This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

A surprise jump in UK inflation to 10.4 per cent in February has fuelled concerns about the cost of living crisis and reinforced expectations that the Bank of England will raise interest rates tomorrow.

The increase, from 10.1 per cent the previous month, was driven by an 18.2 per cent rise in food and non-alcoholic drink prices, the highest pace in more than 45 years. Core inflation, which strips out food and other volatile items such as energy, also rose more than expected, from 5.8 per cent to 6.2 per cent.

Soaring food prices are especially bad news for poorer households as they make up a greater proportion of their spending. The opposition Labour party accused the government of having its priorities wrong, preferring a “£1bn bung” for the top 1 per cent in its recent Budget, rather than doing more to alleviate pressures on those at the bottom.

Food prices have been pushed up by a range of factors. Britain’s farmers have been struggling with rising input costs on everything from fuel to animal feed, while they have also lost income because of Brexit, as new UK support failed to match previous EU payments. February saw a rise in salad vegetable costs and shortages at supermarkets because of supply chain problems as well as adverse weather conditions in Spain and Morocco. Farmers are also still suffering from post-Brexit labour shortages.

Energy prices, which had been the main driver of the surge in inflation, are now falling, but remain higher than in the US and the eurozone.

Like other central banks, the BoE is faced with the task of raising rates to restrain inflation against a backdrop of turbulence in the banking sector. Chancellor Jeremy Hunt told parliament yesterday that the BoE should remain focused on the inflationary threat even as he acknowledged that recent rate rises were the “root cause of the volatility we have seen in recent months”.

Markets are now predicting an increase of 0.25 percentage points tomorrow, with some even pricing in a rise of 0.50 points. Before today’s data, investors were evenly split between forecasting a quarter point rise and no change.

Although the UK has the highest inflation in the G7, it is not alone in struggling to turn the tide. European Central Bank chief Christine Lagarde warned today of the risk of a “tit-for-tat dynamic” between companies and workers as demands for higher wages increased price pressures. Lagarde said recent ECB rate rises were only starting to take effect and needed to continue to “bring rates to sufficiently restrictive levels” to damp demand.

Her comments echo those of Bundesbank chief Joachim Nagel, who said rate-setters must be “more stubborn” in their fight against inflation. Germany’s economic council separately warned that financial market instability was making the task that much harder

Browse our global inflation tracker to see how your country compares.

Need to know: UK and Europe economy

EU greenwashing rules that were watered down after business lobbying have been attacked by consumer groups. Industrialists said the bloc’s attempts to compete with US green subsidies were insufficient. Brussels attempted to resolve its spat with Germany over a proposed ban on vehicles with combustion engines by suggesting new models using carbon-neutral e-fuels could be sold after 2035.

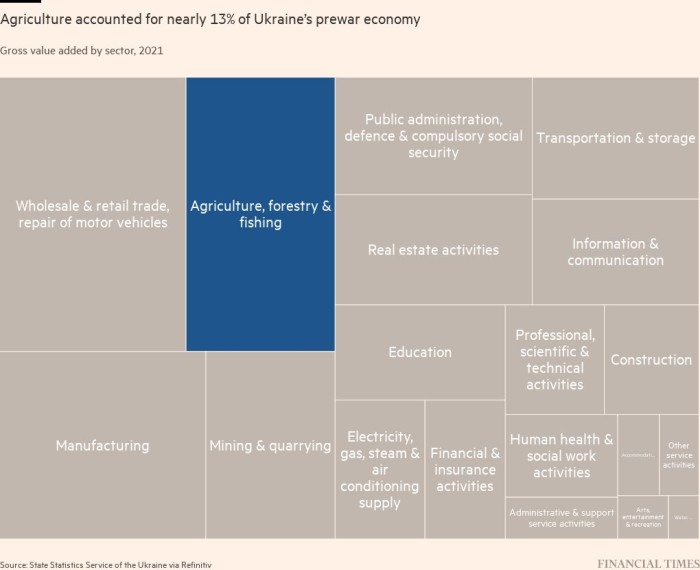

The IMF has struck a deal with Ukraine for a $15.6bn loan and a long-awaited financial lifeline. Our latest Big Read tells the story of the war’s effect on Ukraine’s agricultural sector through the fate of Nibulon, one of its biggest grain producers.

Need to know: Global economy

Chinese president Xi Jinping backed Vladimir Putin over Ukraine but held back from confirming plans for a crucial pipeline to reroute Russia’s gas exports from Europe to Asia.

The IMF approved a $3bn bailout for Sri Lanka to help it restructure its debts and address a “catastrophic” economic and social crisis. The country’s progress is being closely watched by other troubled debtors that owe large amounts to China, such as Ghana and Pakistan.

Venezuela’s oil minister resigned amid a corruption probe into Petróleos de Venezuela, the state oil company. Tareck El Aissami was a leading figure in former president Hugo Chávez’s “Bolivarian revolution”.

The Democratic Republic of Congo said it was losing almost $1bn a year in minerals illegally smuggled into Rwanda including gold, tin, tantalum and tungsten.

Need to know: business

Asian investors who had loaded up on Credit Suisse AT1 debt were said to be “gobsmacked” at the $17bn bond wipeout when it was taken over by UBS. The EU vowed to maintain bank creditor hierarchies and respect bondholders’ rights, while the wipeout could hit further issuance of risky bank debt. Switzerland meanwhile has banned deferred bonuses for CS staff. Here’s our new explainer on what the takeover means for UBS.

In the US, treasury secretary Janet Yellen signalled that the government would provide further backing for deposits at smaller American banks if needed. Bank shares rose in response. Want more? Head to our special “Banks in turmoil” section.

The head of JPMorgan Asset Management warned that property could be the next sector under threat from rising borrowing costs. Commercial property values have started to fall in recent months as borrowing costs hit investors’ ability to transact.

Commodity traders hit record profits in 2022 from extreme volatility in energy markets after Russia’s invasion of Ukraine.

Chinese tech group Tencent returned to growth as consumer spending started to tick up after pandemic restrictions ended. TikTok is caught up in a US-China legal struggle over its powerful algorithm, said to be one of the most advanced uses of artificial intelligence in consumer technology.

Google launched its Bard chatbot, which provides answers to text-based questions, in a bid to rival OpenAI’s popular ChatGPT.

Nestlé, the world’s largest food company, said less than half of its mainstream food and drinks were considered “healthy”. The widely used health star rating system measures levels of saturated fats, sugar and salt as well as “positive nutrients” such as fibre, fruit and vegetables.

The World of Work

Is it better to use carrots or sticks to get people back into work? For the past 25 years or so, a lot of countries have gone big on the latter, writes columnist Sarah O’Connor, but forcing the unemployed into low-paid work isn’t a good solution to today’s labour market problems, she argues.

What’s the best way to get back into work after several years of retirement? Careers expert Jonathan Black and FT readers offer some advice.

Our new Working It podcast discusses the unintended consequences of mass lay-offs.

Some good news

Kindness is on the rise. Although this week’s World Happiness Report reflects a turbulent period of human history, it also shows a globe-spanning surge in benevolence, with “prosocial” acts about one-quarter more common than before the pandemic.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you