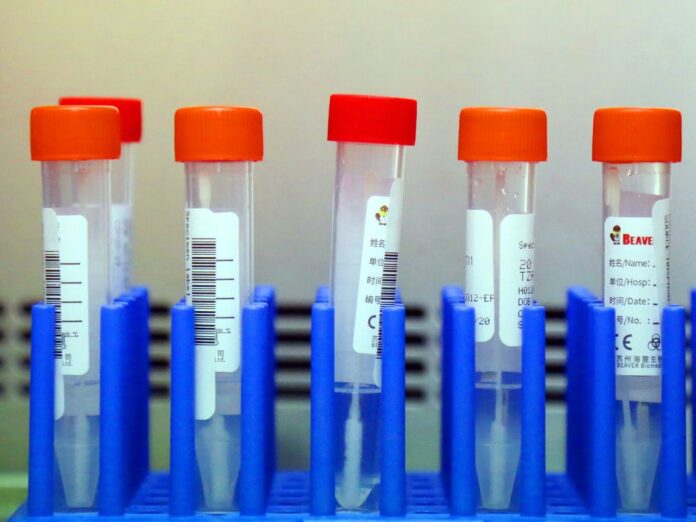

COVID-19 testing

The taxpayer, presumably an employer, wrote to the CRA asking about employer-paid COVID-19 testing, particularly a polymerase chain response check the place staff mail within the pattern to a laboratory for evaluation. The outcomes take a number of days to course of and are available again. The testing is absolutely funded by the employer, participation by staff is voluntary, and an unfavourable check consequence (that’s, a constructive COVID-19 check consequence) would stop the worker from coming into the employer’s premises. Notably, the worker would nonetheless have the ability to keep their employment standing by means of an alternate work association if a constructive check consequence had been to happen.

The CRA responded that it was the company’s “long-standing view” that an employer is taken into account to be the first beneficiary of medical testing in conditions the place such testing is important to fulfil a situation of employment. Within the scenario described within the letter, nevertheless, staff should not required to take a COVID-19 check and the check outcomes (whether or not constructive or unfavorable) don’t have any impression on an worker’s employment standing. Consequently, voluntary COVID-19 testing doesn’t create an employment situation.

Commercial 4

Article content material

That mentioned, within the context of the pandemic, “appreciable effort is being made to manage the unfold of the virus,” with governments encouraging employers to make testing obtainable to staff. Consequently, the CRA concluded that the place the outcomes of employer-provided COVID-19 testing are primarily for using an employer, it’s “each unlikely and unintended that an worker could be enriched or thought of to have obtained an financial benefit,” and so the CRA doesn’t view employer-provided COVID-19 testing as a taxable profit to staff. (Phew.)

Identification theft protect premiums

The second technical interpretation letter was written by an employer asking whether or not id theft protect premiums it presumably would pay to a 3rd social gathering on behalf of its staff could be thought of a taxable profit to staff, and whether or not these premiums could be thought of a tax-deductible enterprise expense for the employer.

Commercial 5

Article content material

Identification theft safety companies usually present id or credit score monitoring companies to find out if a person’s private info has been compromised. In keeping with the small print of the plan, the issuer of the coverage supplies privateness and safety monitoring, id session companies and id restoration companies. Particularly, the service screens for matches of a person’s personally identifiable info: identify, date of start, social insurance coverage quantity, driver’s licence quantity, as much as 5 passport numbers, and as much as 10 of every of the next: checking account numbers, worldwide checking account numbers, credit score/debit card numbers, medical identification numbers, e-mail addresses and telephone numbers.

Commercial 6

Article content material

The CRA, after reviewing the small print of the plan and companies on provide, and within the absence of further info suggesting a heightened danger of id theft for the corporate’s staff or some sort of hyperlink between the non-public info monitored and the employer’s enterprise, decided that the employer-paid plan would seem to offer an financial benefit primarily for the advantage of the staff. Consequently, the CRA concluded that employer-paid premiums would, certainly, be included within the worker’s earnings as a taxable employment profit.

-

Cash may be king, but it can cause headaches if the taxman denies your claims

-

The case of the taxpayer who was dinged with a taxable benefit for taking a business trip

-

If you thought the CRA wouldn’t follow up on improperly claimed CERB and other benefits, think again

-

These are the tax-sheltered savings options first-time homebuyers need to know about

Commercial 7

Article content material

The CRA then turned to the query as as to whether the premiums paid could be tax deductible to the employer as a enterprise expense. Usually, with a view to qualify as a tax-deductible enterprise expense, it have to be incurred for the aim of incomes enterprise earnings, have to be neither a capital expenditure nor a private expense, and have to be cheap within the circumstances.

Primarily based on the small print of the id theft safety plan described above, the CRA felt that the companies relate to defending a person’s private and monetary info, and weren’t associated to both the worker’s employment or enterprise info. That mentioned, the CRA concluded that to the extent the employer-paid premiums are included within the staff’ earnings as a taxable profit, the premiums would even be tax deductible for enterprise functions supplied they’re additionally thought of cheap. This conclusion is per most employer-paid perquisites, that are usually tax deductible to the employer.

Jamie Golombek, CPA, CA, CFP, CLU, TEP, is the managing director, Tax & Property Planning with CIBC Non-public Wealth in Toronto. [email protected]

_____________________________________________________________

In case you like this story, sign up for the FP Investor E-newsletter.

_____________________________________________________________