Good morning. This text is an on-site model of our FirstFT e-newsletter. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Joe Biden and Xi Jinping will hold a telephone call today, in response to a US official, as tensions escalate over the deliberate go to to Taiwan by Nancy Pelosi, the Speaker of the Home of Representatives.

The deliberate name can be solely the fifth dialog between the 2 leaders since Biden grew to become US president 18 months in the past. Biden and the Chinese language president had been anticipated to debate many contentious points, from navy challenges to know-how competitors. However these plans have been difficult by Pelosi’s supposed go to to Taiwan in August.

The Monetary Occasions reported final week that the 82-year-old Democrat deliberate to journey to Taiwan in a present of help because it comes beneath rising stress from China, which claims sovereignty over the island. Beijing has privately issued harsh warnings suggesting a potential navy response if Pelosi proceeds with the journey.

The White Home is extraordinarily involved that her go to may spark a disaster throughout the Taiwan Strait. Biden has despatched high officers, together with nationwide safety adviser Jake Sullivan, to elucidate the dangers. However that has been difficult by the truth that Congress is unbiased and he has no formal energy to dam her go to.

-

Opinion: US and China are coming into a lure of their very own making. The prices of miscalculation by both facet can be deadly, and the dangers are solely rising, writes Edward Luce.

5 extra tales within the information

1. Fed raises charges by 0.75 factors for second month in a row On the finish of its two-day coverage assembly, the Federal Open Market Committee lifted the goal vary of the federal funds price to 2.25 per cent to 2.50 per cent. The choice, which had unanimous help, prolonged a string of rate of interest will increase that started in March and have ratcheted up in measurement because the Federal Reserve’s battle to battle inflation intensifies.

2. South Korea probes crypto-linked foreign exchange transactions Regulators are investigating $3.1bn value of “abnormal” foreign exchange transactions at two of the nation’s largest industrial banks for potential cash laundering linked to crypto investments.

3. European gasoline worth rise accelerates European gasoline costs have jumped after Russia adopted by on its threat to make deepening cuts in gas supplies to the area. Costs rose as a lot as 13 per cent as flows on the Nord Stream 1 pipeline have been minimize to only a fifth of regular capability.

4. Fb dad or mum Meta reviews first decline in income Meta reported its first revenue decline within the second quarter, laying the blame at macroeconomic pressures and providing traders a dismal outlook for the approaching months. Meta, previously generally known as Fb, is the newest huge internet advertising participant to wilt as advertisers pulled again on spending.

5. Singapore’s GIC warns of arduous yr forward Singapore state fund is directing cash in the direction of actual property and different inflation-protecting property because it prepares for several years of disruption from rising costs. In an interview with the Monetary Occasions, GIC’s administration mentioned that hovering inflation may reverse good points it had made in recent times.

The day forward

French president meets Saudi crown prince Emmanuel Macron will meet Mohammed bin Salman in Paris today amid Europe’s continued power disaster. The journey is a part of the crown worth’s first journey to Europe for the reason that killing of Jamal Khashoggi. (Politico EU)

Earnings The marathon of company earnings continues. We’ll have our eye on Amazon, Apple, Barclays, Nissan Motor, Panasonic, Pfizer and more. European supermajors particularly — BP, Shell and TotalEnergies — are anticipated to report bumper profits over the following week.

What else we’re studying and listening to

The white elephants stoking fury over Sri Lanka’s debt disaster The Rajapaksas lavished spending on vainness initiatives which might be rotting away within the warmth. As we speak, the unpaid debts and mounting maintenance prices mirror the issues confronted by Ranil Wickremesinghe because the incoming president prepares to institute painful reforms.

-

Hear: On this week’s episode of Behind the Money, the FT’s Antoni Slodkowski shares what he’s seen after per week of reporting in Sri Lanka.

How dangerous will the worldwide meals disaster get? Meals commodity costs are falling, however specialists say international manufacturing and starvation charges is perhaps even worse in 2023. The warfare in Ukraine is just one of a large number of issues that would maintain greater starvation charges for a few years to come back.

Shrimsley: Truss is the appropriate selection for this Conservative social gathering As we speak’s Conservative social gathering dislikes arduous decisions. And it is a drawback for Rishi Sunak, as a result of the previous chancellor has determined to make going through as much as them his key pitch to succeed Johnson. The cakeist candidate is Liz Truss and she or he is ready to go full gateau if it will get her to the highest.

To fight illness, look past the Kardashian of proteins If there have been a star hierarchy of proteins, P53 can be its Kim Kardashian. The protein scuppers tumour progress: an absence of P53 — for instance — predisposes an individual to most cancers. Whereas P53 is certainly essential to well being, it’s also a beneficiary of the “avenue gentle impact”, through which a phenomenon that’s already illuminated attracts additional consideration.

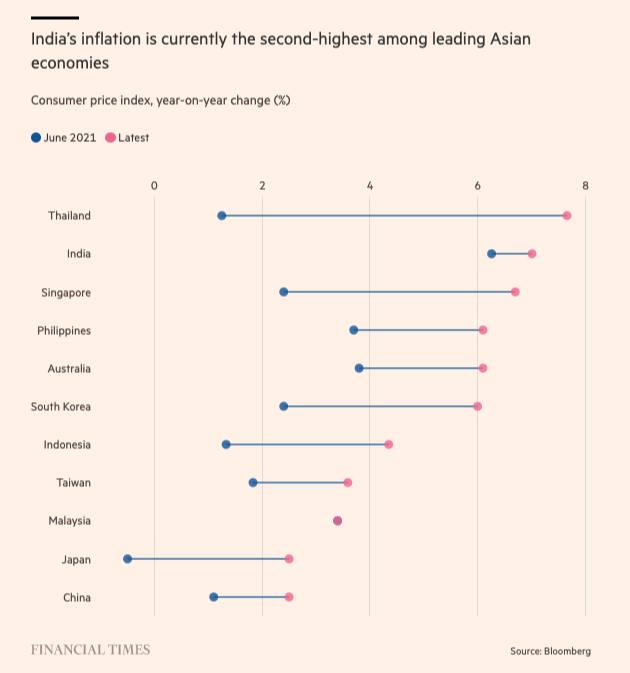

India’s roaring post-pandemic restoration in danger from inflation In a rustic that has historically maintained shut ties with Moscow, Narendra Modi’s authorities has been buying Russian oil at a reduction regardless of US and European sanctions over Vladimir Putin’s invasion of Ukraine. This has not been sufficient, nevertheless, to cushion the power shock.

Books

Former Fed chair Ben Bernanke and historian Edward Chancellor provide conflicting views on the disaster in central banking in two new books reviewed by Martin Wolf. “Chancellor has written an overheated and unbalanced polemic,” Martin writes. “But this doesn’t altogether vindicate Bernanke’s managerialist perspective.”

Thanks for studying and bear in mind you may add FirstFT to myFT. You too can elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to [email protected]. Enroll here.