Rising inflation headlines bought you on edge? Or possibly you’re already feeling the rising prices in your finances.

You’re not alone. Lots of people are nervous about inflation lately, and for good cause.

There are a few alternative ways you’ll be able to attempt to shield your self from inflation. A method is to spend money on Sequence I Bonds. Another choice is to spend money on TIPS, which stands for Treasury Inflation-Protected Securities.

Each are strong choices, however which one is the higher inflation hedge? We’ll reply that query and extra on this article.

Inflation Present Standing

Inflation continues to soar, because the CPI simply reported a 9.21% annualized inflation charge for the month of June. That is the best inflation has been since 1981, according to CNBC, and it’s solely going to proceed to go up. And, in keeping with JPMorgan, we may see inflation attain 10% by the summer time of 2023.

With all of this in thoughts, it’s no surprise that persons are scrambling to seek out methods to guard themselves from inflation. Let’s take a better have a look at I Bonds vs TIPS to see which is the higher inflation hedge…

What are Inflation-Listed Bonds?

Inflation-indexed bonds are debt securities issued by the USA authorities that present safety towards inflation. The principal worth of those bonds rises with inflation and falls with deflation, as measured by the Shopper Worth Index (CPI).

The curiosity funds on these bonds are fastened, that means that they don’t change with fluctuations in inflation or deflation. Inflation-indexed bonds are generally known as “Actual Return Bonds” or “TIPS”, which stands for Treasury Inflation-Protected Securities.

What are Sequence I Bonds?

I Bonds are a kind of inflation-indexed bond that’s issued by the U.S. authorities. The rate of interest on I Bonds consists of two elements:

A hard and fast-rate, which stays the identical for all the 30-year lifetime of the bond

An inflation-adjusted charge modifications each six months to maintain tempo with the CPI.

I Bonds may be bought instantly from the U.S. Treasury’s web site, by way of a monetary establishment, or a payroll financial savings plan. I Bonds are additionally obtainable in denominations of $50, $75, $100, $200, $500, $1,000, $5,000, and $10,000.

When you’re all in favour of including them to your funding portfolio, you’ll want to try our step-by-step tutorial on purchasing Series I Bonds.

I Bonds are restricted to $10,000 per particular person, per 12 months. Nonetheless, there’s a approach to get round this restrict through the use of a authorized loophole that I found. Extra on this later…

How Sequence I Bonds and TIPS Are Related

- Each I Bonds and TIPS are issued by the U.S. authorities. As protected because it will get relating to investing your money during these uncertain times, the U.S. authorities is not going to default in your I Bonds or TIPS or refuse to pay again your cash.

- Each I Bonds and TIPS shield us, and assist us hedge towards inflation. Albeit in numerous methods which we’ll speak about it afterward similarity.

- Each I Bonds and TIPS are adjusted for inflation primarily based on the CPI-U shopper value index. The CPI-U measures the typical change over time within the costs paid by city shoppers for a market basket of shopper items and providers and is taken into account probably the most consultant measure of inflation similarity.

- Each I Bonds and TIPS may be purchased on-line. These bonds may be bought on Treasurydirect.gov an internet site run by the U.S. treasury division that lets particular person traders such as you and me purchase and redeem securities instantly from the federal government without charge similarity.

- Each I Bonds and TIPS are exempt from native and state taxes, however not federal taxes. Word: besides underneath particular circumstances, which we’ll cowl shortly.

These had been the similarities. Now let’s speak concerning the variations between the 2, as a result of it’s the variations which have pushed many to make use of I Bonds versus TIPS as an inflation hedge of their private portfolio.

8 Variations of Sequence I Bonds vs TIPS

There are eight key variations between I Bonds versus TIPS. The strategy of buy, the minimal holding interval, the acquisition limits the phrases or maturities the best way of adjusting for inflation, the strategy of taxation, the curiosity ground, and the return of principal.

