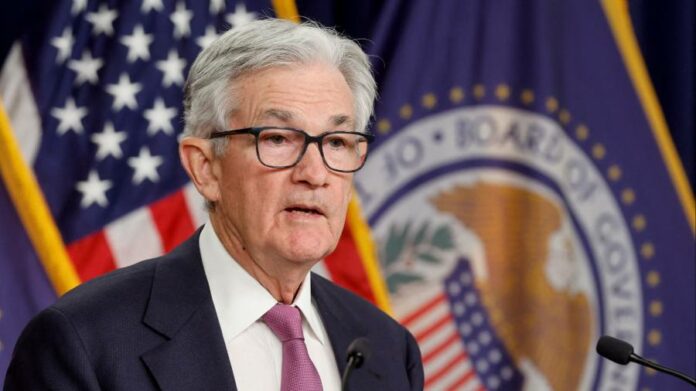

Jay Powell, the chair of the Federal Reserve, said reducing inflation would still take a “significant period of time” as he pointed to the need for additional interest rate increases in the face of stronger labour market data.

Powell’s comments on Tuesday were his first since data unexpectedly showed a jump in job growth in January, which suggested the US central bank might have to go further in its monetary tightening to cool down the economy.

The Fed has lifted its main interest rate from near-zero to a target range between 4.5 per cent and 4.75 per cent in less than a year. Last week, it slowed the pace of its rate increases to 25 basis points from 50 at the end of last year and 75 before that, suggesting its most aggressive efforts to tame inflation were behind it.

But Powell said the “disinflationary process” still had a “long way to go” and was still in its early stages. “It’s probably going to be bumpy,” he said in remarks at the Economic Club of Washington, DC.

Powell stressed that Fed policy would be dependent on incoming economic figures but the central bank would “certainly raise rates more” if data continued to be “stronger than we expect”.

In recent days, other Fed officials have also pointed to the enduring strength of the labour market as a reason for the central bank to keep pressing ahead with tightening.

“It’ll probably mean we have to do a little more work,” Raphael Bostic, the president of the Atlanta Fed, told Bloomberg News. “And I would expect that that would translate into us raising interest rates more than I have projected right now.”