One thing that I have craved for investors is a tool that allows you to sync all your financial accounts – your investment portfolio, checking and savings accounts, credit cards and other loan accounts – in one place, and then provides an investment-related analysis of your entire portfolio.

Mint does a fantastic job of giving you numbers, but falls short on providing any financial insight.

Then there’s Blueleaf, which I subscribe to for my clients and find to be excellent on both accounts, but it’s not available to the DIY investor.

So when I discovered Empower (formerly Personal Capital), I was so excited to learn more that I immediately signed up and synced all of my investment accounts to it.

What is Empower (formerly Personal Capital)?

Personal Capital is an online tool, available from your desktop or phone, that will help you:

- Monitor all of your financial accounts in real-time – whether checking account, certificate of deposit, or retirement account

- Get objective investment advice designed to make you – not the advisor – money

- Provide investment options that are tailored to your goals

This is fantastic. You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees.

So, while these advisors can certainly be excellent, they’re mostly unreachable unless you have millions of dollars to invest.

What’s more, these wealth advisors aren’t really there to teach you how to put together a budget, they strictly manage your money.

Personal Capital to the rescue.

I know what you’re thinking. “Okay, great, but why should I trust these new guys?” I’ve got to be honest with you. There were two words I saw on Personal Capital’s website that made my heart skip a beat.

Those two words? Are you ready?

Fiduciary Obligation

Here’s copy straight from their website:

Objective Advice: The sorry truth is that bankers and brokers are motivated to help themselves, not you. They are salespeople paid to push products, earning commissions and kickbacks when they do. In stark contrast, Personal Capital is an investment advisor. We accept a fiduciary obligation to act in your best interest, and our advice must be aimed at making money for you, not for us.

This is absolutely key with any financial advisor you talk to, whether in person or online. Fiduciary duty means the party has a legal obligation to put your interests above their own.

Whereas normal brokers get paid commissions by getting you to churn your investments over and over (which costs you thousands of dollars in lost percentages here and there), Personal Capital is putting a requirement on themselves to put your interests above theirs.

This is huge!

Seriously, major points for Personal Capital from me on this one.

How Empower Works

.mc-hide{display:none !important}.mc-block{display:block !important}.mc-youtube-container{max-width:800px;margin:0 auto}.mc-youtube-container .mc-player-trigger{position:relative;text-align:center;display:block}.mc-youtube-container .mc-player-trigger img{max-width:100%}.mc-youtube-container .mc-player-trigger .mc-player-trigger-play-btn{background:rgba(0,0,0,0.55);width:64px;height:34px;border-radius:5px;display:flex;align-items:center;justify-content:center;position:absolute;top:50%;left:50%;margin-left:-32px;margin-top:-17px;-webkit-transform:translateY(-50%);-ms-transform:translateY(-50%);transform:translateY(-50%)}.mc-youtube-container .mc-player-trigger .mc-player-trigger-play-btn .mc-tri{width:0;height:0;border-style:solid;border-width:7px 0 7px 14px;border-color:transparent transparent transparent #ffffff;margin:0 auto}.mc-youtube-container .mc-player-trigger:hover .mc-player-trigger-play-btn{background:#cd201f}.mc-youtube-container .mc-youtube-ratio{width:100%;height:0;overflow:hidden;padding-bottom:56.25%;position:relative}.mc-youtube-container iframe{position:absolute;left:0;top:0;width:100%;height:100%}

(function(){

function buildIframe(youtube_id, iframe_id) {

return [

”

].join(”)

}

var trigger = document.getElementById(‘mc-player-trigger-17588’);

trigger.addEventListener(‘click’, function(e) {

e.preventDefault();

var ratio = document.getElementById(‘mc-youtube-ratio-27415’);

ratio.innerHTML = buildIframe(‘QVsP-VqIb9o’, ‘mc-player-iframe-58449’);

ratio.classList.remove(‘mc-hide’);

trigger.classList.add(‘mc-hide’);

var iframe = document.getElementById(‘mc-player-iframe-58449’);

iframe.src += “?autoplay=1”;

});

})();{

“@context”: “https://schema.org”,

“@type”: “VideoObject”,

“name”: “Personal Capital Review – Greatest Investment Tool EVER (and it’s free!)”,