Let’s dive into the variations…

1. How You Buy Them

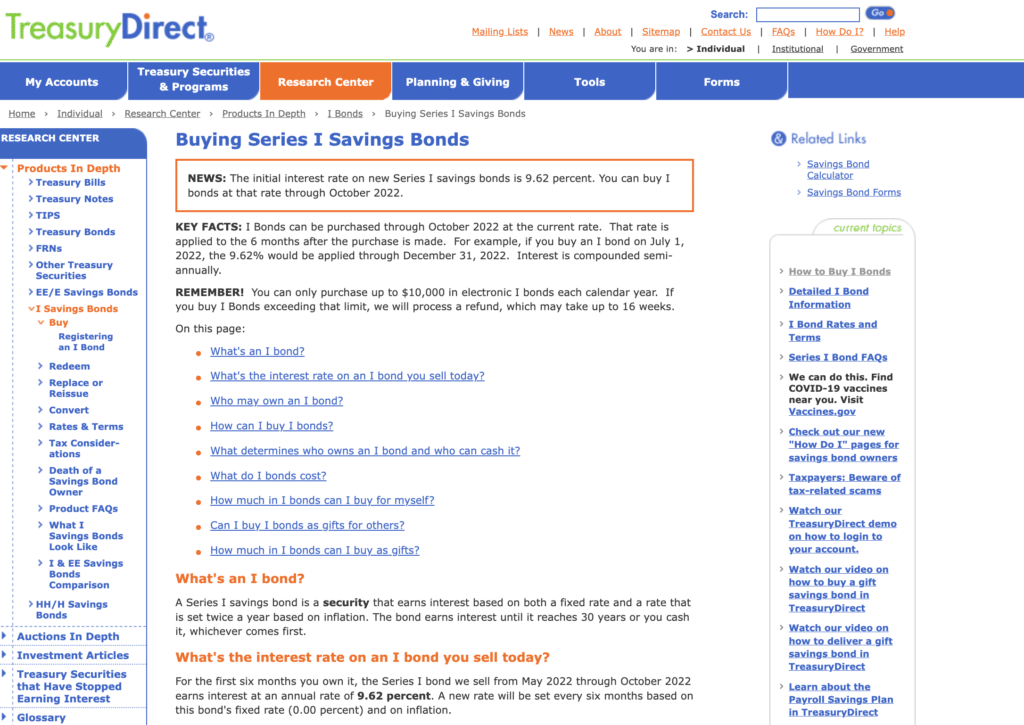

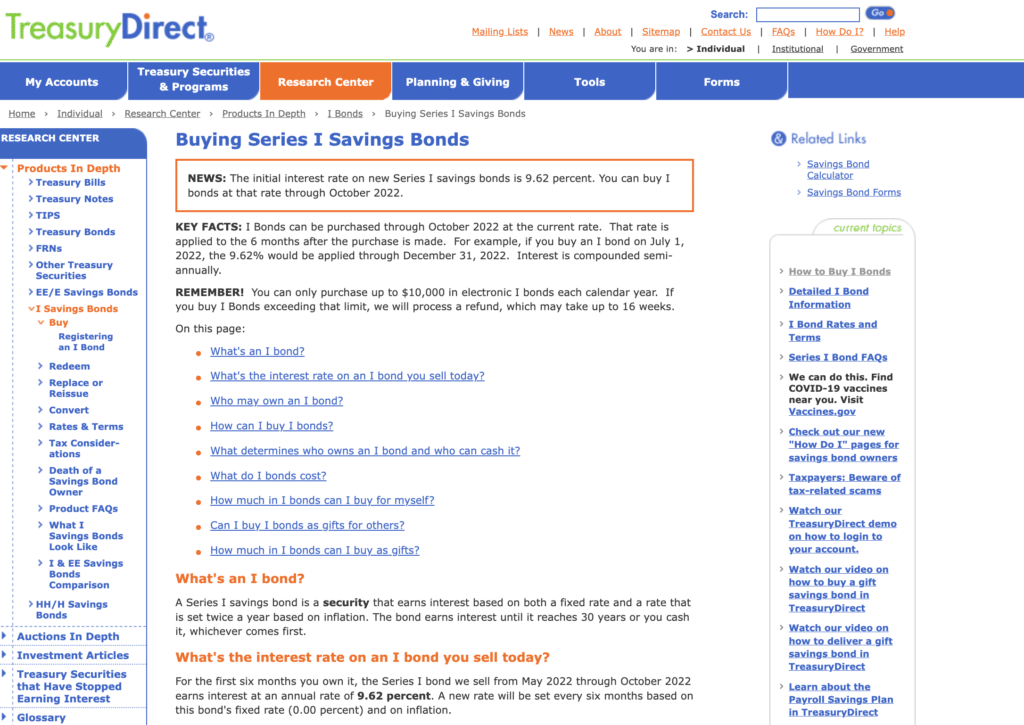

You possibly can solely purchase and redeem I Bonds from Treasurydirect.gov, not like TIPS. I Bonds are “non-marketable” or which implies not obtainable within the secondary market.

You possibly can’t merely go to your brokerage agency, your financial institution, online brokerages resembling Constancy or Vanguard to purchase and promote I Bonds like you’ll be able to with shares, mutual funds, index funds, and ETFs.

Bonus: Unsure if bonds are best for you? Learn this to study the difference between stocks and bonds for your investment portfolio.

