This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

China accused the US of flying high-altitude balloons into its airspace more than 10 times last year, and of conducting hundreds of reconnaissance missions, as the aerial surveillance dispute between the two nations intensified.

-

Ukraine urged its European allies to avoid “negative messaging” about its prospects of joining the EU as diplomats warned of unrealistic expectations about the speed of the country’s accession process. Nato warned that it was in an “ammunitions race” in the country against Russia.

-

Wirecard’s former chief executive Markus Braun denied any knowledge of fraud at the German payments company that collapsed in 2020 in one of Europe’s largest accounting scandals, telling judges that he was rejecting “all charges” against him.

For up-to-the-minute news updates, visit our live blog

Good evening.

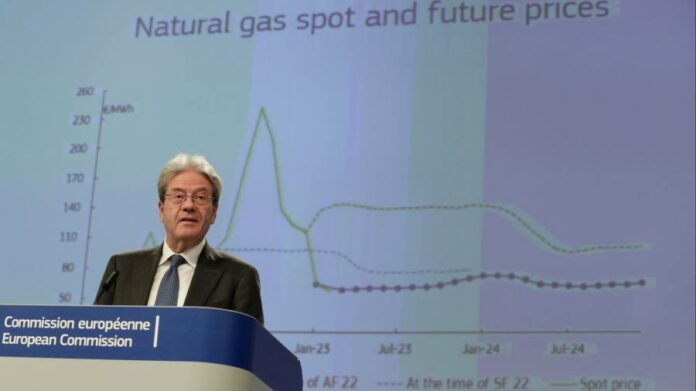

Could Europe’s gas crisis be over? The European Commission seems to think so, judging by its economic forecasts this morning that suggest falling gas prices and a mild winter, as well as supportive government policies and a revival in household spending, mean the EU will dodge recession.

The upgrade says EU growth this year will be 0.8 per cent rather than the 0.3 per cent forecast in November, while the euro area will expand by 0.9 per cent rather than the 0.3 per cent suggested at the end of last year. Brussels also said that inflation had peaked, forecasting EU consumer price growth would hit 6.4 per cent this year, falling from last year’s 9.2 per cent, while in the euro area it would drop from 8.4 per cent to 5.6 per cent.

The feeling that the worst of the power crisis has passed is echoed by top trader Pierre Andurand, who tells the FT that Vladimir Putin has “lost the energy war”. The cut in gas exports to Europe may have driven prices temporarily higher but Putin has underestimated buyers’ ability to adapt, Andurand argues. The miscalculation means “Russia has lost its biggest customer forever.”

The next big task for EU ministers, who meet today in Brussels, is the reform of the bloc’s electricity market, which they hope will be less stressful than last year’s tortuous negotiations over the gas price cap.

The FT’s Alice Hancock has seen draft plans, led by Denmark and signed by other northern European countries including Germany and the Netherlands. Eight “key principals” of the proposals include incentivising investment in clean energy, ensuring consumers benefit and making the EU more resilient to “external shocks”.

They hope to reach agreement before Spain, which has alternative proposals, assumes the rotating EU presidency in July. “A fight is inevitable but let’s just hope there will be unity and a clean fight without bitten-off ears,” one diplomat said.

The moves follow stinging criticism two weeks ago from the European Court of Auditors which said consumers could have saved billions of euros if the bloc’s energy watchdog had properly regulated electricity providers.

Meanwhile, the optimism engendered by improved gas storage levels in the EU is yet to spread to the UK. Infrastructure expert Sir John Armitt tells the FT that the government is taking a “big gamble” on energy prices continuing to fall after failure to reach an agreement on storage capacity. Talks with Centrica, which owns Rough, the UK’s biggest storage facility, have collapsed over a disagreement on state subsidies.

Need to know: UK and Europe economy

UK employers expect private-sector pay to rise by 5 per cent in the first quarter, highlighting ongoing labour shortages. By contrast, the Chartered Institute of Personnel and Development said expectations of just 2 per cent pay rises in the public sector helped provide some context for the current wave of strikes.