“description”: “ Free Personal Account here: personalcapital.sjv.io/kj1Nan\n\nWhen I was a practicing financial planner I used to dream of having a software program that would allow me to sync up all of my clients financial accounts in one place.\n\nFinally, after years of begging there was a company that finally created this software. I was happy to pay $500/month to use this software.\n\nThen something crazy happened…..a company created this exact type of software that was absolutely FREE to use.\n\nIt is called Personal Capital.\n\n\n🔎 RESOURCES MENTIONED 👇\n\nhttps://wealthhackerlabs.com/ask/\nhttps://www.goodfinancialcents.com/personal-capital-review/\nhttps://www.goodfinancialcents.com/personal-capital-vs-mint-review/\n\n🔖CHAPTERS 👇\n\n00:00 Intro\n01:41 What the App can do for you\n04:20 Overview of Personal Capital \n10:04 What happens when uou sign up?\n11:11 An over-the-shoulder look at the dashboard\n15:04 Is there a security risk?\n20:54 Additional services they offer\n\n\n★☆★Buy Crypto Here★☆★\n\n💶Blockfi- Crypto Currency Saving Accounts : https://wealthhackerlabs.com/blockfi\n➜Celsius – Free Bitcoin w/ New Account: https://wealthhackerlabs.com/celsius\n▶️ CoinBase – $5 Bitcoin New Accounts bonus: https://wealthhackerlabs.com/celsius\n🎯Webull: Get Free Stock and trade crypto: https://wealthhackerlabs.com/webull\n\n★☆★Time to Invest!★☆★\n\n📊Build Custom Portfolios at M1 Finance: https://wealthhackerlabs.com/M1Finance\n🎯Get Free Stock w/ WeBull: https://wealthhackerlabs.com/webull\n🏠Invest in Real Estate w/ Fundrise: https://wealthhackerlabs.com/fundrise\n\n💳 Free Credit Score w/ Credit Karma: https://wealthhackerlabs.com/creditkarma\n\n——\n\n

Free Personal Account here: personalcapital.sjv.io/kj1Nan\n\nWhen I was a practicing financial planner I used to dream of having a software program that would allow me to sync up all of my clients financial accounts in one place.\n\nFinally, after years of begging there was a company that finally created this software. I was happy to pay $500/month to use this software.\n\nThen something crazy happened…..a company created this exact type of software that was absolutely FREE to use.\n\nIt is called Personal Capital.\n\n\n🔎 RESOURCES MENTIONED 👇\n\nhttps://wealthhackerlabs.com/ask/\nhttps://www.goodfinancialcents.com/personal-capital-review/\nhttps://www.goodfinancialcents.com/personal-capital-vs-mint-review/\n\n🔖CHAPTERS 👇\n\n00:00 Intro\n01:41 What the App can do for you\n04:20 Overview of Personal Capital \n10:04 What happens when uou sign up?\n11:11 An over-the-shoulder look at the dashboard\n15:04 Is there a security risk?\n20:54 Additional services they offer\n\n\n★☆★Buy Crypto Here★☆★\n\n💶Blockfi- Crypto Currency Saving Accounts : https://wealthhackerlabs.com/blockfi\n➜Celsius – Free Bitcoin w/ New Account: https://wealthhackerlabs.com/celsius\n▶️ CoinBase – $5 Bitcoin New Accounts bonus: https://wealthhackerlabs.com/celsius\n🎯Webull: Get Free Stock and trade crypto: https://wealthhackerlabs.com/webull\n\n★☆★Time to Invest!★☆★\n\n📊Build Custom Portfolios at M1 Finance: https://wealthhackerlabs.com/M1Finance\n🎯Get Free Stock w/ WeBull: https://wealthhackerlabs.com/webull\n🏠Invest in Real Estate w/ Fundrise: https://wealthhackerlabs.com/fundrise\n\n💳 Free Credit Score w/ Credit Karma: https://wealthhackerlabs.com/creditkarma\n\n——\n\n 🧠Learn From Jeff

🧠Learn From Jeff 🧠\n\n▶︎▶︎▶︎ Free Course: \”Make $1K Blogging\” 💻\n\n//Step by step guide shows you how to start a blog and make your first $1,000 \n\n➡️➡️➡️ http://Make1kChallenge.com\n\n————\n\n★☆★The Ultimate Guide to Make More Money 💰 [FREE DOWNLOAD]★☆★\n\n//This guide has everything you need to know about how to make MORE money:\n\n➡️➡️➡️ https://wealthhackerlabs.com/make-mon…\n\n——\n\n★☆★The Passive 1k Formula

🧠\n\n▶︎▶︎▶︎ Free Course: \”Make $1K Blogging\” 💻\n\n//Step by step guide shows you how to start a blog and make your first $1,000 \n\n➡️➡️➡️ http://Make1kChallenge.com\n\n————\n\n★☆★The Ultimate Guide to Make More Money 💰 [FREE DOWNLOAD]★☆★\n\n//This guide has everything you need to know about how to make MORE money:\n\n➡️➡️➡️ https://wealthhackerlabs.com/make-mon…\n\n——\n\n★☆★The Passive 1k Formula ★☆★\n\n\n//The exact process Jeff used to grow his passive income business that generates hundreds of thousands dollars per year passively.\n\n\n➡➡ https://learn.wealthhackerlabs.com/p/…\n\n\n—\n—\n\n\n🔔 SUBSCRIBE TO WEALTH HACKER ON YOUTUBE 👇\nhttps://wealthhackerlabs.com/subscribe\n\n\n\n\n★☆★ WANT MORE FROM WEALTH HACKER

★☆★\n\n\n//The exact process Jeff used to grow his passive income business that generates hundreds of thousands dollars per year passively.\n\n\n➡➡ https://learn.wealthhackerlabs.com/p/…\n\n\n—\n—\n\n\n🔔 SUBSCRIBE TO WEALTH HACKER ON YOUTUBE 👇\nhttps://wealthhackerlabs.com/subscribe\n\n\n\n\n★☆★ WANT MORE FROM WEALTH HACKER LABS?★☆★\n\n💰Wealth Hacker

