“Europe can be solid in disaster and would be the sum of the options adopted for these crises.” These phrases from the memoirs of Jean Monnet, one of many architects of European integration, echo at present, as Russia closes its predominant fuel pipeline. That is certainly now a disaster. Whether or not Monnet’s optimistic perspective prevails, we have no idea. However Vladimir Putin has assaulted the ideas on which postwar Europe was constructed. He merely needs to be resisted.

Power is an important entrance in his battle. It is going to be pricey to win this battle. But Europe can and should free itself from Russia’s chokehold. This isn’t to underestimate the problem. Capital Economics argues that at at present’s costs the worsening of the phrases of commerce would quantity to as a lot as 5.3 per cent of Italy’s gross home product over a yr and three.3 per cent of Germany’s. These losses are greater than both of the 2 oil shocks of the Nineteen Seventies. Furthermore, this ignores the disruption to industrial exercise and the impression of hovering power costs on poorer households.

It’s inevitable, too, that sharply rising power costs will result in excessive inflation. The expertise of the Nineteen Seventies signifies that the perfect response is to maintain inflation firmly below management, because the Bundesbank then did, quite than permit determined makes an attempt to stop the inevitable reductions in actual incomes to show into a seamless wage-price spiral. But this mixture of huge losses in actual incomes with lower than absolutely accommodative financial coverage signifies that a recession is inevitable.

Troublesome although the longer term seems to be, there’s additionally hope. As Chris Giles has written: “There’s nearly no strategy to escape a Europe-wide recession, nevertheless it want be neither deep nor extended.” The probability of a recession has most likely risen additional since then. However work by IMF workers reveals that substantial adjustment is possible, even within the quick run. In the long term, Europe can dispense with Russian fuel. Putin will lose if Europe can solely maintain on.

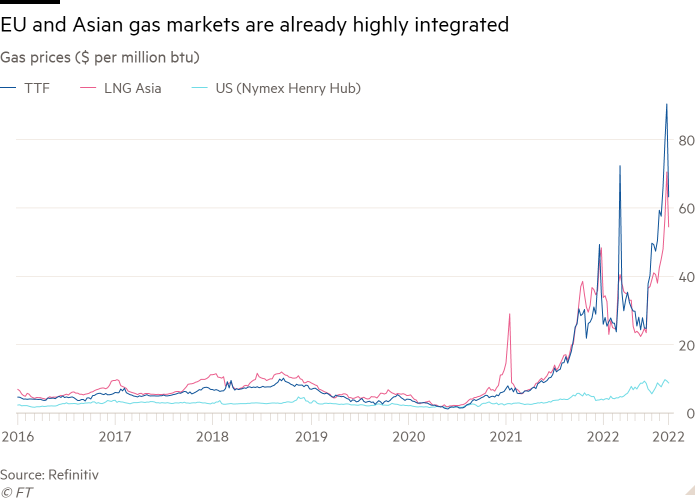

A current paper from the IMF factors to the potential position of the worldwide liquefied pure fuel market in cushioning the shock to Europe. European integration inside world LNG markets is imperfect, however substantial.

The paper concludes {that a} Russian shut-off would result in a decline in EU gross nationwide expenditure of solely about 0.4 per cent a yr after the shock, as soon as one takes the worldwide LNG market under consideration. With out the latter, the decline can be between 1.4 and a pair of.5 per cent. However the former, whereas much better for Europe, would additionally imply greater costs elsewhere, particularly in Asia. The estimated fall of 0.4 per cent additionally ignores demand-side results and assumes full integration of world markets. For these and different causes, the precise impression will certainly be far better.

One other IMF paper means that, with uncertainty added, Germany’s GDP may very well be 1.5 per cent beneath baseline in 2022, 2.7 per cent in 2023 and 0.4 per cent in 2024. IMF work on particular person EU international locations additionally concludes that Germany wouldn’t be the worst hit member state. Italy remains to be extra susceptible. However the worst hit are going to be Hungary, the Slovak Republic and Czechia.

The large lesson of the oil shocks of the Nineteen Seventies was that by the mid-Nineteen Eighties there was a world glut. Market forces will certainly ship the identical final result in time. The short-term impression may even be manageable. The wanted actions are to cushion the shock on the susceptible and encourage wanted changes, which could embrace emergency reopening of gasfields.

Ursula von der Leyen, European Fee president, has asserted that the goal of coverage ought to now be to scale back peak electrical energy demand, cap the worth on pipeline fuel, assist susceptible shoppers and companies with windfall income from the power sector, and help electrical energy producers dealing with liquidity challenges brought on by market volatility. All that is smart, as far as it goes.

A vital side of this disaster is that, like Covid, however in contrast to the monetary disaster, virtually all European international locations are adversely affected, with Norway the large exception. On this case, above all, Germany is among the many most susceptible. Which means that the shock, and so additionally the response, are in widespread: it’s a shared predicament. However it is usually true that particular person members not solely face challenges that differ in severity, but in addition possess considerably completely different fiscal capability. If the eurozone is to get by way of this problem efficiently, the query of sharing fiscal sources will once more come up. It’ll finally be unsustainable to count on the European Central Financial institution to be the primary fiscal backstop in such a disaster. But if weaker international locations had been to be deserted, the political penalties can be dire.

At the very least two additional large points come up. The narrower one is the position of the UK below its new prime minister, Liz Truss. She has a right away selection: to fix the nation’s fences with its European allies in response to the shared risk of Putin, or to interrupt the treaty her predecessor made to “get Brexit performed”. Europeans will rightly neither overlook nor forgive if she chooses the latter on this hour of want.

The second and much greater situation is local weather change. As Fatih Birol of the Worldwide Power Company writes, this isn’t a “clear power disaster”, however the reverse. We want way more clear energy, each due to local weather dangers and to scale back reliance on unreliable suppliers of fossil fuels. We learnt this lesson within the Nineteen Seventies. We’re studying it once more. The case for an power revolution has develop into stronger, not weaker.

How Europe responds to this disaster will form its rapid and longer-term future. It should resist Putin’s blackmail. It should regulate, co-operate and endure. That’s the coronary heart of the matter.