Photographer: Bloomberg/Bloomberg

On Friday, officers from Treasury Division introduced that the Inside Income Service (IRS) had unintentionally revealed confidential data pertaining to roughly 120,000 taxpayers’ retirement accounts on its web site.

“This letter offers discover that the Inside Income Service not too long ago recognized an inadvertent and now-corrected disclosure of a subset of Kinds 990-T,” Performing Secretary Anna Canfield Roth wrote in a letter addressed to Homeland Safety Chairman Thompson.

“Federal Data Safety Modernization Act (FISMA) requires this report back to Congress “not later than seven days after the date on which there’s cheap foundation to conclude {that a} main incident has occurred.” The IRS decided on Friday, August 26, that the inadvertent disclosure met this threshold,” the letter said.

“Kind 990-T is the enterprise tax return utilized by tax-exempt entities, together with tax-exempt organizations, authorities entities and retirement accounts, to report and pay revenue tax on revenue that’s generated from sure investments or revenue unrelated to their exempt goal,” the letter defined.

Names, contact particulars, and monetary information pertaining to IRA revenue had been among the many particulars that had been “inadvertently” made public.

Primarily based on the IRS assessment, the information that had been leaked on-line didn’t embody Social Safety numbers, particular person revenue data, detailed monetary account information, or different delicate data that might impression a taxpayer’s credit score.

The Wall Street Journal reported that an investigation by the US Treasury Division discovered that delicate information had been posted on the IRS web site due to human coding errors.

Extra from Fox News:

“The IRS took quick steps to handle this problem,” the company mentioned in a press release offered to FOX Enterprise. “The information have been faraway from IRS.gov and can be changed with up to date information within the close to future. As well as, the IRS additionally can be working with teams that routinely use the information to take away the faulty information and substitute them with the proper variations as they change into obtainable.”

The company mentioned that it could contact all affected people.

Data included in Kind 990-T — like all particular person taxpayer information — is meant to be confidential in most situations. However charities with unrelated enterprise revenue are speculated to file Kind 990-T, which is meant to be made public.

The IRS found the error in latest weeks and took “quick steps to handle this problem,” based on a letter despatched to Congress by Anna Cothfield Roth, the appearing assistant secretary for administration on the Treasury Division.

“The IRS is constant to assessment this example,” Cothfield Roth wrote within the letter. “The Treasury Division has instructed the IRS to conduct a immediate assessment of its practices to make sure crucial protections are in place to forestall unauthorized information disclosures.”

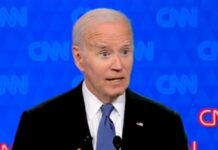

The information comes shortly after Joe Biden signed the Inflation Reduction Act, a $750 billion well being care, tax, and local weather bundle, into legislation on the White Home.

“With this legislation, the American individuals received and the particular pursuits misplaced,” Biden mentioned in the course of the signing. “For some time individuals doubted whether or not any of that was going to occur, however we’re in a season of substance.”

The reconciliation bundle would additionally double the present IRS workforce by hiring an extra 87,000 staff to the bureau’s employees of 78,661 staff.

The invoice may even add 87,000 new IRS employees to harass and abuse working Individuals and their political opponents. These recruits should be keen to hold a firearm and “use lethal pressure, if crucial.”

Now that Joe Biden is increasing the IRS by 87,000 new brokers, he wants somebody to supervise the division’s progress.

Would you imagine he picked somebody who labored with Lois Lerner? The lady who was on the middle of the Obama IRS scandal when conservatives had been focused?

The IRS promoted Nikole Flax, certainly one of a handful of staff whose emails “disappeared” after being implicated alongside Lois Lerner within the company’s focusing on scandal, to guide a “centralized” workplace in Biden’s mega-IRS.

What may go improper? (trace: loads)https://t.co/N111FKfrmT

— Spencer Brown (@itsSpencerBrown) August 30, 2022