LABS?★☆★\n\n💰Wealth Hacker blog: https://wealthhackerlabs.com/\n\n💻 Personal finance blog: https://www.goodfinancialcents.com/\n\nPodcast: \n\n🎙 https://itunes.apple.com/us/podcast/g…\n\n\n\n★☆★Pick up Jeff’s best selling book, Soldier of Finance, here: ★☆★\n\n📗https://amzn.to/2JVzwwo\n\n\n\n\n★☆★ CONNECT WITH JEFF ON SOCIAL★☆★\n\n➡Twitter: https://twitter.com/jjeffrose\n➡Instagram: https://www.instagram.com/jjeffrose/\n➡Facebook: https://www.facebook.com/jjeffrose/\n➡Linked In: https://www.linkedin.com/in/jeffrosecfp/”,

blog: https://wealthhackerlabs.com/\n\n💻 Personal finance blog: https://www.goodfinancialcents.com/\n\nPodcast: \n\n🎙 https://itunes.apple.com/us/podcast/g…\n\n\n\n★☆★Pick up Jeff’s best selling book, Soldier of Finance, here: ★☆★\n\n📗https://amzn.to/2JVzwwo\n\n\n\n\n★☆★ CONNECT WITH JEFF ON SOCIAL★☆★\n\n➡Twitter: https://twitter.com/jjeffrose\n➡Instagram: https://www.instagram.com/jjeffrose/\n➡Facebook: https://www.facebook.com/jjeffrose/\n➡Linked In: https://www.linkedin.com/in/jeffrosecfp/”,

“thumbnailUrl”: “https://i.ytimg.com/vi/QVsP-VqIb9o/maxresdefault.jpg”,

“uploadDate”: “2022-04-12”,

“duration”: “PT24M11S”,

“contentUrl”: “https://www.youtube.com/watch?v=QVsP-VqIb9o”,

“embedUrl”: “https://youtu.be/QVsP-VqIb9o”,

“publisher”: {

“@type”: “Organization”,

“name”: “GoodFinancialCents® – Jeff Rose, CFP®”

}

}

Personal Capital offers a free version and a premium version that features direct investment management. Whichever version you use, your account is actually held by Pershing Advisor Solutions, who acts as trustee for your account.

The Free Version

With the free version, you get full use of the Personal Capital platform as well as a free consultation from a financial advisor. That advisor will give you a personalized analysis of your investments and recommendations as to what you can do with your portfolio. Your financial advisor can be contacted by phone, email, or by online chat.

In fact, the only feature that differentiates the free version from Personal Capital’s premium product is their personalized portfolio management. Other than that, the free version includes all of the many features and benefits that are available on the platform, including the ability to aggregate all of your financial accounts, the 401(k) analyzer, objective investment advice and investment check-ups, a real-time financial dashboard, and access via the mobile app.

