Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Nato is to agree an overhaul of its plans to supply higher safety to the alliance’s jap flank, tearing up a mannequin that might have meant relinquishing Baltic states after which trying to recapture them within the occasion of a Russian invasion.

Jens Stoltenberg, Nato secretary-general, advised the Monetary Instances that the navy blueprint, to be agreed at an annual leaders’ summit that begins in Madrid tomorrow, would drastically improve the alliance’s jap defences, shifting focus from deterrence to a full defence of allied territory.

Estonia’s prime minister has claimed that beneath the present doctrine, Baltic states can be “wiped off the map” by a Russian assault earlier than Nato tried a counter-attack to liberate them after 180 days.

The alliance will “considerably reinforce” its defences in jap Europe, Stoltenberg mentioned, pledging that Russia wouldn’t be capable to seize the Estonian capital Tallinn “simply as they haven’t been capable of seize town of Kirkenes in northern Norway or West Berlin in the course of the chilly struggle”.

Extra on Russia’s struggle in Ukraine

-

Army developments: Russian missiles struck residential buildings in central Kyiv yesterday. Ukraine’s retreat from the jap metropolis of Severodonetsk was a “tactical” move to keep away from a repeat of the siege in Mariupol, the nation’s navy intelligence chief mentioned.

-

Vitality politics: G7 leaders assembly within the Bavarian Alps are searching for a deal to impose a “price cap” on Russian oil to curb Moscow’s means to finance its struggle.

Thanks for studying FirstFT Europe/Africa. To start out your week, right here’s the remainder of the day’s information. — Jennifer

5 extra tales within the information

1. EY valued NSO Group at $2.3bn The Large 4 accounting agency valued the secretive Israeli spyware company at $2.3bn, months earlier than the maker of the Pegasus cyberweapon wanted emergency bailout funding. In contrast, Berkeley Analysis Group, which represents NSO’s non-public fairness house owners, mentioned this yr that the corporate’s fairness was “worthless”.

2. BIS: main economies liable to high-inflation entice The Financial institution for Worldwide Settlements warned yesterday that main economies have been near “tipping” into a high-inflation world through which speedy value rises dominate every day life and are troublesome to quell, and urged central banks to not be shy about inflicting short-term ache and even recessions to forestall it.

3. RWE: UK windfall tax might danger £15bn in renewables The pinnacle of one of many nation’s largest energy producers has warned that Germany’s greatest utility will reconsider £15bn of investment within the UK’s renewable power sector if the nation imposes a windfall tax on electrical energy mills.

4. UBS courts US funding heavyweights The Swiss lender, the world’s greatest wealth supervisor, has begun courting investment houses to change into prime shareholders because it tries to enhance its market worth to be nearer aligned with Wall Road friends and mission a picture as a worldwide financial institution.

5. UK Treasury takes stake in intercourse celebration planner The British taxpayer has become a shareholder in Killing Kittens, recognized for its unique and hedonistic occasions, beneath the Future Fund, a scheme arrange by Chancellor Rishi Sunak to assist revolutionary corporations in the course of the pandemic beneath which loans are transformed into fairness.

The day forward

UK attorneys on strike Members of the Prison Bar Affiliation begin a walkout in an escalating dispute with the federal government over funding, which is predicted to trigger widespread disruption to hearings throughout England and Wales.

UK adjustments N Eire buying and selling regime MPs will have their first vote on Boris Johnson’s laws to unilaterally rip up elements of Northern Eire’s post-Brexit buying and selling preparations, regardless of fierce criticism from Brussels.

Financial indicators The annual European Central Financial institution Discussion board on Central Banking begins in Sintra, Portugal. Within the US, durable goods orders could present whether or not inflation, rising rates of interest and financial uncertainty weighed on demand in Could. (FT, WSJ)

UN Ocean Convention The week-long convention on ocean conservation and sustainability begins and is co-hosted by Kenya and Portugal.

