Rising market bonds are struggling their worst losses in virtually three a long time, hit by rising international rates of interest, slowing development and the battle in Ukraine.

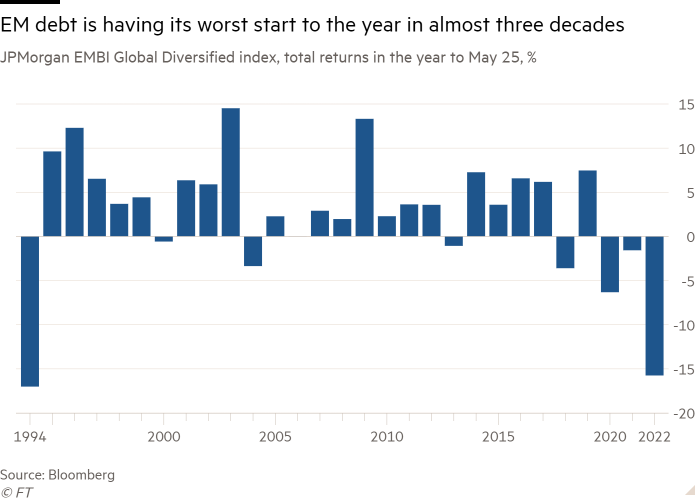

The benchmark index of dollar-denominated EM sovereign bonds, the JPMorgan EMBI International Diversified, has delivered complete returns of round minus 15 per cent thus far in 2022, its worst begin to the 12 months since 1994. The decline has solely been barely eased by the broad rally throughout international markets in latest days, which ended a seven-week shedding streak for Wall Road shares.

Practically $36bn has flowed out of emerging market mutual and change traded bond funds because the begin of the 12 months, in line with information from EPFR; fairness market flows have additionally gone into reverse because the begin of this month.

“It’s definitely the worst begin I can keep in mind throughout the asset class and I’ve been doing EMs for greater than 25 years,” stated Brett Diment, head of world rising market debt at Abrdn.

Creating economies have been hit onerous by the coronavirus pandemic, straining their public funds. Rising inflation, slowing international development and the geopolitical and monetary disruption brought on by Russia’s battle in Ukraine have added to the financial pressures they face. The funding outflows threaten to worsen their woes by tightening liquidity.

David Hauner, head of EM technique and economics at Financial institution of America International Analysis, stated he anticipated the scenario to worsen.

“The large story is that now we have a lot inflation on this planet and financial policymakers proceed to be stunned by how excessive it’s,” he stated. “Meaning extra financial tightening and central banks will proceed till one thing breaks, the financial system or the market.”

Yerlan Syzdykov, international head of rising markets at Amundi, stated greater yields in developed markets just like the US — pushed by central banks’ fee rises — make EM bonds much less enticing. “At greatest you’ll make zero, at worst you’ll lose cash [this year],” he stated.

Hauner stated that fee rises in main developed market economies weren’t essentially dangerous for EM belongings in the event that they have been accompanied by financial development. “However that isn’t the case now — now we have a significant stagflation downside and central banks are elevating charges to kill rampant inflation in some locations, such because the US. This can be a very unhealthy backdrop for rising markets.”

China, the world’s greatest rising market, has confronted among the heaviest promoting.

Considerations about geopolitical threat, together with the likelihood that China will invade Taiwan within the wake of Russia’s invasion of Ukraine, had been exacerbated by the financial slowdown as the federal government imposed draconian lockdowns in pursuit of its zero-Covid coverage, stated Jonathan Fortun, economist on the Institute of Worldwide Finance, which displays cross-border portfolio flows to rising markets.

Chinese language belongings have acquired massive so-called passive inflows over the previous two years, he famous, following the nation’s inclusion in international indices which meant that fund managers trying to reflect their benchmarks robotically purchased Chinese language shares and bonds.

This 12 months, nevertheless, such flows had gone into reverse, with greater than $13bn leaving Chinese language bonds in March and April and greater than $5bn leaving Chinese language equities, in line with IIF information.

“We’re pencilling in detrimental outflows from China for the rest of this 12 months,” Fortun stated. “This can be a very large deal.”

Fund managers haven’t allotted among the cash withdrawn from China to different EM belongings, he stated, leading to a widespread retreat: “Everybody is popping from the entire EM advanced as an asset class and going to safer belongings.”

The shock to commodity costs brought on by the battle in Ukraine has added to the pressure on many growing international locations that depend on imports to satisfy their wants for meals and vitality.

However this has additionally delivered some winners amongst commodity exporters. Diment at Abrdn famous that, whereas native forex bonds within the JPMorgan GBI-EM index have delivered complete returns of minus 10 per cent thus far this 12 months in greenback phrases, there may be vast divergence between international locations.

Bonds issued by Hungary, which is near the battle and depends on Russian vitality imports, have misplaced 18 per cent within the 12 months thus far. These of Brazil, an enormous exporter of business and meals commodities, are up 16 per cent in greenback phrases.

Diment stated valuations of EM debt “arguably look fairly enticing now” and that Abrdn has seen internet inflows thus far this 12 months into its EM debt funds.

Nonetheless, Hauner at Financial institution of America argued that the underside will solely be reached when central banks shift their consideration from preventing inflation to selling development. “That will occur someday by the autumn nevertheless it doesn’t really feel like we’re there but,” he stated.

Syzdykov stated it trusted whether or not the surge in inflation ebbs, returning the worldwide financial system to an equilibrium between low inflation and low rates of interest. The choice is that the US goes into recession subsequent 12 months, including to the drag on international development and pushing EM yields greater nonetheless, he warned.