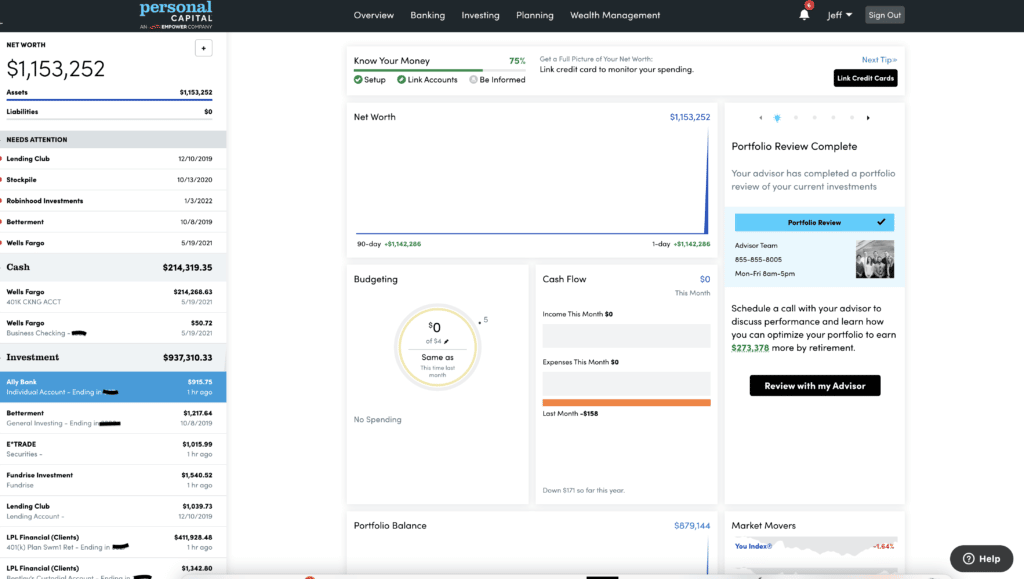

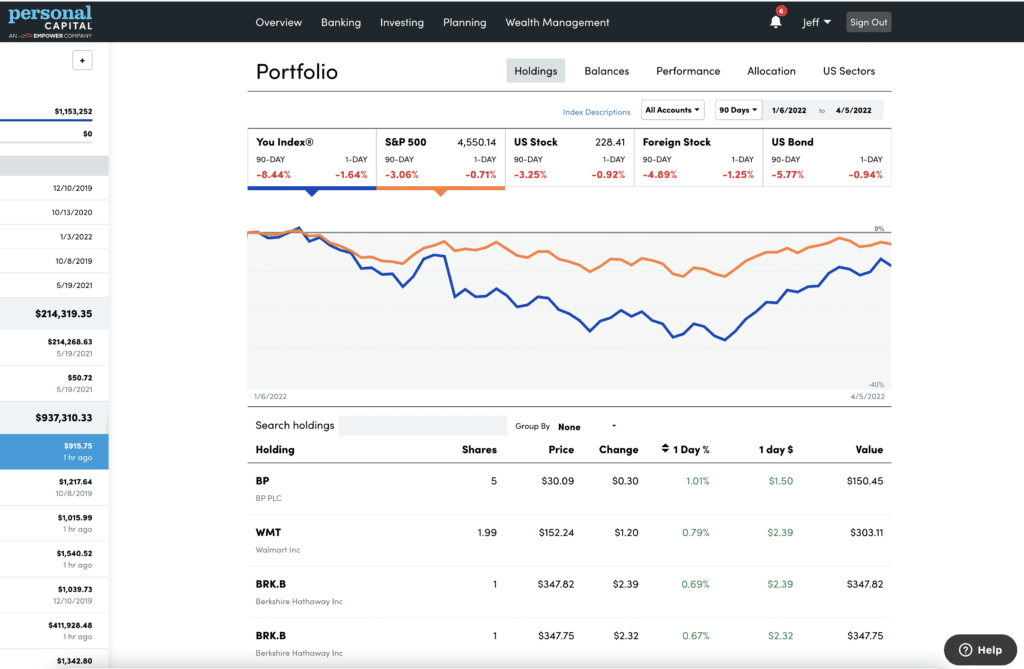

To show you how comprehensive their free platform is, take a look at this screenshot of their Portfolio Review from my free account:

This is just the “Holdings” tab on this feature. You can also get information on your performance and asset allocation. I can’t stress enough how valuable this information is for all types of investors – beginner or seasoned.

The Premium Version

Also known as their Wealth Management program, Personal Capital’s premium program includes active management of your investment portfolio. Like other similar products, they first determine your risk tolerance, personal preferences, and investment goals. Using that evaluation, they then create a portfolio tailored to fit within those parameters.

The fee structure for this service is as follows:

- 0.89% of the first $1 million

- 0.79% of the first $3 million

- 0.69% of the next $2 million

- 0.59% of the next $5 million

- 0.49% on balances over $10 million

These fees are quite reasonable when compared with fees of 1% to 2% that are customarily charged by active investment management services. The fees apply only to the assets you have under management at Personal Capital, and not to other investments that may be aggregated on the site, such as your 401(k) plan.

And, that’s it. There are no additional fees. Personal Capital does not charge trading, commission, administrative, or any other types of investment fees. Your only cost is the annual, all-inclusive percentage that applies to your portfolio level.

