Trade is again. For the final a number of a long time, the sector has been neglected and underinvested in, as Wall Road embraced Silicon Valley, companies and all issues technology-related. Manufacturing, notably in wealthy international locations just like the US, was thought to be a “has been” enterprise. Fewer and fewer wished to take a position or work in it. The inevitable decline of manufacturing facility jobs grew to become an financial truism.

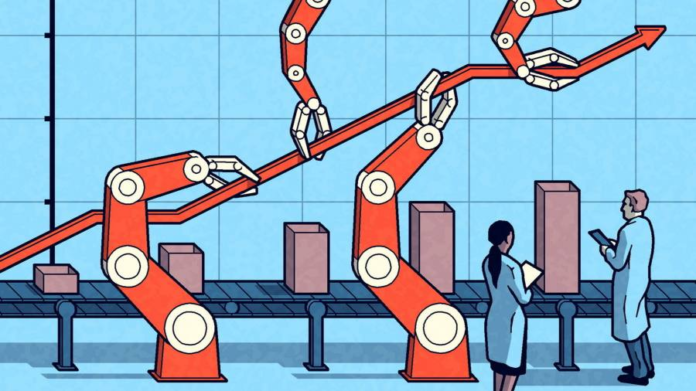

Now, in our post-neoliberal, deglobalising world, issues are altering. As resilience replaces effectivity as a enterprise mantra, international locations and corporations are bolstering industrial capability in strategic sectors corresponding to semiconductors, electrical automobiles, clear know-how and agriculture, at the same time as a altering international wage panorama and power arbitrage are bringing the manufacturing of decrease margin items corresponding to textiles or furnishings nearer to dwelling.

However within the US, a fair broader post-Covid resurgence in manufacturing is underneath approach. Whereas American producers minimize 1.36mn jobs in the course of the pandemic, August information reveals that they’ve now added again 1.43mn, a rise of 67,000 staff. And the positive factors are unfold broadly throughout geographies and sectors.

A part of that is a few federal push for domestic purchasing. A part of it’s about provide chain delays that favour extra home manufacturing. And a few of additionally it is about continued decoupling from China, in addition to the present inflation in transport prices. However past this, there’s something neglected and under-reported: the hidden energy of personal, middle-market, typically family-owned US producers.

As somebody aware of the manufacturing facility ground — my father ran auto elements manufacturing strains for a number of corporations within the Midwest, and ultimately began his personal enterprise — I’ve all the time thought that the “decline of business within the US” story was overblown.

Past the headlines of catastrophe in Detroit or the hollowing out of the rustbelt, there have all the time been loads of smaller, community-based industrial corporations, removed from the pressures of Wall Road, that had been in a position to keep aggressive by investing extra in know-how and making an effort to upskill native labour.

Now many enterprise leaders are beginning to agree. Asutosh Padhi, the managing accomplice for McKinsey North America, just lately co-wrote a e-book with colleagues entitled The Titanium Financial system, about these undervalued, over-performing center market manufacturing companies, 80 per cent of that are personal. The authors consider they would be the darlings of the long run. They usually have gross sales starting from $1bn to $10bn, from 2,000 to twenty,000 staff and posted a compound annual income progress charge (CAGR) of 4.2 per cent between 2013-2018, outpacing the S&P 500 by 1.3 per cent.

These are the businesses that make what’s “round us in all places we glance — in our vehicles, our cellphones, our jewelry, sports activities tools, surgical instruments and extra.” These corporations obtain lower than 1 per cent of enterprise capital funding, and but, as Padhi tells me, “if you need robust, yr on yr progress, they’re the place to be”.

Why are these typically neglected corporations so profitable? Partially as a result of they take the lengthy view, one thing that’s simpler to do when you find yourself personal. Analysis reveals that personal corporations make investments double the amount of cash into issues like R&D, coaching, and different types of long-term productive capital expenditure than comparable public corporations, which regularly see their share costs fall after they make investments sooner or later reasonably than paying again dividends or shopping for again shares. As Padhi rightly places it, “there’s a distinction between an excellent inventory and an excellent firm”.

But it surely’s additionally about being finest in school. Which means investing within the newest industrial know-how, following the edicts of “lean manufacturing” to extend high quality and productiveness, and utilizing native provide chains to innovate extra rapidly and higher handle threat. Companies that function this fashion know what German and Japanese world-beaters do: getting tight groups of engineers, scientists, labourers and managers working in proximity yields the perfect outcomes.

I’ve spent the previous week within the Carolinas, taking a look at corporations within the textile provide chain which are working in precisely this fashion. Not solely are they bolstering their enterprise at dwelling, however in some instances they’re grabbing extra international market share as corporations in Europe transfer enterprise to the US to profit from decrease power costs. Some German automakers, for instance, are transferring extra manufacturing to North America to keep away from disruption from the conflict in Ukraine.

The McKinsey companions conclude that “as extra superior tech turns into prevalent in industrial merchandise and processes”, extra jobs will return to the US. That’s nice information for the American financial system, since titanium financial system corporations pay on common greater than double the wage paid to staff within the service sector ($63,000 versus $30,000 yearly). There are additionally the best variety of open jobs at each degree in these corporations, that are unfold throughout communities all through the nation.

These of us that grew up in such locations all the time knew this. Traders at the moment are studying it too. Because the tech bubble deflates, I predict market curiosity in industrials will develop.