Firms developments Nike posts fourth-quarter outcomes. Disney’s board meets for 2 days lower than per week after giving under-fire chief executive Bob Chapek a vote of confidence.

Wimbledon begins The tennis match begins on the All England Garden Tennis and Croquet Membership in south-west London without the men’s top player or girls’s reigning champion. Daniil Medvedev is ineligible after a ban on Russian gamers, whereas Ash Barty has retired. “Retiring aged 25 looks like submitting for divorce whereas on honeymoon. However Barty’s determination reveals numerous truths,” writes Henry Mance.

What else we’re studying

Grim occasions lie forward for UK The nation is within the throes of the type of labour unrest not seen for many years. The reason for it’s clear. Unanticipated inflation delivers losses everyone desires to recoup. This triggers social battle, writes Martin Wolf. But if inflation is unhealthy, so is the remedy.

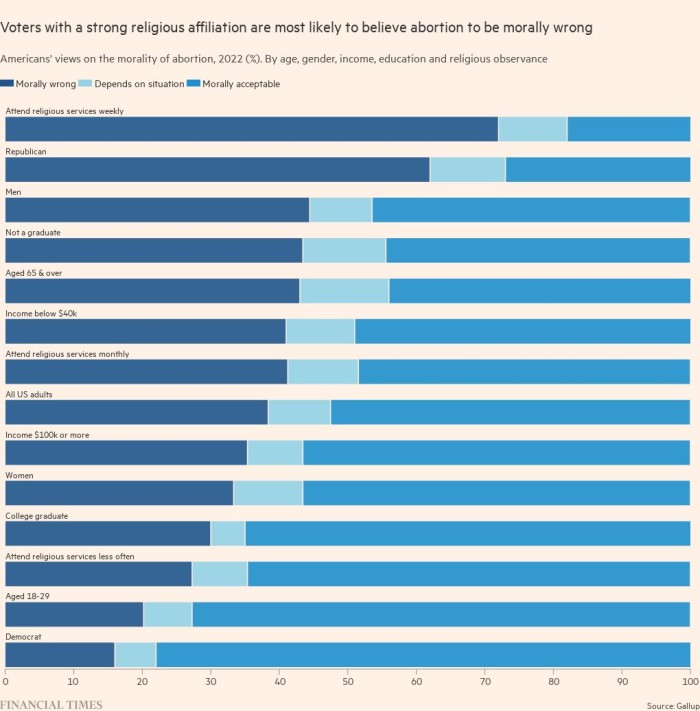

The street to rolling again Roe vs Wade Because the Supreme Court docket overturns the landmark 1973 ruling enshrining the constitutional proper to abortion, Lyz Lenz documents the rise of the Christian right and the way it reached this historic second. In response to the ruling, Democratic lawmakers are stepping up efforts to establish “sanctuary states” for reproductive rights.

Crypto and meme company bonds comply with their very own path The crash of among the flagbearers of the fairness bubble has been painful for traders. Much less seen are the losses of their bonds. Such gaps illuminate variations within the possession and returns for shares versus bonds, writes Ellen Carr at Barksdale Funding Administration.

How the sweetness business left tortoise-like Revlon trailing As soon as a behemoth of the sweetness business, Revlon has been sidelined by fashionable influencer- and social media-driven make-up manufacturers. The 90-year-old group’s chapter submitting reveals how competitive and fast-paced the sector has become.

There’s no such factor as an unintentional plagiarist The acclaimed Australian novelist John Hughes claims that most of the 58 cases of plagiarism in his new guide have been accidentally. Everybody steals after they write, however where does “good” theft end and clumsy rip-off begin?

Books

Whether or not you’re in search of a guide on urbanism, a literary thriller, a tome on the royal household or one thing else sudden, it would be best to take a look at these must-read titles beneficial by FT writers and editors.

Thanks for studying and bear in mind you possibly can add FirstFT to myFT. It’s also possible to elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to [email protected]. Enroll here.