Investment Strategy

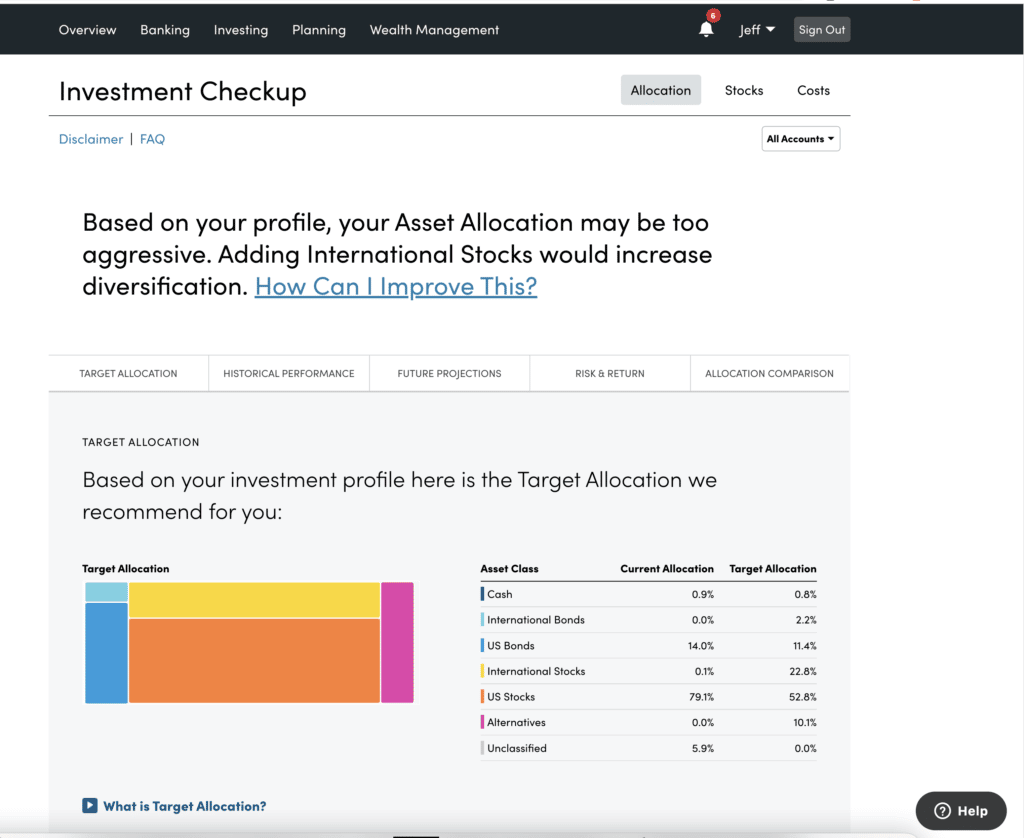

Personal Capital uses Modern Portfolio Theory (MPT), to manage your portfolio. MPT focuses less on individual security selection, and more on diversification across broad asset classes. Those asset classes include:

- US stocks (which can include individual stocks)

- US bonds

- International stocks

- International bonds

- Alternative investments (including ETFs and commodities)

- Cash

Though Personal Capital makes use of funds in constructing your portfolio, they may also include up to 100 individual securities in order to avoid being too heavily concentrated in a small number of companies.

I also discovered through my review that Personal Capital uses an integrated investment approach to managing your investments, which is a pretty unique feature. This means that they factor in all of your investment holdings – including those not managed by Personal Capital – in managing your portfolio.

For example, though they don’t manage your 401(k) account, your 401(k) allocations will be considered when making decisions about your investments that are actually managed by Personal Capital.

Review of Personal Capital Tools and Benefits

There is a long list of tools and benefits in using Personal Capital. Some of the more interesting ones include:

The Investment Checkup

This tool analyzes your investment portfolio and gives a risk assessment of it, to make sure that your level of risk is consistent with your goals. This will help you to create an asset allocation that will get you where you need to go with your investments. Here’s a screenshot of their Investment Checkup from my Personal Capital dashboard:

401(k) Fund Allocation

This tool can be used to analyze your employer-sponsored 401(k) plan, even though it is not under the direct management of Personal Capital. It can be used to help you with your asset allocation, at least based on the investment options that your plan includes. This is an excellent tool since most 401(k) plans don’t, any kind of investment management advice.

Retirement Planner

You can often find retirement planners or retirement calculators on various sites throughout the Internet. But what better place than to have it available where you also have all of your investment accounts listed? Personal Capital’s Retirement Planner allows you to run numbers on your retirement to make sure that you will be prepared when the time comes. It allows you to incorporate major changes in your life into your retirement planning, such as the birth of a child or saving for college.

Net Worth Calculator

Since Personal Capital aggregates all of your financial accounts on the same platform, they can also provide you with ongoing monitoring of your net worth. This will enable you to get the most comprehensive view of your financial situation since it not only takes into account your assets but also your debts. Net worth is the best single indicator of your overall financial strength, and this will give you an opportunity to track it.

Cash Flow Analyzer

Though our focus in this article has been primarily on the investment side of Personal Capital, it’s important to recognize that it also includes a budgeting capability. The Cash Flow Analyzer tracks your income and expenses from all sources, letting you know where you’re spending money (or spending too much of it), which will help you to make adjustments that will improve your overall budget.

Mobile App

Personal Capital’s mobile app is a free feature that can be downloaded on Apple iPhone, iPad, Apple Watch and Android. The mobile version has everything that is available on the desktop platform. It will enable you to track your investment portfolio, as well as your banking and credit card activity while you’re on the go.

Tax Optimization

Personal Capital uses tax optimization in the management of your portfolio. This feature is available to premium Wealth Management clients, and not if you are using the free version.

They use several tactics as part of tax optimization. For example, they include income-producing investments in tax-deferred accounts, while growth-oriented investments – that have the benefit of lower capital gains taxes – are held in taxable accounts.

In addition, they don’t use mutual funds, but instead use exchange-traded funds with a mix of individual stocks, since stocks can be easily bought and sold for tax-loss harvesting. And speaking of tax-loss harvesting, they use this strategy to sell losing stocks, which offsets the gains on the sale of winning stocks. This strategy minimizes the negative impact on your investment portfolio from income taxes.

Site Security

Personal Capital uses bank-level, military-grade encryption on the platform. They also perform ongoing third-party security audits to test their systems. They also use device authentication so that each device you link your account to must first be authenticated in order to be used

Crash Test Your Portfolio

Investing expenses and taxes are the two things you can absolutely count on within the investing world. You can’t rely on gains every year, but you can guarantee you will be taxed and you will pay expenses. That makes reducing those expenses as one of two ways you can control your investing destiny.