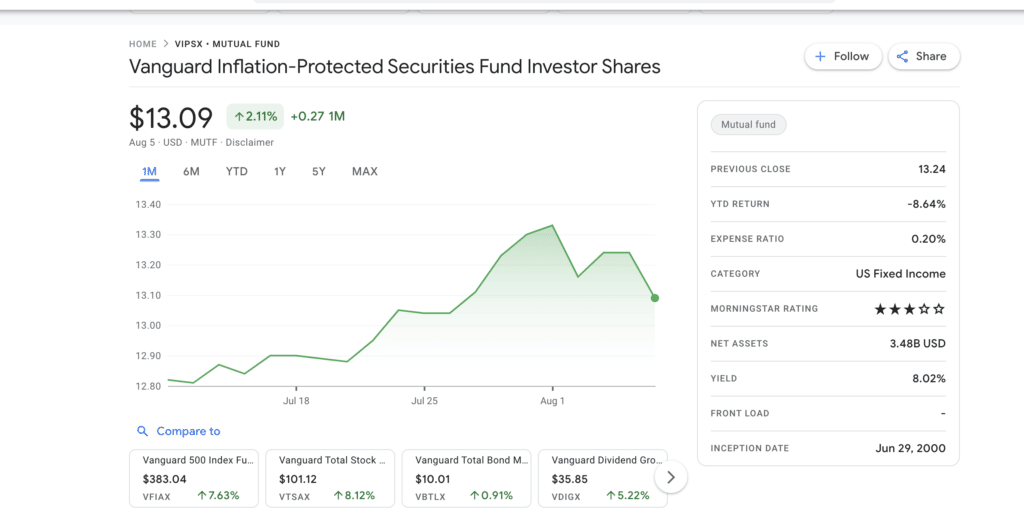

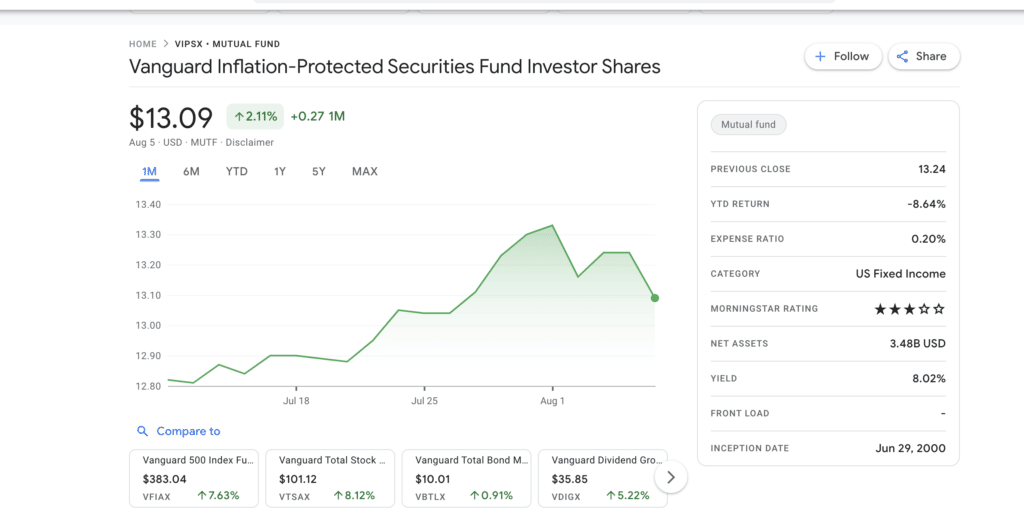

TIPS are additionally obtainable on Treasurydirect.gov, however not like I Bonds they’re marketable and likewise obtainable within the secondary market. This implies you should purchase and promote them through your financial institution or dealer, not simply on the federal government’s web site.

When you have a brokerage account with Constancy proper now, you should purchase TIPS by way of an ETF from iShares. Even in retirement accounts held with Vanguard, TIPS may be bought.

Vanguard’s Vanguard Inflation-Protected Securities Fund mutual fund, image VIPSX is in one of many largest within the business.

In that sense, assuming you have already got an current brokerage or retirement account arrange, TIPS are simpler to purchase than I Bonds.

This easier-to-buy issue is likely one of the the reason why many determine to buy TIPS vs Sequence I Bonds. However organising an account to buy Sequence I Bonds is actually not that tough and may solely take you 5-10 minutes. You should utilize our step-by-step tutorial to purchase Series I bonds to make it that much easier.

2. Minimal Holding Interval of I Bonds Vs TIPS

The minimal holding interval you must maintain I Bonds for a minimum of 12 months. There isn’t a approach you’ll be able to promote your I Bonds again to the federal government to money out of them within the first 12 months. As well as, there’s an early redemption penalty – You lose the final three months’ curiosity.

| Early Withdrawal Penalty – Buyers that money out their Sequence I financial savings bonds early (throughout the 1st 12 months) will lose 3 months of curiosity. |

When you redeem throughout the first 5 years, form of like in case you had been holding certificates of deposits, besides that certificates of deposits CDs are paying charges like these. Whereas let’s assume I Bonds have an annualized yield of seven.12%. Maybe you don’t see these final three months of curiosity loss for an early withdrawal as such an enormous deal, however the one-year minimal holding interval, that’s one thing it’s best to take into severe consideration with TIPS.

