Whether or not you make lower than $45,000 yearly, or greater than $220,000, there are some key factors to remember when deciding the place to place your cash

Critiques and proposals are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

By Julie Cazzin with Allan Norman

Commercial 2

Article content material

Q: That is the time of 12 months after I all the time take a look at the cash in my financial savings account and attempt to decide if I’ve sufficient to make a registered retirement financial savings plan (RRSP) or a tax-free financial savings account (TFSA) contribution. With two youngsters and a mortgage, cash is usually tight and I can solely do one or the opposite. How do I’m going about deciding which is greatest for me? And if I ever find the money for to do each — one thing that may seemingly occur shortly after my mortgage is paid off — does it make sense to take action? — Leona

Article content material

FP Solutions: That’s an excellent query, Leona, and I do know from expertise that lots of people have this conundrum. Nevertheless it all begins by understanding the mathematics. There are different components concerned, however understanding the mathematics will take you a good distance towards making your choice.

Commercial 3

Article content material

Earlier than we get to the mathematics, keep in mind an RRSP contribution is earlier than tax and withdrawals are taxable, whereas a TFSA contribution is after tax and withdrawals are tax free. This is a crucial distinction, as you will notice shortly.

Additionally, an RRSP supplies you with a tax refund, which it’s best to consider as an interest-free mortgage that’s yours to do with what you want, however must be paid again once you withdraw out of your RRSP or registered retirement revenue fund (RRIF).

Now, to the mathematics.

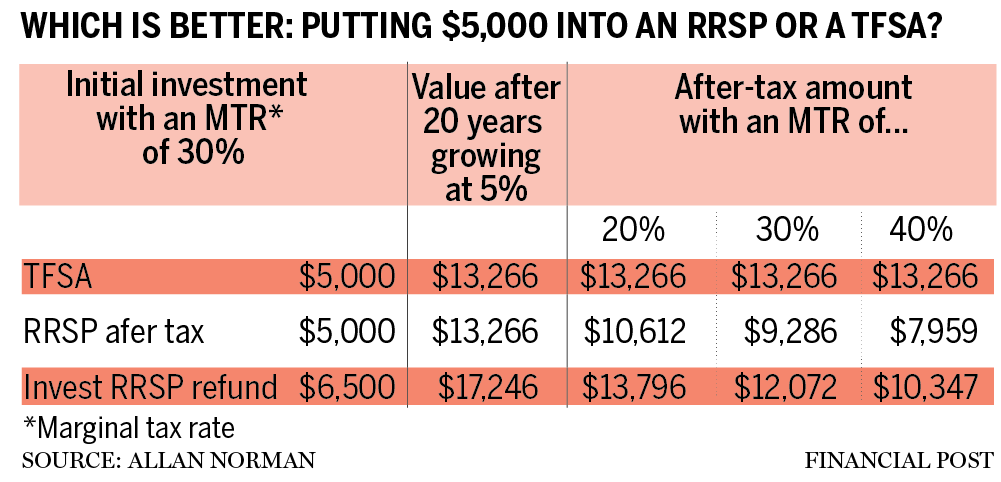

The accompanying desk compares the after-tax outcomes of investing in an RRSP in opposition to a TFSA funding incomes 5 per cent over 20 years. Which funding account do you suppose will do higher, assuming your marginal tax fee (MTR) stays the identical?

Commercial 4

Article content material

The reply is in row six: In case your MTR stays the identical and each accounts earn the identical fee of curiosity, there is no such thing as a distinction between investing in an RRSP or TFSA.

Row seven exhibits that you probably have a decrease MTR on the time of withdrawal than once you contributed, the RRSP beats the TFSA. Many individuals will discover themselves on this scenario after they retire or if they’re a part of a pair and are in a position to pension cut up.

Row eight exhibits the other. In case your MTR is larger on the time of withdrawal than on the time of contribution, then the TFSA is best.

Row 9 extra seemingly represents most individuals’s property taxes. In Ontario, your MTR is 53.53 per cent you probably have a taxable revenue or property of greater than $220,000. Only a reminder that not all revenue is taxed at 53.53 per cent — solely the revenue over $220,000.

Commercial 5

Article content material

To keep away from the massive tax chew, it could make sense to attract surplus revenue out of your RRIF even if you happen to don’t want it to assist your life-style. That shouldn’t be an issue in case your MTR was 40 per cent on the time of contribution and it’s 40 per cent on the time of withdrawal. The maths says it’s no totally different than if it was a TFSA funding (although the Previous Age Safety (OAS) clawback could also be a difficulty).