Thankfully, Personal Capital realizes this and offers you a really great tool to analyze the cost of your investments. Where this gets interesting is you can do an analysis on your employer’s 401 (k) plan (as discussed above) to discover whether your plan is amazing, just okay, or terrible as it comes to costs. You might be the person to go to HR to reveal just how expensive your plan is, lay out a new plan that would cut costs for everyone, and end up getting a promotion just for running a cost analysis.

Even if you don’t get promoted to head investment advisor for your employer, at the very least you’ll save your own retirement from exorbitant fees. And that’s a huge win we can all settle for.

Is Personal Capital for Me?

The idea of wealth management means you need to have wealth to manage. If you’re struggling to get out of debt, that’s okay, but Personal Capital probably isn’t the best fit for you. In that case, Mint might be a better option and you can see a full comparison in my complete personal capital vs mint review.

However, if you are building up your retirement assets and want to be able to maximize your nest egg without gambling on penny stocks, then you should definitely sign up for the service. All of the features aside from the personalized portfolio management are absolutely free, so there’s really no reason not give them a try.

FAQs on Personal Capital App

Personal Capital is a financial management company that provides a range of financial services, including financial planning, investment management, and retirement planning. The company is registered with the Securities and Exchange Commission (SEC) as an investment adviser and is subject to regulatory oversight.

They were founded in 2009 and sold to Empowe for up to $1 billion in enterprise value. You can read their formal ADV filed with the SEC here.

In general, Personal Capital is a reputable and trustworthy company. The company has received positive reviews from customers and industry experts, and it has a strong track record of helping its clients achieve their financial goals.

Here are a few potential cons to consider before using Personal Capital’s services:

Fees: Personal Capital charges fees for its financial planning and investment management services. These fees may be higher than those charged by other financial institutions or financial advisors. It’s important to carefully review the fees and understand how they are calculated before deciding to use Personal Capital’s services.

Limited access to advisors: Personal Capital’s financial planning and investment management services are primarily conducted online, and you may not have in-person access to an advisor. This can be a drawback if you prefer to have in-person meetings or if you have complex financial questions that require in-depth discussion.

Limited investment options: Personal Capital offers a limited number of investment options, including mutual funds and exchange-traded funds (ETFs). If you are interested in investing in individual stocks or other securities, you may need to look elsewhere.

It’s important to carefully consider these potential cons and to do your own research before deciding to use Personal Capital’s services.

.wp-review-24208.review-wrapper { font-family: ‘Josefin Sans’, sans-serif; }

Personal Capital Review

Product Name: Personal Capital

Product Description: Personal Capital is a financial advisor and investment management company. They provide services such as wealth management, retirement planning, and portfolio management.

Summary

Personal capital is a company that provides financial planning and investment management services.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Investment Management

-

Portfolio Analysis

Overall

Pros

- The app is free to use

- User-friendly interface

- Provides a comprehensive overview of your financial situation

- Offers a variety of tools to help you manage your finances

Cons

- Limited features

- Investment management fees

- Limited access to advisors

- Limited investment options

- Potential conflicts of interest

.wp-review-24208.review-wrapper {

box-shadow: 0 0 20px rgba(0, 0, 0, 0.1);

width: 98%;

float: left;

border: none;

background: #ffffff;

margin: 0 1% 30px;

}

.wp-review-24208.review-wrapper .review-desc {

clear: both;

padding: 25px 30px 25px 30px;

line-height: 26px;

}

.wp-review-24208.review-wrapper .review-desc .review-summary-title {

text-transform: uppercase;

}

.wp-review-24208.review-wrapper,

.wp-review-24208 .review-title,

.wp-review-24208 .review-desc p,

.wp-review-24208 .reviewed-item p {

color: #6a788a;

}

.wp-review-24208 .review-links a {

background: #8cc739;

padding: 10px 20px 8px 20px;

box-shadow: none;

border: none;

color: #fff;

border-radius: 50px;

cursor: pointer;

transition: all 0.25s linear;

}

.wp-review-24208 .review-links a:hover {

background: #1f3457;

color: #fff;

box-shadow: none;

}

.wp-review-24208 .review-list li {

padding: 20px 30px;

}

.wp-review-24208 .review-list li:last-child {

border-bottom: 0;

}

.wp-review-24208.wp-review-circle-type .review-list li {

padding: 19px 30px;

}

.wp-review-24208.wp-review-circle-type .review-list .review-circle .review-result-wrapper { height: 32px; }

.wp-review-24208.wp-review-circle-type .review-list .wp-review-user-rating .review-circle .review-result-wrapper {

height: 50px;

}

.wp-review-24208.wp-review-circle-type .wpr-user-features-rating .review-list li {

padding: 10px 30px;

}

.wp-review-24208.wp-review-point-type .review-list li,

.wp-review-24208.wp-review-percentage-type .review-list li {

padding: 24px 30px;

}

.wp-review-24208.wp-review-point-type .review-list li > span,

.wp-review-24208.wp-review-percentage-type .review-list li > span {

display: inline-block;

position: absolute;

z-index: 1;

top: 32px;

left: 45px;

color: #ffffff;

font-size: 14px;

line-height: 1;

text-shadow: 0 1px 1px rgba(0, 0, 0, 0.3);