When you purchase them from Treasury Direct, there’s a minimal holding interval, however solely 45 days. And in case you purchase them, purchase them as an ETF in your brokerage or retirement account, as many particular person traders do. Doing so this fashion means there’s usually no minimal holding interval.

3. Buy Limits of Sequence I Financial savings Bonds vs TIPS

The acquisition restrict for Sequence I Bonds is $10,000 yearly per social safety or tax ID quantity.

You could possibly additionally buy as much as an extra $5,000 of I Bonds every year along with your tax refund.

The acquisition restrict through this technique is both $5,000 or as much as your tax refund quantity. With TIPS the earnings restrict is $5 million per particular person or family per public sale. Nothing to fret about right here for the typical particular person investor. And if this is a matter, I believe we are able to agree you’re doing okay income-wise!

4. Phrases and Maturities

As I at all times say, everybody’s monetary journey is completely different. So selecting the best time period or maturity will largely rely in your long-term monetary targets. I Bonds are solely obtainable for a 30-year time period. Whereas TIPS are issued in 5, 10, and 30-year phrases.

This solely issues in case you intend to carry these securities to maturity, or you probably have a private perspective on the course that inflation is headed and the way lengthy it would final distinction.

5. How They Modify For Inflation

I Bonds and TIPS are adjusted for inflation in another way. I Bonds modify inflation through their rate of interest, whereas TIPS modify through their principal quantity. Right here’s what I imply…

The I Bonds charge is a mix of two charges, a set charge that’s set on the time of buy and doesn’t change over time. Plus a variable or inflation charge that modifications each six months in Might and November. Yow will discover all the present and historic fastened and inflation charges on the TreasuryDirect web site.

Hypothetical Sequence I Bond Price Calculation.

When you had been to purchase an I Bonds in April 2023, you’d get the I Bonds fastened charge that was set in November 2022, which is 0%. Doesn’t sound very enticing till you add on the I Bonds variable charge.