It’s enough to drive you to drink — if you can find a pub that’s still open, that is. New analysis showed closures in 2022 were near their highest level in a decade, with the prospect of “much starker” damage to come after the government’s £18bn energy support package for business “tapers away” from the end of March.

Prosecutors in Turkey have issued arrest warrants for scores of developers as president Recep Tayyip Erdoğan tries to address mounting criticism over lax enforcement of building standards that led to such a high death toll in last week’s earthquake.

Need to know: Global economy

Following data showing a still-hot US jobs market, investors are now betting on a longer period of higher interest rates with a peak slightly above 5 per cent in July, with only one cut by year-end. The view was given credence today by Fed official Michelle Bowman.

Ukraine’s minister of finance Serhiy Marchenko writes in the FT that Russia needs to be cut out of the global financial system, and in particular from the Financial Action Task Force. The FATF, created by the G7, sets standards to limit money laundering, the financing of terrorism and the proliferation of weapons of mass destruction.

New Brazilian leader Luiz Inácio Lula da Silva has worried some investors by criticising the president of the country’s central bank and questioning its independence. Lula has hit out at its 3.25 per cent inflation target, saying it is too low and that interest rates are being cut too slowly.

Israeli president Isaac Herzog urged the country’s new hardline government to delay a judicial overhaul, warning the country was “on the brink of constitutional and social collapse”.

Contributing editor Ruchir Sharma tells the story of the world’s most resilient currency: Thailand’s baht.

Need to know: business

Massive January spending has confirmed for many the unfair advantage enjoyed by England’s Premier League over the rest of European football. Our Big Read highlights how it has become the de facto Super League.

With inflation at about 17 per cent — almost double the eurozone average — retailers and food producers in Poland are resorting to “shrinkflation” or skimping on the quantity or quality of products while keeping prices the same.

Saudi Arabia is making another attempt at launching its own car industry, but this time with electric vehicles, as it tries to diversify away from oil production. It aims to pour billions into a manufacturing hub to produce 500,000 cars a year by 2030.

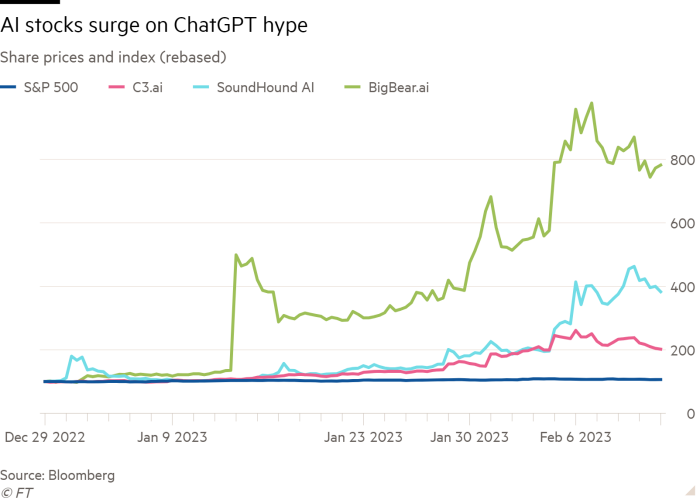

Shares in small artificial intelligence groups are soaring following the hype around ChatGPT and other generative AI models, leading analysts to warn of a “speculative” bubble.

The World of Work

Is there such a thing as too much pay? Management editor Anjli Raval examines an issue facing many chief executives: how do you manage the pay and expectations of the highest earners?

Talking of which, six-figure bonuses for those joining major US and UK law firms came back down to earth last year as a new era of job cuts replaced the “frenzied market” of 2021.

Senior business writer Andrew Hill delves into the world of “psychological safety” and the art of encouraging teams to be open.

The 25th anniversary edition of our Global MBA Ranking features a new number one school and updated methodology with an increased focus on sustainability and diversity.

And don’t forget to sign up for MBA 101, the new email series from our business education team that guides you through the step-by-step process of applying for an MBA. Register here ahead of the first instalment on February 14.

Some good news

Chester Zoo is celebrating the first successful birth of a baby “dancing lemur” in Europe. The Coquerel’s sifaka is only found on the island of Madagascar where it faces a fight for survival due to widespread deforestation.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you