Let me begin by acknowledging that the surge in inflation over the previous few months is actual and completely exacerbates Individuals’ struggles to pay their payments, feed their households, gas their automobiles to get to and from work, and total to afford the fundamental wants of their day by day lives.

This can be a truth, and it must be addressed. Learn how to deal with them, or how they are often addressed, is a big query, and one I’ll deal with beneath.

In fascinated about how you can deal with Individuals’ waning financial wherewithal, we have to perceive that it’s also a incontrovertible fact that these financial struggles for a lot of, if not most, Individuals usually are not new and shouldn’t be understood to be a results of the latest inflationary surges, although, once more, inflation has multiplied the levels of hardship Individuals endure, for certain.

Behind the fast scourge of inflation looms the gross and longstanding—and seemingly ever-worsening—financial inequality divisively plaguing American society and democracy and pointing to extra entrenched structural inequities, certainly injustices, at work in our financial system.

The media’s protection of inflation typically glosses over the persistent financial struggles of Individuals to satisfy primary wants in a nation that flouts an abundance of wealth, seeming guilty the latest and hopefully momentary inflationary pressures for American’s struggles somewhat than addressing the abiding financial inequality and injustice Individuals have confronted.

Certainly, if we constructed a extra democratically functioning financial system, inflation wouldn’t be hitting Individuals so exhausting. It’s as a result of so many Individuals already had and have been dwelling on the sting in our grossly class-stratified society that the influence of inflation is so extreme.

The protection sometimes doesn’t actually inform this story, reporting with amnesia somewhat than historic consciousness.

Take this latest editor’s note printed on CNBC, reporting that the latest inflation has instantly thrust a big proportion of Individuals into the situation of dwelling paycheck to paycheck. Right here’s one passage:

Whereas the financial system isn’t technically in a recession, it’s beginning to really feel prefer it for a lot of Individuals. Though wages have elevated over the previous 12 months, it isn’t protecting tempo with inflation. The rise in lease, meals and gasoline costs is making it troublesome for a lot of employees to cowl their bills. In April, 61% percent of consumers reported living paycheck to paycheck and that quantity will seemingly enhance as costs proceed to stay excessive and borrowing prices go up as effectively.

What we’ve got to acknowledge is that this case is in no way new. In 2018, 80% of Individuals reported dwelling paycheck to paycheck, as did 78% of employees in 2019. A fast look again at 2014 exhibits that 76% of employees that 12 months lived equally on the sting of poverty. One might return 12 months by 12 months and discover this financial precariousness is pretty fixed and abiding.

Below the Trump administration poverty increased, and his insurance policies not solely did nothing to handle this case, somewhat, they really abetted, certainly created, these circumstances. His massive tax cut for companies and the wealthiest Individuals from 35% to 21% exacerbated revenue inequality. Certainly, we noticed firms reaping tens of billions of {dollars} in tax windfalls whilst they laid off employees.

Whereas unemployment remained traditionally low to the purpose of being negligible, so lots of the jobs created had been part-time or low-wage, rising a category of working poor.

To speak about and symbolize inflation as the first or fundamental explanation for Individuals’ financial ache is to disregard the persistent and underlying injustices within the U.S. financial system, labor relations, and insurance policies that seemingly ritualistically have interaction in transferring increasingly more wealth from the employees who produce it to the wealthiest who don’t want it and stockpile it.

And to symbolize inflation because the perpetrator for financial woes misdirects us from figuring out the right answer.

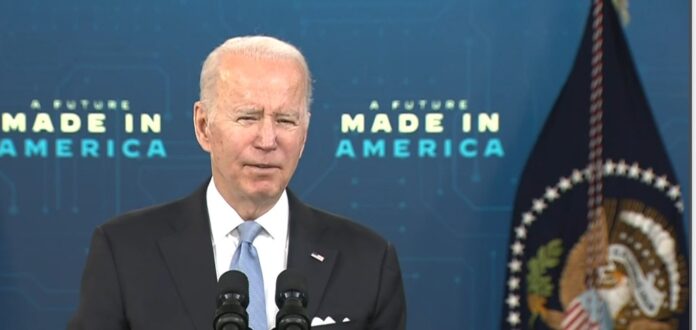

For instance, the mantra of media protection tends to be that inflation will hurt President Joe Biden’s re-election possibilities and even hurt Democrats on this November’s mid-term elections. The pundits insist voters at all times take out their frustrations on the incumbents, whilst they are saying on the similar time that there’s little or no any president can do to handle inflation.

This protection blinds us to the truth that Biden’s Construct Again Higher plan contained the very insurance policies that promise to maneuver the U.S. financial system in a extra democratic course and to handle in basic methods financial inequality and the excessive prices of dwelling Individuals face, no matter inflation. The plan proposed insurance policies to make well being care and pharmaceuticals extra inexpensive, to assist Individuals with the excessive value of childcare that may make it prohibitive for some mother and father to enter the labor power, to make greater schooling extra accessible and inexpensive, and to create well-paying union jobs whereas addressing local weather change, amongst different proposals. The plan additionally would reduce taxes for almost all of Individuals, whereas elevating them on the wealthiest .1%, reversing the development of transferring wealth to the richest Individuals and firms.

And but the media in the best way it focuses on inflation and fuels, if not endorses, the blaming of Biden, performs the harmful sport of validating Individuals’ chance of voting out of mere response for Republicans, who persistently not solely disregard America’s working households however truly enact insurance policies hostile to them, as we noticed underneath Trump and as we see of their refusal to assist Biden’s Construct Again Higher agenda.

General, the GOP’s reactionary and hateful agenda worsens the financial system and stokes inflation. For instance, one explanation for inflation, as former Microsoft CEO Steve Ballmer explained, is the scarcity of employees, which a extra strong immigration circulation into the U.S. might assist treatment. Republican xenophobia and hate towards immigrants, nonetheless, truly get in the best way of addressing the labor scarcity, which might assist resolve some provide chain points and ease inflation.

The media, although, in overlaying inflation, ignores these broader points and blinds us to the potential options that would assist this nation construct a extra democratic financial system.

Tim Libretti is a professor of U.S. literature and tradition at a state college in Chicago. A protracted-time progressive voice, he has printed many educational and journalistic articles on tradition, class, race, gender, and politics, for which he has acquired awards from the Working Class Research Affiliation, the Worldwide Labor Communications Affiliation, the Nationwide Federation of Press Ladies, and the Illinois Lady’s Press Affiliation.