Kim Kardashian agreed to pay greater than $1 million in a settlement with the Securities and Trade Fee for selling a crypto safety with out telling those that observe her that she was paid $250,000 to hawk the safety.

The case goes again to Kardashian pushing EMAX tokens bought by Ethereum Max on her Instagram account, in line with a doc filed by the SEC.

“Are you guys into crypto?” the Instagram submit requested. “This isn’t monetary recommendation however simply sharing what my buddies informed me in regards to the Ethereum Max token.”

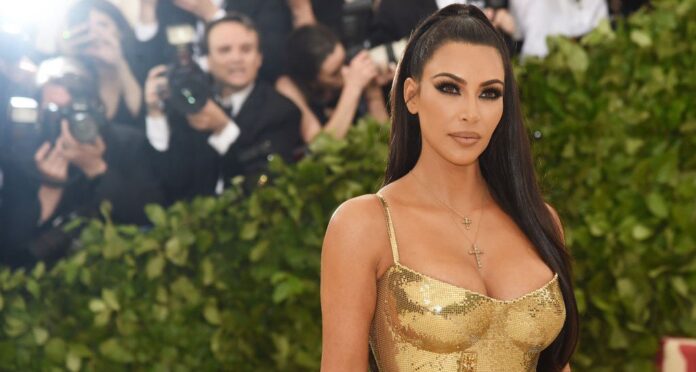

The Kim Kardashain Instagram submit that acquired her in hassle with the Securities and Trade Fee. (SEC court docket submitting)

The submit was revealed June 13, 2021, the in line with the SEC settlement order.

TRENDING: 2022 Midterm Action List – SEVEN STEPS You Can Take to SAVE OUR ELECTIONS From Fraud

“EthereumMax, by way of an middleman, paid Kardashian $250,000 for this promotion,” the order states. “Kardashian didn’t disclose that she had been paid by EthereumMax or the quantity of compensation she acquired from EthereumMax for making this submit. “

The failure of disclosure “violated Part 17(b) of the Securities Act, which makes it illegal for any particular person to advertise a safety with out totally disclosing the receipt and quantity of such consideration from an issuer,” the order said.

The order states Kardashian has to pay $1.26 million to the SEC – the $250,000 she acquired, about $10,000 in curiosity, and a $1 million penalty.

Underneath phrases of the order, Kardashian can be banned from hawking any kind of crypto safety instrument for the subsequent three years.

The order famous that in 2017, the SEC had required celebrities who promote any sort of digital foreign money or safety have to disclose how a lot they had been paid to advertise.

In a news release on the SEC’s web site, SEC Chair Gary Gensler mentioned followers ought to be cautious when well-known folks provide monetary recommendation.

“This case is a reminder that, when celebrities or influencers endorse funding alternatives, together with crypto asset securities, it doesn’t imply that these funding merchandise are proper for all traders,” he mentioned.

Right now @SECGov, we charged Kim Kardashian for unlawfully touting a crypto safety.

This case is a reminder that, when celebrities / influencers endorse funding opps, together with crypto asset securities, it doesn’t imply these funding merchandise are proper for all traders.

— Gary Gensler (@GaryGensler) October 3, 2022

“We encourage traders to think about an funding’s potential dangers and alternatives in gentle of their very own monetary targets,” he mentioned.

“Ms. Kardashian’s case additionally serves as a reminder to celebrities and others that the legislation requires them to confide in the general public when and the way a lot they’re paid to advertise investing in securities,” he mentioned.

A consultant of Kardashian mentioned she has totally cooperated with the SEC, in line with Axios.

“Ms. Kardashian totally cooperated with the SEC from the very starting and he or she stays prepared to do no matter she will be able to to help the SEC on this matter,” the assertion mentioned.

“She needed to get this matter behind her to keep away from a protracted dispute. The settlement she reached with the SEC permits her to try this in order that she will be able to transfer ahead together with her many alternative enterprise pursuits,” the assertion mentioned.

An SEC official mentioned the case is a warning that the SEC’s guidelines have to be adopted.

“The federal securities legal guidelines are clear that any movie star or different particular person who promotes a crypto asset safety should disclose the character, supply, and quantity of compensation they acquired in trade for the promotion,” Gurbir Grewal, Director of the SEC’s Division of Enforcement, mentioned within the SEC’s launch.

“Traders are entitled to know whether or not the publicity of a safety is unbiased, and Ms. Kardashian did not disclose this info,” Grewal mentioned.

This text appeared initially on The Western Journal.