Inflation isn’t new, however worth rises can nonetheless shock. I lately holidayed within the Hamptons, a tony seashore space outdoors New York, the place I used to be shocked to pay $800 for a single purchasing cart of groceries. This wasn’t at some foodie emporium, however fairly on the IGA, which is the American equal of the UK’s Tesco. Meals costs are up in all places, however in locations like this, they’ve reached nosebleed ranges.

Rich locals and trip customers discover, however appear to not curb their spending. Everybody else is travelling an hour or extra to get groceries outdoors the resort areas, ordering dry items from Costco and rising their very own produce.

This story is excessive, however in no way a one-off. To the extent that the rich within the US usually are not but reducing again on spending, they could be an necessary and under-explored issue driving the inflation felt by all.

The highest two-fifths of earnings distribution within the US accounts for 60 per cent of shopper spending, whereas the underside two-fifths accounts for a mere 22 per cent, in keeping with 2020 BLS statistics.

Earnings inequality shouldn’t be the identical as wealth inequality. However the two can go hand in hand. Individuals who make greater incomes are inclined to obtain a larger proportion of compensation in inventory. Additionally they have vastly extra house fairness (which tends to encourage extra consumption spending, in keeping with IMF analysis).

The American Enterprise Institute, a right-leaning think-tank, estimated in February that the wealth impact of each asset positive factors and money extraction from the refinancing of property (which hasn’t corrected but, like shares) represented $900bn, with a consumption impression that began final 12 months and can proceed by means of 2022.

Amazon’s Jeff Bezos can construct a half-billion-dollar yacht, and it doesn’t change life for anybody however him. However when the highest quintile of People as a complete take pleasure in 80 per cent of the wealth impact from rising inventory and residential values (the AEI’s estimate), I think it begins to have an actual impression on inflation, and on the general construction of our economic system, which over the course of the previous 30 years of actual falling rates of interest has change into extremely financialised.

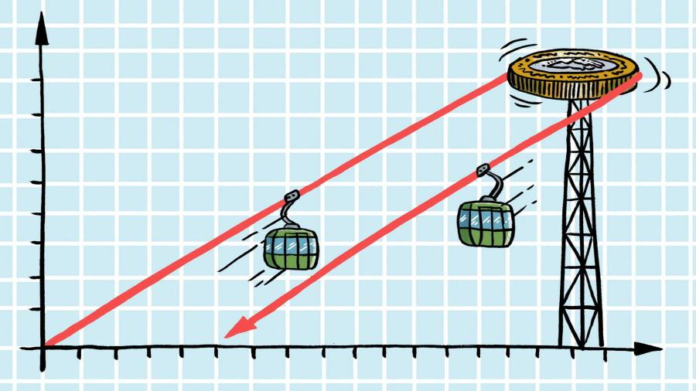

Gavekal founder Charles Gave defined the underlying dynamics of all this in a current piece for shoppers. “If the market charge [of interest] is simply too low versus the pure charge, then monetary engineering pays off . . . borrowing to seize the unfold will result in an increase within the worth of these property which yield greater than the market charge, but in addition to an increase in indebtedness.”

The problem is that fewer new property shall be created — why spend money on a manufacturing unit or workforce coaching when you should purchase again inventory? One sensible results of this unlucky Wall Road-Major Road arbitrage is decrease productiveness. Falling productiveness and artificially low charges usually equal inflationary restoration durations — simply as within the Nineteen Seventies.

The one approach out is thru the ache of upper rates of interest. The market price of capital have to be normalised to cut back financialisation, and the unproductive allocation of assets and inequality that comes with it.

Sadly, the ache of that paradigm shift (like the advantages of the earlier one) received’t be shared equally. Rising charges hit the poor hardest, elevating the price of non-expendable gadgets equivalent to meals, housing and cost of bank cards and different loans. The wealthy can preserve spending, whereas others need to make more durable financial decisions.

The US housing market is the perfect instance of the financial and social downsides of extraordinarily financialised development. Traditionally, excessive house costs — that are partly a results of extra cash patrons and traders out there, in addition to zoning restrictions and financing developments that favour the wealthy — imply extra persons are renting. Rents immediately are rising not simply in massive cities, however throughout a lot of the nation.

However the individuals who are inclined to lease are these least seemingly to have the ability to pay the upper costs. In accordance with 2021 Pew Information, 60 per cent of renters are within the decrease quartile of American earnings. When you take a look at internet price, together with asset wealth, that quantity rises to 87.6 per cent. As extra discretionary earnings goes on fundamentals, the consumption image is additional skewed in direction of the wealthy.

In fact, no financial paradigm lasts without end. Greater rates of interest will ultimately deliver down artificially inflated asset values.

In the meantime, the Biden White Home is doing what it may possibly to buffer inflationary ache for working folks. It has been releasing strategic petroleum reserves in a partly profitable effort to decrease costs on the pump, extending pandemic-era caps on some student loan payments and pushing for antitrust motion in areas the place company focus (which has grown hand in hand with financialisation) could also be chargeable for some inflationary stress.

However extra modifications are wanted. The success of company lobbyists in overturning efforts to roll again carried curiosity loopholes are shameful. Scholar debt forgiveness — regardless of how beneficiant it’s — won’t change the truth that the price of 4 years of personal college within the US (an elastic price that may be bid up indefinitely by the worldwide wealthy) is almost double the median household earnings. Housing markets proceed to cry out for main reform.

I think it should take a youthful technology to push by means of these kinds of systemic modifications. They merely don’t have as a lot asset wealth to guard.