The author is a monetary journalist and creator of ‘Surviving the Day by day Grind: Bartleby’s Information to Work’

It’s now clearer than ever that we’ve entered a brand new period of economic and financial coverage. On this new interval, governments are far much less keen to incur the unpopularity of elevating taxes or slicing spending to maintain their budgets in test.

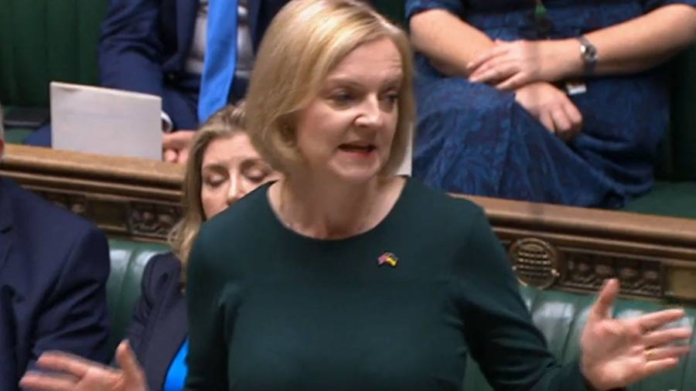

There may very well be no higher image of this alteration than the sight of a British prime minister, who campaigned for a smaller state, saying a huge intervention in the energy market to cap costs, at a value that will attain £150bn.

By the identical token, western governments adopted a “shock and awe” method to fiscal coverage within the face of the Covid-19 pandemic. Price range deficits handed 10 per cent of gross home product in a number of international locations, together with the US and the UK.

Governments felt free to borrow this a lot as a result of, normally, the markets positioned no obvious constraint on their deficits; rates of interest and bond yields stayed very low.

The response to the 2008 monetary disaster was somewhat totally different. True, there was a short interval of Keynesian fiscal stimulus within the fast aftermath of the disaster. However austerity programmes adopted when deficits grew so giant that politicians turned nervous, particularly when the bond markets’ willingness to finance Greece’s deficit evaporated in 2010.

Central banks bore the brunt of supporting the financial system within the 2010s, simply as they’d in a lot of the interval since 1980. This was the dominant development in what was usually dubbed the “neoliberal” period.

In principle, neoliberalism was about open markets and a smaller state. In follow, states didn’t shrink that a lot. In 1980, the typical OECD nation spent 14.5 per cent of its GDP on social spending. By 2019, this common had elevated to twenty per cent, with the US and Britain matching the worldwide development. The extra placing factor in regards to the previous 40 years has been the dominance of financial coverage and the low ranges of inflation and rates of interest. This period was, by and enormous, superb for dangerous property and people who commerce them.

When the 2008 disaster hit, central banks felt obliged to interrupt an previous taboo, utilizing newly created cash to purchase authorities bonds — so-called quantitative easing. The expertise of financial financing of presidency spending in Germany within the Twenties was so calamitous that it had develop into anathema till that time. When the foundations of the euro had been arrange within the Nineties, the German authorities tried arduous to rule out financial financing.

QE didn’t contain the direct financing of governments by the central financial institution; the bonds had been purchased within the secondary market. However the distinction was pretty technical, particularly as soon as central banks began returning the curiosity on their amassed bond piles to their respective Treasuries.

Hyperinflation didn’t happen, as some feared, and QE seemed to be the one technique of preserving the developed economies from a deflationary hunch. However the behavior was arduous to interrupt. Solely now, after greater than a decade, are central banks beginning to unwind their amassed bond portfolios. And politicians have gotten used to low-cost finance and have come to consider that deficits don’t matter. This view has appeared all of the extra pertinent since 2016 when the election of Donald Trump as US president appeared to point out that voters had been uninterested in “orthodox” financial coverage.

Conservative politicians could mouth the mantra that slicing tax charges will result in elevated revenues. However look what occurred after the Trump tax cuts of 2017, which centered on enterprise and the rich. In 2016, beneath Barack Obama, the US funds deficit was $587bn or 3.2 per cent of GDP. By 2019, earlier than the pandemic, the deficit had risen to $984bn or 4.6 per cent of GDP. The Republican occasion stopped speaking about balancing the funds.

Rightwing politicians criticise their leftwing rivals for “tax and spend” insurance policies however their different appears to be “spend however don’t tax”. There isn’t any urge for food for renewed austerity and any political leaders who shift in that path could quickly discover themselves out of workplace.

But when politicians are counting on central banks to maintain supporting them, they might be disillusioned. Inflation is now properly above goal and central banks are tightening coverage rapidly. Nor are central banks prone to return to QE.

So as a substitute of tight fiscal coverage and unfastened financial coverage, monetary markets could face an period of the reverse. This may occasionally imply larger rates of interest and decrease valuations for dangerous property. The adjustment could also be extraordinarily painful.