Britain’s new prime minister is establishing a coverage conflict with the Financial institution of England that economists assume will result in leap in rates of interest earlier than Christmas.

Liz Truss’s plans for generous energy subsidies will increase the financial system, reducing measured inflation and serving to households keep their spending ranges, however that is prone to drive the central financial institution to lift charges quicker to maintain inflation underneath management.

Monetary markets are betting that the financial institution’s official rate of interest will rise from the present stage of 1.75 per cent to greater than 3 per cent in December in a leap designed to shock households and corporations.

There are three Monetary Policy Committee conferences earlier than Christmas, with the primary on September 15. Allan Monks, UK economist at JPMorgan, stated: “It seems to be more and more probably that the BoE will ship a 0.75 proportion level fee hike subsequent week.”

Allies of Truss have indicated she is going to announce a plan to handle hovering power prices on Thursday based mostly round a freeze in power payments at a stage of £2,500 a yr, which is bigger than economists had anticipated. The BoE didn’t issue any new assist into its August forecasts.

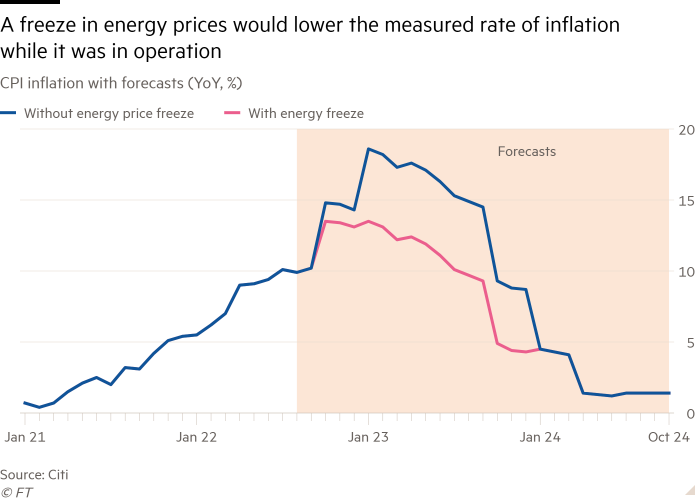

Freezing power payments would cease inflation rising far above the ten.1 per cent stage it reached in July, however the BoE thinks the financial system wants to enter recession to convey it down sustainably.

A big fiscal stimulus would average the probabilities of recession, Monks added, however that “would probably go away the financial system and labour market extra resilient than the BoE anticipated in August, and place a better burden on the financial institution to convey inflation down by taking charges increased”.

He stated financial and monetary coverage have been prone to “collide”.

In a tricky speech on Monday, Catherine Mann, one of many exterior members of the financial institution’s MPC, stated rate of interest rises wanted to be “quick and forceful” in an effort to present the BoE was critical about assembly its inflation goal. That was higher, she stated, than counting on financial weak spot alone to convey inflation down.

Writing in the Financial Times this week, Kwasi Kwarteng, who was appointed chancellor on Tuesday, stated that “co-ordination throughout financial coverage and monetary coverage is essential”.

However economists assume this can be virtually unimaginable to attain if the federal government is in search of to spice up spending whereas the BoE is making an attempt to damp demand.

James Searle, European rate of interest strategist at Citi, warned that “fiscal and financial coverage within the UK at the moment are set to tug in several instructions”.

Searle added that the developments have been “regarding” as a result of Treasury coverage would contradict that of the central financial institution and “it additionally suggests a basic incongruity within the analytical framework utilized by the central financial institution and monetary authority”.

With the BoE having the ultimate phrase, Searle predicted that “the MPC will react with rising levels of aggression to additional fiscal easing”.

Jonathan Portes, professor of economics at King’s Faculty London, believes this battle is inevitable. “Trussonomics means extra borrowing,” he stated, cautioning that whereas growing authorities debt was not an issue for the BoE when rates of interest have been caught near zero, that didn’t apply now.

“UK rates of interest are effectively off their ground and are headed up. Inflation, after all, is working at about 10 per cent,” Portes stated.

Truss, in the meantime, has develop into much less aggressive in the direction of the BoE as she has come nearer to energy.

In July, she wished to evaluation the BoE’s mandate and called for ministers to present the financial institution “a really clear path of journey on financial coverage”. However this week, she has pledged her assist for the financial institution’s independence, saying “it’s the Financial institution of England’s job to convey inflation down”.

Her feedback will give Andrew Bailey, BoE governor, and different officers on the financial institution some reassurance that Truss and her chancellor is not going to object to increased rates of interest. The governor and his colleagues are set to look on the Home of Commons Treasury choose committee on Wednesday to stipulate their newest pondering.