Let’s say the inflation charge that was additionally set in November 2022, and that charge is at 3.56% for the six-month interval, till it’s reset once more in Might 2023, add the fastened charge of 0%, the semi-annual inflation charge of three.56%.

That’s the I Bonds charge you’ll get for the subsequent six months. However bear in mind I Bonds charges change each six months in Might and November. So this 3.56% inflation charge is only for six month interval, that means annualized it’s 7.12%.

What the treasury direct refers to because the composite charge. That’s what you need to be utilizing if you’re evaluating returns in your I Bonds investments versus different investments, on condition that inflation has gone up steadily month over month.

6. Technique of Taxation

Curiosity funds are usually taxed at redemption for I Bonds versus yearly within the 12 months of prevalence for TIPS. As I discussed earlier, each I Bonds and TIPS are exempt from native and state taxes, however not from federal taxes.

With I Bonds although, most traders will delay reporting curiosity and paying federal taxes on these quantities till the 12 months that they money out or redeem their I Bonds. You possibly can’t do that with TIPS as said on the Treasury Direct web site.

For TIPS, semi-annual curiosity funds and inflation changes that enhance the principal are topic to federal tax within the 12 months that they happen because of this. Some individuals favor to not maintain TIPS in taxable accounts.

Yet one more tax benefit that I Bonds have over TIPS is that in some cases, the curiosity on I Bonds could also be exempt from federal earnings taxes. When you use the proceeds for certified increased training bills at an eligible establishment, both for your self, your partner, or your dependence as at all times, there are particular exemptions and earnings limitations.

7. Curiosity Flooring

The rate of interest on I Bonds won’t ever go beneath zero. There have been intervals when the I Bonds variable charge, and the inflation charge have gone destructive, like in Might 2009 and Might 2015.

Irrespective of how destructive the inflation charge goes, the mixed rate of interest or yield in your I Bonds won’t ever go beneath zero.

That’s additionally the federal government’s promise with TIPS.

You is perhaps asking your self:

“Why would somebody spend money on TIPS if the yield is destructive?”

Right here’s why: that particular person has far more extra money to spend money on inflation, and guarded securities than is permitted underneath the annual I Bonds buy limits.

Even when she or he used the authorized loophole that I’m attending to shortly and two, that particular person expects inflation to go up even increased than what the market expects.

8. Return of Principal

You’ll at all times get your authentic principal again with I Bonds. You’ll by no means get again lower than what you paid. When you purchase $10,000 of I Bonds at present and redeem them at any level sooner or later, after the minimal holding interval of 12 months, however earlier than maturity, the federal government would pay you again your preliminary funding of $10,000, no matter the place the rates of interest is perhaps on the time with TIPS.

That’s not at all times the case. When you purchase $10,000 of TIPS and also you promote them earlier than maturity says within the secondary market through your financial institution or constancy, the value you get will rely upon what the secondary market is keen to pay. And with TIPS like with all regular bonds, the value goes up when rates of interest go down and the value goes down when rates of interest go up.

When you purchase $10,000 of five-year TIPS at present and promote the subsequent 12 months, you’ll almost definitely lose cash on the sale as a result of rates of interest are anticipated to go up. And when that occurs, the value of my TIPS will go down.

Now, this solely issues in case you promote your TIPS earlier than their maturity date if I maintain my $10,000 of five-year TIPS to maturity. So for the complete 5 years, I might be paid the inflation-adjusted principal or the unique principal, whichever is bigger, however identical to I hate destructive yields.

I hate shedding principal.

The second cause for why we opted for I Bonds versus TIPS, leads properly to how we’re utilizing I Bonds versus TIPS as an inflation hedge in our private portfolio and that authorized loophole I discussed earlier, that might make it easier to enhance your annual I Bond buy restrict. Prefer it helped us our retirement and different long-term financial savings. We’re nonetheless dollar-cost averaging these quantities into the market to purchase equities. As a result of on the finish of the day, we consider that’s nonetheless the most effective inflation hedge in the long term.

I Bonds and TIPS are designed to maintain tempo with inflation. They don’t seem to be designed to make you wealthy.