-webkit-touch-callout: none;

-webkit-user-select: none;

-khtml-user-select: none;

-moz-user-select: none;

-ms-user-select: none;

user-select: none;

}

.wp-review-24208.wp-review-point-type .wpr-user-features-rating .review-list li > span,

.wp-review-24208.wp-review-percentage-type .wpr-user-features-rating .review-list li > span {

color: inherit;

text-shadow: none;

}

.wp-review-24208.wp-review-point-type .wpr-user-features-rating .review-list li .wp-review-input-set + span,

.wp-review-24208.wp-review-percentage-type .wpr-user-features-rating .review-list li .wp-review-input-set + span,

.wp-review-24208.wp-review-point-type .wpr-user-features-rating .review-list li .wp-review-user-rating:hover + span,

.wp-review-24208.wp-review-percentage-type .wpr-user-features-rating .review-list li .wp-review-user-rating:hover + span {

color: #fff;

}

.wp-review-24208 .review-list li:nth-child(even) {

background: #edf2f9;

}

.wp-review-24208 .review-links {

padding: 30px 30px 20px 30px;

}

.wp-review-24208.review-wrapper .review-result-wrapper i {

font-size: 18px;

}

#review.wp-review-24208.review-wrapper .review-pros-cons {

clear: both;

padding: 0;

border-top: 1px solid #edf2f9;

}

#review.wp-review-24208.review-wrapper .review-pros-cons .review-pros,

#review.wp-review-24208.review-wrapper .review-pros-cons .review-cons {

width: 100%;

flex: none;

padding: 0;

}

#review.wp-review-24208.review-wrapper .review-pros-cons .review-pros {

background: #1f3457;

padding: 30px 30px 10px 30px;

color: #fff;

box-sizing: border-box;

}

#review.wp-review-24208.review-wrapper .review-pros-cons .review-cons {

background: #8cc739;

padding: 30px 30px 10px 30px;

color: #fff;

box-sizing: border-box;

}

.wp-review-24208.review-wrapper .mb-5 {

text-transform: uppercase;

}

.wp-review-24208.review-wrapper .mb-5 + p {

line-height: 26px;

}

.wp-review-24208 .user-review-area {

padding: 15px 30px;

border-top: 1px solid;

}

.wp-review-24208 .wp-review-user-rating .review-result-wrapper .review-result {

letter-spacing: -2.35px;

}

.wp-review-24208.review-wrapper .review-title {

letter-spacing: 1px;

font-weight: 700;

padding: 15px 30px;

background: transparent;

}

.wp-review-24208.review-wrapper .review-total-wrapper {

width: 40%;

margin: 0;

padding: 35px 0;

color: #fff;

background: #ffffff;

border-left: 1px solid;

text-align: center;

float: right;

clear: none;

border-top: 1px solid;

}

.wp-review-24208.review-wrapper .review-list {

clear: none;

width: 60%;

float: left;

border-top: 1px solid;

}

.wp-review-24208.review-wrapper .wpr-user-features-rating,

.wp-review-24208.review-wrapper .wpr-user-features-rating .review-list {

width: 100%;

clear: both;

border-top: 1px solid #edf2f9;

}

.wp-review-24208.review-wrapper.wp-review-circle-type .review-total-wrapper {

padding: 20px 0;

}

.wp-review-24208.review-wrapper.wp-review-circle-type .review-total-wrapper .review-circle.review-total {

margin: auto 0;

padding-top: 10px;

width: auto;

height: 100%;

clear: both;

}

.wp-review-24208.review-wrapper.wp-review-circle-type .user-review-area {

padding: 12px 30px;

}

.wp-review-24208.review-wrapper.wp-review-thumbs-type .review-list {

width: 100%;

}

.wp-review-24208.review-wrapper .review-result-wrapper {

border-radius: 25px;

}

.wp-review-24208.review-wrapper .review-percentage .review-result-wrapper,

.wp-review-24208.review-wrapper .review-percentage .review-result,

.wp-review-24208.review-wrapper .review-point .review-result-wrapper,

.wp-review-24208.review-wrapper .review-point .review-result {

height: 26px;

margin-bottom: 0;

background: #f1e3cd;

border-radius: 25px;

}

.wp-review-24208.review-wrapper li .review-point .review-result {

background: #8cc739;

}

.wp-review-24208.review-wrapper li:nth-of-type(2n) .review-point .review-result {

background: #1f3457;

}

.wp-review-24208 .review-total-wrapper .review-point.review-total,

.wp-review-24208 .review-total-wrapper .review-percentage.review-total {

width: 70%;

display: inline-block;

margin: 20px auto 0 auto;

}

.wp-review-24208.review-wrapper .review-total-wrapper .review-total-box {

float: left;

text-align: center;

padding: 0;

color: #6a788a;

line-height: 1.5;

}

.wp-review-24208.review-wrapper .review-total-wrapper .review-total-box h5 {

margin-top: 10px;

color: inherit;

}

.wp-review-24208.review-wrapper.wp-review-point-type .review-total-wrapper .review-total-box,

