What’s the way forward for globalisation? That is among the many largest questions of our time. In June, I argued that, opposite to more and more widespread opinion, “Globalisation just isn’t lifeless. It might not even be dying. However it’s altering.” Among the many most vital methods during which it’s altering is through the expansion of providers offered at a distance.

Because the industrial revolution, we now have, argues Richard Baldwin in his guide The Nice Convergence, seen three waves of alternatives to commerce. First, industrialisation and the revolution in transport generated alternatives for commerce in items. Extra lately, new info applied sciences allowed “commerce in factories”: it grew to become worthwhile to maneuver complete factories to the place labour was low cost. In the present day, nevertheless, the broadband web permits “commerce in places of work”: if one can work for one’s employer from residence, somebody in India can accomplish that, too.

Furthermore, an vital distinction between the primary and second waves, which want motion of objects, and the third, which strikes info nearly, is that obstacles to bodily commerce are far simpler to impose than these to digital commerce. It’s not not possible to impose the latter, as China exhibits. However it requires nice effort.

As Baldwin argues in four current blogs, this analytical framework permits us to view the way forward for commerce in a distinct mild from the one now modern. Particularly, what he calls the “lazy” view of the historical past of globalisation and commerce is deceptive on various dimensions. What then is that view? It’s that after some twenty years of very speedy development, world commerce in items peaked in 2008, beneath the mortal blow of the monetary disaster, because the world turned away from commerce.

This view each of what occurred and why is deceptive.

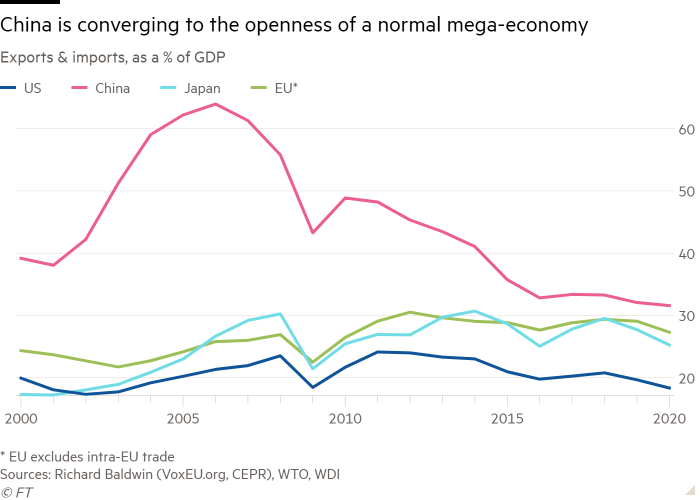

First, the commerce ratio of the world’s second largest dealer of products, China, really peaked earlier than 2008 (in 2006). These of the third and fourth largest items merchants, the US and Japan, peaked after 2008 (in 2011 and 2014). The ratio of the biggest dealer, the EU, has not peaked, although it has stagnated.

Second, the largest fall within the commerce ratio is in China. However this doesn’t replicate protectionism overseas or a deliberate turning away from commerce by China itself. China has merely normalised reliance on commerce relative to its financial dimension.

Third, in cash phrases, the largest reason behind the declining commerce ratio was the autumn within the value of commodities, not a discount within the quantity of commerce. This value fall accounted for five.7 share factors of the 9.1 share factors decline within the ratio of products commerce to world output between 2008 and 2020.

Lastly, there may be certainly proof of an unwinding of cross-border provide chains, however the turning level appears to be in 2013, after the monetary disaster, however earlier than the election of Donald Trump. A principal rationalization is the shift of provide chains inside the brand new suppliers, particularly China, the dominant one. As a substitute of assembling imported intermediates, China now produces them itself.

In all, there exist completely pure explanations for the autumn within the ratio of world commerce in items to output. However the slowdown in provide chain unbundling is actual. Amongst different explanations, a lot of these chains have now shifted inside China.

Companies are a distinct story. The ratio of commerce in providers to world output, although a lot decrease than for items, has continued to rise. Companies are a really heterogeneous group of actions, a few of which require motion of individuals (tourism, for instance). However actions within the exceptionally dynamic class of “different industrial providers” (OCS) can, largely, be provided nearly. These embody a extremely various vary of actions. The expansion of commerce in OCS can be exceptionally dynamic: between 1990 and 2020, commerce in items expanded fivefold whereas OCS multiplied 11-fold.

An important level is that the growth of commerce in such providers has depended little on commerce agreements. The regulation of service actions focuses on last providers, not intermediate ones. There exist, for instance, strict guidelines on promoting accounting providers within the US. But there are few guidelines on the {qualifications} of the employees that do the paperwork behind the supply of such providers.

Thus, a “US accountant can make use of just about anyone to tally up a consumer’s journey bills and collate them with expense receipts”. Examples of occupations that present intermediate versus last providers embody book-keepers, forensic accountants, screeners of CVs, administrative assistants, on-line assist employees, graphic designers, copy-editors, private assistants, X-ray readers, IT safety consultants, IT assist employees, software program engineers, attorneys who examine contracts, monetary analysts who write stories. The listing goes on.

As Baldwin argues in The Globotics Upheaval, the potential for this form of technology-enabled commerce is large. It’s going to even be extremely disruptive: the white-collar employees who present these providers in high-income nations are an vital a part of the center class. However will probably be exhausting to guard them.

In all, the proof means that pure financial forces have largely been answerable for previous adjustments within the sample of world commerce. Rising concern over the safety of provide chains will little doubt add to those adjustments, although whether or not the consequence will probably be “reshoring” or “friendshoring” is uncertain. Extra seemingly is a fancy sample of diversification. In the meantime, expertise is opening up new areas of development in providers.

Evidently, disasters could change this image: Covid was disruptive; so, too, is right this moment’s vitality disaster; and warfare or the specter of it might disrupt much more. Wholesome global trade is an indication of peace, even when it might not trigger it. No one sane would want the grim alternate options.