This text is an on-site model of Martin Sandbu’s Free Lunch e-newsletter. Join here to get the e-newsletter despatched straight to your inbox each Thursday

Power costs proceed to drown out all different financial conversations. However on this week’s Free Lunch we’ll speak about different issues. To not be contrarian for the sake of it. However prior to now two weeks I’ve already bombarded you, pricey readers, with my reflections on vitality costs (on the peculiarities of how they are formed, on their political effects in Europe, and on the huge international wealth transfers they entail).

I need to maintain off on one other volley till we now have particulars of the assist bundle of recent UK prime minister Liz Truss and of the EU’s co-ordinated plan to alter its vitality market construction to carry costs down. Each are anticipated after this text’s deadline.

As well as, I’ve some Free Lunch housekeeping that can refill this version of your world financial coverage e-newsletter. I’ve been having fun with feedback and suggestions on current items and want to share a few of it with you — a lot of it certainly on the vitality disaster. I’m additionally glad to announce that the final instalment in our collection of video spin-offs, Free Lunch on Movie, has simply been revealed: on why I believe a net wealth tax can be a good suggestion.

The very last thing first. Like with the earlier two instalments (on universal basic income and climate techno-optimism), the thought is to kick the tyres on an financial concept that I’ve lots of time for however that’s, to place it mildly, controversial. In every movie, I attempt to discuss to folks about what I believe are essentially the most strong arguments on all sides of the difficulty — and it might or might not shock you that it’s typically best to search out my strongest critics amongst my greatest FT colleagues.

Longtime Free Lunch readers will know that I believe a well-designed internet wealth tax is an effective financial coverage. As a result of it taxes internet wealth on the similar charge no matter its return, it rewards those that make investments productively relative to those that preserve their wealth idle. In different phrases, it rewards competent capitalists over poor or lazy ones, appearing as a handmaiden of capitalism. As well as, (increased) internet wealth taxes would restore some equity to tax methods that fail to place the best burdens on the broadest shoulders, ie the shoulders of these with a lot wealth they’ll simply keep away from incurring any taxable earnings or positive factors in any respect.

Why is that this significantly related as we speak? As a result of we could also be dealing with a winter of bleeding public budgets throughout Europe. Take into account the numbers swirling round: a €65bn energy support package in Germany, rumours of a plan within the triple-digit billion pounds within the UK, €280bn already allocated across the EU as an entire. Whether or not now or later, nationwide treasuries shall be looking out for extra income to fill within the holes. And within the video, I level out that the tax base most haven’t checked out for a very long time is internet wealth.

That tax base, nevertheless, has turn into way more fertile floor for a strong tax yield prior to now three to 4 many years. Wealth has grown a lot sooner than nationwide incomes, because the chart beneath exhibits:

And extra of these nationwide incomes at the moment are rewarding capital homeowners than prior to now, because the earnings share going to pay wages has fallen:

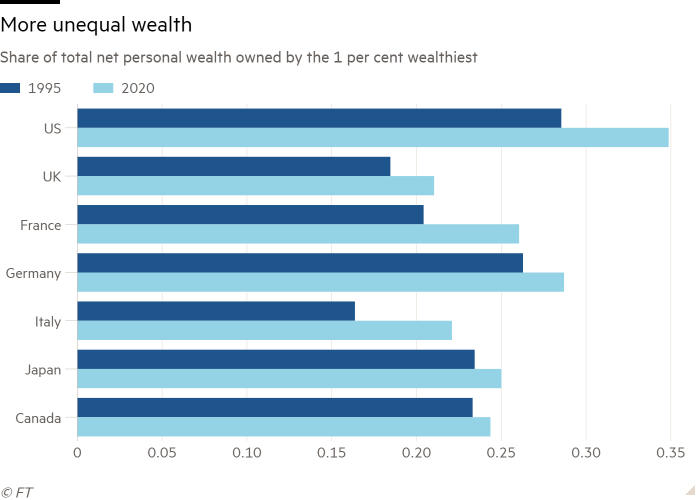

As well as, as wealthy economies have gathered way more wealth, that wealth has turn into extra unequally distributed:

And but governments’ revenues from taxes levied on outright wealth haven’t elevated. Because the movie factors out, of the international locations that used to have an annual internet wealth tax, solely Spain, Norway and Switzerland nonetheless do. Do watch it and assess for yourselves the arguments as as to whether this has been a great or a foul thought. What is evident is that the taxation of wealth has not tracked the evolution of wealth itself. A winter of pressured public (and personal!) funds is an effective time to rethink whether or not it ought to.

Now to your feedback. Some have already are available in in regards to the wealth tax video. Giordano writes to level out that whereas the Netherlands doesn’t formally have a wealth tax, it prices earnings tax on the “deemed earnings” from sure belongings, which is ready by method and so is, in apply, a tax on asset values.

In final month’s e-newsletter about vitality costs, Tessa takes subject with my description as a “weird confluence of dangerous luck” of the various mishaps in vitality technology prior to now yr: weak wind, depleted hydroelectric reservoirs, low river ranges hindering coal barges, nuclear and fuel liquefaction outages all did hurt to which Russian president Vladimir Putin has added. All, she argues, “are the outcomes of the bodily impacts of local weather change, eg outages in French nuclear vegetation to due inadequate water resulting from drought. So it is extremely possible they are going to all persist collectively in future years.” It’s a great level, and she or he could also be proper (although what I hear on French nuclear is that water shortages are just one reason for the outages and never the most important). My restricted understanding of the meteorology of local weather change is that it’s making excessive climate extra frequent with out essentially making it extra systematic. So even when we should always anticipate extra freak climate occasions, we could also be allowed to hope they gained’t commonly all happen on the similar time. Am I clutching at straws?

And eventually, Nigel writes that the outsize arithmetical impact of vitality value rises on inflation we’re seeing makes him assume that if we need to preserve costs secure, we might not need to depend on slow-working curiosity adjustments from central banks. Change in worth added tax, specifically, may goal client costs way more rapidly and precisely. It’s a horny thought. What do Free Lunchers assume?

Different readables

-

For individuals who can’t look ahead to extra readings on vitality, the researchers at Bruegel suggest a grand bargain on vitality coverage within the EU, the place European Fee president Ursula von der Leyen has set out what Brussels needs vitality ministers to agree with a view to carry electrical energy costs down. My colleagues have put collectively a comparison of energy prices in Europe. And the New Economics Basis has issued a proposal that’s an alternative choice to vitality value freezes: a free allocation of vitality to households, with increased marginal costs for additional consumption.

-

Sergei Guriev and Elias Papaioannou have distilled right down to 80 pages the educational literature on the political economy of populism.

-

Peter Kellner succinctly units out the political impossibility of low-tax conservatism in as we speak’s Britain.

-

Ivan Krastev reflects on what the late Mikhail Gorbachev meant for his technology of east Europeans. In a phrase redolent of Czesław Miłosz’s The Captive Thoughts, he writes: “He freed us from the psychological abyss that tomorrow is nothing greater than the the following day.”

Numbers information

Beneficial newsletters for you

The Lex E-newsletter — Meet up with a letter from Lex’s centres world wide every Wednesday, and a evaluation of the week’s greatest commentary each Friday. Join here

Unhedged — Robert Armstrong dissects an important market traits and discusses how Wall Avenue’s greatest minds reply to them. Join here