That’s what the inventory market is for. When you have the proper long-term mindset in direction of investing, regardless of which decade you began investing your common annual charge of return from the S&P 500 beat out the typical annual charge of inflation each time, that means the S&P 500 beat out the returns you’ll’ve gotten on an inflation index, authorities safety like I Bonds and TIPS.

I Bonds vs Suggestions: What’s Higher For an Inflation Hedge?

Sequence I Bonds are an awesome inflation hedge in your extra quick to medium-term money you don’t want for the subsequent 12 months. Consider something above and past your emergency fund. Most traders technique is holding their I Bonds to maturity.

Like different investmetns the one cause you’ll need to promote in case you actually wanted that money for a selected function. Or in case you had been assured you would get higher returns elsewhere in your short-term to medium-term money financial savings.

With inflation being so excessive, TIPS doesn’t make as a lot sense; particularly with the enticing yield of I Bonds. We all know that when it’s time so that you can redeem your I Bonds earlier than maturity you’ll have made a pleasant 7.12% (or increased) rate of interest. Plus, inflation doesn’t appear to be slowing down so it’s best to earn extra.

Now, you probably have a number of $100,000 of extra money sitting round, then this received’t be just right for you for the reason that annual I Bonds buy restrict is just too low. However in case you’re like most traders, you’ll need to purchase greater than the annual I Bonds buy restrict.

Welcome to the authorized loophole that I found just a few weeks again.

Sequence I Bonds Loop Gap Technique – Case Research Instance

As talked about beforehand, traders are restricted to $10,000 of Sequence I Bonds bought except you make the most of the particular tax return that enables an extra $5,000 buy.

First, you should buy your $10,000 I bond restrict for you and your partner. Then you should buy an extra $10,000 of I Bonds in your partner as a present out of your treasury direct account.

This will likely be sitting in your treasury direct account instantly and you may present it to them at a later time (almost definitely in a 12 months or so) if you suppose inflation has peaked.

Right here’s the good half: their $10,000 present that’s sitting in your treasury direct account begins incomes curiosity instantly.

Their I bonds present earns curiosity instantly and it’s topic to the identical circumstances and restrictions as any regular bond. Right here’s what I imply: his bond present began incomes 7.1, 2% curiosity from the date you bought it, regardless that it’s sitting in your account within the present field.

Their I Bonds present additionally could have its charge adjusted for inflation six months from the date you bought it, regardless that it’s sitting in your account within the present field.

When you purchased their I Bonds present in Might 2022, this charge adjustment would occur in September, 2022. And the minimal one-year holding interval on their I Bonds present additionally began from the date that you just bought it, regardless that it’s sitting in my account within the present field.

This doesn’t imply it’s best to run out and borrow different individuals’s names and social safety numbers underneath the pretense of shopping for I Bond for them as presents, after which take the cash again for your self.

Solely the particular person named because the I Bonds present recipient can money out the Sequence I Bonds.

You don’t need to purchase extra I Bonds presents than it’s best to for somebody and find yourself sitting on ridiculous quantities of I Bonds presents. Solely to seek out out that it’ll take you 20 years to ship all the things to your recipient.

Who is aware of the place the yield on I Bonds will likely be in 5 years, neglect about 20 or 30 years from now. Keep in mind the supply of the I Bonds presents to the recipient is topic to the identical authorized restrict of $10,000 per 12 months. As if the recipient had been shopping for I Bonds for himself or herself. Earlier than they’re delivered, whereas the I Bonds presents do earn curiosity in your treasury direct present field, you’ll be able to’t get to them or do something with them, even in case you want the money.

The Backside Line

The choice of whether or not to purchase I Bonds or TIPS is a private one. Think about your funding targets and goals, time horizon, and threat tolerance earlier than making a call.

When you’re on the lookout for a protected funding that can shield your buying energy from inflation, I Bonds could also be a sensible choice. When you’re on the lookout for an funding that can offer you the next charge of return, TIPS could also be a better option.

Each I Bonds and TIPS are backed by the complete religion and credit score of the U.S. authorities, so you’ll be able to really feel assured that your funding is protected.