With a lot of the world’s largest economies having curbed pandemic restrictions, the mantra for the worldwide occasions business is “enterprise is again”, following a troublesome two years.

However attendance on the Imex present in Frankfurt — which caters to the commerce present and journey sectors themselves, with attendees together with convention venues, occasion managers and lodge teams — is telling. The Could occasion had about 9,500 individuals, in contrast with 14,000 earlier than the pandemic.

“Clearly the business has suffered in the course of the previous years, individuals have misplaced jobs, however demand has exploded,” mentioned Carina Bauer, chief govt of Imex, including that latest occasions had a “world vary of exhibitors”.

However she added: “We had only a few individuals from China this 12 months.”

The 32 per cent drop in attendance factors to a combined image for the business because the world reopens. The vital Chinese language market stays stymied by restrictive lockdowns as Beijing pursues a zero-Covid policy. In the meantime, conference centres and organisers elsewhere are nonetheless gauging whether or not demand for face-to-face conferences will return to pre-pandemic ranges regardless of an preliminary surge.

China supplied the occasions business a sliver of hope two years in the past when it grew to become the primary giant nation to cautiously reopen after the primary section of the pandemic.

Now the tables have turned. Whereas many rich international locations have signalled that corporations shouldn’t anticipate future restrictions on social mingling, China has chosen to impose journey restrictions, in addition to lockdowns on cities when native coronavirus outbreaks happen.

“We don’t know methods to compensate for China if the nation doesn’t return,” mentioned Wolfgang Marzin, chief govt of Messe Frankfurt, a German occasions organiser co-owned by town of Frankfurt and the state of Hesse that runs commerce festivals world wide.

“Everyone took benefit of labour and manufacturing capability in China — a lot nonetheless comes from there — and now we’re as depending on them as we’re from oil for Mr Putin,” he added, nodding to the variety of worldwide corporations manufacturing within the nation.

For now, Marzin mentioned Chinese language consumers and sellers had been largely absent from occasions in different elements of the world. “The zero-Covid coverage implies that since January we don’t see Chinese language corporations,” he mentioned. “For a present in textile, sometimes we’d have round 400 exhibitors and now we’ve 25.”

Marzin wouldn’t disclose the personal firm’s revenues and earnings however mentioned turnover this 12 months was prone to be near ranges in 2010, including that he anticipated the corporate to be again on monitor in 2025 — assuming the worldwide financial system just isn’t derailed by additional crises.

China just isn’t solely an indispensable a part of many corporations’ provide chains, however the world’s second-largest financial system has additionally emerged as an essential purchaser at commerce reveals.

In 2019, mainland China accounted for 16 per cent of occasions revenues at Informa, the world’s largest commerce truthful group. In 2021, the corporate had recovered to solely four-fifths of this stage.

However the FTSE 100 firm is extra sanguine in regards to the scenario in China, arguing that rebounding demand within the US has offset the lag.

Each Marzin and Bauer are bullish in regards to the eventual full-scale return of in-person conferences, so is Lord Stephen Carter, Informa’s chief govt.

“The ability of bodily presence won’t go away,” mentioned Carter. “Even when China is opening at a slower price than different international locations, we all know that it will likely be reopening.”

The group has put its cash the place its mouth is, saying final December that it will dispose of its intelligence arm and deal with occasions and tutorial publishing. It had unveiled an annual £1.1bn pre-tax loss for 2020 linked to lockdown-related exhibition cancellations. However in 2021 it swung again to a £137mn pre-tax revenue as restrictions eased.

Informa mentioned in July that it will start paying dividends once more following a pandemic hiatus, disregarding a world financial slowdown that’s threatening many industries. The group expects its income and adjusted working revenue this 12 months to achieve the higher finish of earlier steering of £2.15bn-£2.25bn and £470mn-£490mn respectively.

“All of the occasions companies I communicate to are tremendously bullish,” mentioned Citi analyst Thomas Singlehurst, who added that as exhibitions companies are inclined to have a low price base they might stand to be beneficiaries of surging inflation as they raised their very own costs.

“What’s attention-grabbing with occasions is that re-emergence of inflation might be the very best factor that has occurred,” he mentioned, explaining that the majority development within the business got here from pricing.

Carter mentioned Informa had maintained 2019 costs for its exhibitions with the intention to encourage as many purchasers as potential, however added that sooner or later “in fact, there might be pure value inflation as you’ll anticipate”.

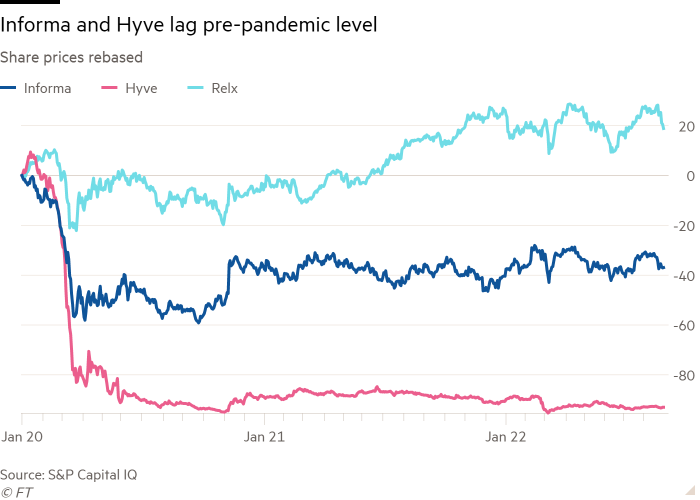

However, the business stays below stress. Of the three largest listed occasions suppliers — Informa, Hyve and Relx — solely the latter’s share value has recovered to the extent of early 2020 and it’s largely focused on subscription businesses similar to tutorial publishing.

However Hyve, which runs the annual retail reveals Shoptalk and Groceryshop, has nonetheless struck an optimistic observe, saying the 2022 editions both had or had been anticipated to earn more money than the 12 months earlier than Covid-19 struck.

“Submit-pandemic . . . our clients spend extra with us than earlier than,” mentioned chief govt Mark Shashoua.

The UK-based group reported income of £59mn within the first half of 2022, in contrast with £68mn for a similar interval in 2019. It blamed the delay of two giant occasions within the mining and paper industries within the second half of the 12 months for the lower.

There are predictions of a shakeout. Shashoua mentioned some smaller or extra area of interest reveals had been unlikely to return in any respect, even on-line, after the pandemic, with the biggest teams similar to Hyve who run the “must-attends” of varied industries able to consolidate.

This has already begun. In March, Hyve introduced the acquisition of US-based Fintech Meetup for as much as £42mn, a couple of months after it snapped up an occasions organiser centered on the mining business for the same quantity. In the meantime, Informa purchased business-focused writer Business Dive in July, a deal that may grant it a content material arm to raised have interaction purchasers past occasions.

For Informa’s Carter, future development within the business will come from a rise within the vary of companies that occasions corporations can present, with the primary reveals changing into “way more digitally enhanced [with more] sophistication at registering and profiling [buyers and sellers]”.

“If you’re working with a tier-one product, demand is extraordinarily excessive,” he mentioned.