The issue is you want one other funding tax shelter. In case you are drawing surplus revenue from a RRIF then presumably you don’t want it — it’s surplus. In case you have kids or grandchildren, contemplate contributing to their registered training financial savings plans (RESPs), TFSAs or RRSPs.

That’s the textbook rationalization of the RRSP math, however let’s get real looking.

Commercial 6

Article content material

Discover in row three that the RRSP funding was $7,142 (which is earlier than tax) and the TFSA funding was $5,000 after tax. That’s the correct method to do the comparability, however is that how most individuals make investments? In case you have $5,000 to spend money on an RRSP or TFSA, do you cease to suppose, “How a lot did I’ve to earn to get my $5,000?” after which contribute the bigger grossed-up quantity to your RRSP?

Most individuals don’t.

Right here is the system to do the calculation, if you happen to’re : investment quantity/(1-MRT) = pre-tax earnings.

Additionally be aware {that a} small RRSP mortgage is an efficient technique to gross up your RRSP funding. Repay the mortgage when the RRSP tax refund comes.

In case you don’t use the mortgage technique, some buyers will make investments the RRSP tax refund, however the tax refund on $5,000 is smaller than the gross-up quantity, so it’s not as efficient as grossing up your preliminary funding.

Commercial 7

Article content material

The second desk exhibits the after-tax outcomes of investing the identical quantity in an RRSP or a TFSA, and investing the refund versus not investing the refund.

As you in all probability guessed, you might be greatest off investing in a TFSA in nearly each case. The slight exception will be seen in row three, when the RRSP tax refund was invested and the MTR on the time of withdrawal was decrease than it was at time of contribution.

At this level, you could be questioning why it’s best to ever contemplate investing in an RRSP. One cause is you possibly can contribute extra to an RRSP than a TFSA, however listed below are another key issues to think about based mostly on revenue solely.

-

FP Answers: Does it make sense to take a pension payout and invest in a farm?

-

FP Answers: Can I retire in 15 years even though I’m still paying off my mortgage?

-

FP Answers: When’s the best time to make my last RRSP contribution?

-

FP Answers: Is it worth it leveraging my HELOC to invest in dividend-paying ETFs?

Commercial 8

Article content material

Incomes lower than $45,000 and an approximate MTR of 20 per cent

The TFSA is probably going the most suitable choice as a result of your withdrawal MTR seemingly received’t be decrease than your MTR at time of contribution; your tax-free withdrawals in retirement received’t negatively affect authorities advantages such because the Assured Revenue Complement (GIS), or tax credit such because the age credit score; if you happen to begin investing younger sufficient, the utmost TFSA contribution restrict might be all it’s essential to save to assist your present life-style in retirement when mixed with Canada Pension Plan (CPP) and OAS.

An exception could also be if you’re attempting to scale back your taxable revenue to assert extra of the Canada Little one Profit (CCB).

Incomes between $45,000 and $90,000 with an approximate MTR of about 30 per cent

Commercial 9

Article content material

That is the perhaps/maybe-not vary for RRSP contributions. Are you going to gross up your RRSP contribution? How a lot do it’s essential to save for retirement? Is it greater than what TFSA contribution limits allow? Will your MTR be decrease once you retire?

Typically, most individuals on this revenue vary might be contributing to RRSP accounts. The upper your revenue on this vary, the extra that RRSP contributions make sense.

In case you are simply above the $45,000 revenue or MTR stage, contemplate contributing solely sufficient to an RRSP to drop you into the decrease tax bracket.

Incomes over $90,000 and an MTR over 40 per cent

At this revenue stage your focus could also be on maximizing your RRSP contributions and utilizing up all previous RRSP contribution room earlier than making TFSA contributions. A objective could also be to compensate for your RRSPs after which use the tax refunds to maximise your TFSA.

Commercial 10

Article content material

There are a lot of different components to consider, corresponding to revenue splitting, the RRSP Dwelling Consumers’ Plan and Lifelong Studying Program (LLP), and the affect on authorities advantages and credit.

My suggestion is that you just focus on your scenario with a planner if you’re unsure if you have to be contributing to an RRSP or a TFSA. Or resolve what you suppose is greatest to your scenario and make a contribution to a type of plans. You received’t be making a foul choice and it’s higher to contribute to both one relatively than do nothing in any respect.

Allan Norman, M.Sc., CFP, CIM, RWM, is each a fee-only licensed monetary planner with Atlantis Monetary Inc. and a totally licensed funding adviser with Aligned Capital Companions Inc. He will be reached at www.atlantisfinancial.ca or [email protected]. This commentary is supplied as a common supply of data and is meant for Canadian residents solely.

_____________________________________________________________

For extra tales like this one, sign up for the FP Investor publication.

______________________________________________________________