.wp-review-24208.review-wrapper.wp-review-percentage-type .review-total-wrapper .review-total-box {

width: 100%;

}

.wp-review-24208.review-wrapper .review-star.review-total {

color: #fff;

margin-top: 10px;

}

.wp-review-24208.review-wrapper .user-review-title {

padding: 15px 30px 10px;

margin: 0;

color: inherit;

background: #edf2f9;

border-top: 1px solid;

border-bottom: 1px solid;

}

.wp-review-24208.review-wrapper .user-total-wrapper .user-review-title {

display: inline-block;

color: #6a788a;

text-transform: uppercase;

letter-spacing: 1px;

padding: 0;

border: 0;

background: transparent;

margin-top: 3px;

}

#review.wp-review-24208.review-wrapper.wp-review-circle-type .user-total-wrapper h5.user-review-title {

margin-top: 12px;

}

#review.wp-review-24208.review-wrapper.wp-review-circle-type .user-total-wrapper span.user-review-title {

margin-top: 8px;

}

.wp-review-24208.review-wrapper .reviewed-item {

padding: 30px;

}

.wp-review-24208.review-wrapper.wp-review-circle-type .review-total-wrapper > .review-total-box {

display: block;

}

.wp-review-24208.review-wrapper.wp-review-circle-type .review-total-wrapper > .review-total-box > div { display: none; }

#review.wp-review-24208.review-wrapper .user-review-area .review-percentage,

#review.wp-review-24208.review-wrapper .user-review-area .review-point {

width: 20%;

float: right;

margin-bottom: 5px;

}

.wp-review-24208 .review-embed-code { padding: 10px 30px; }

.wp-review-24208.review-wrapper,

.wp-review-24208 .review-title,

.wp-review-24208 .review-list li,

.wp-review-24208 .review-list li:last-child,

.wp-review-24208.review-wrapper .review-list,

.wp-review-24208 .user-review-area,

.wp-review-24208.review-wrapper .review-total-wrapper,

.wp-review-24208 .reviewed-item,

.wp-review-24208 .review-links,

.wp-review-24208 .wpr-user-features-rating,

.wp-review-24208.review-wrapper .user-review-title {

border-color: #edf2f9;

}

.wp-review-24208 .wpr-rating-accept-btn {

background: #8cc739;

margin: 10px 30px;

width: -moz-calc(100% – 60px);

width: -webkit-calc(100% – 60px);

width: -o-calc(100% – 60px);

width: calc(100% – 60px);

border-radius: 50px;

}

@media screen and (max-width:480px) {

.wp-review-24208.review-wrapper .review-title,

.wp-review-24208.review-wrapper .reviewed-item,

.wp-review-24208.review-wrapper .review-list li,

.wp-review-24208.review-wrapper .review-desc,

.wp-review-24208.review-wrapper .user-review-area,

.wp-review-24208.review-wrapper .review-embed-code { padding: 15px; }

.wp-review-24208.wp-review-circle-type .review-list li {

padding: 15px 15px 0px 15px;

}

.wp-review-24208.review-wrapper .review-pros-cons > div > div { padding: 15px; padding-top: 0; }

.wp-review-24208.review-wrapper .ui-tabs-nav { padding: 0 15px; }

.wp-review-24208.review-wrapper .review-links { padding: 15px 15px 5px; }

.wp-review-24208.review-wrapper .review-list,

.wp-review-24208.review-wrapper .review-total-wrapper { width: 100%; }

.wp-review-24208.review-wrapper .review-total-wrapper { padding: 10px 0; }

.wp-review-24208.review-wrapper .review-total-wrapper .review-total-box h5 { margin-top: 0; }

.wp-review-24208.review-wrapper .review-total-wrapper .review-total-box div { line-height: 1; }

}

{

“@context”: “http://schema.org”,

“@type”: “Review”,

“itemReviewed”: {

“@type”: “Product”,

“name”: “Personal Capital”,

“description”: “Personal Capital is a financial advisor and investment management company. They provide services such as wealth management, retirement planning, and portfolio management.”,

“image”: “https://www.goodfinancialcents.com/wp-content/uploads/2022/12/Personal-Capital-Logo-300×92.png”,

“url”: “https://www.goodfinancialcents.com/go/personal-capital/review-wp”,

“review”: {

“@type”: “Review”,

“reviewRating”: {

“@type”: “Rating”,

“ratingValue”: 4.3,

“bestRating”: 5,

“worstRating”: 0

},

“author”: {

“@type”: “Person”,

“name”: “Jeff Rose, CFP®”

},

“reviewBody”: “<p>Personal capital is a company that provides financial planning and investment management services.</p>”

}

},

“reviewRating”: {

“@type”: “Rating”,

“ratingValue”: 4.3,

“bestRating”: 5,

“worstRating”: 0

},

“author”: {

“@type”: “Person”,

“name”: “Jeff Rose, CFP®”

},

“reviewBody”: “<p>Personal capital is a company that provides financial planning and investment management services.</p>”

}

The post Empower (formerly Personal Capital) Review – Managing All Your Investments in One Place appeared first on Good Financial Cents®.