Jay Newman was a senior portfolio manager at Elliott Management and is author of the finance thriller Undermoney.

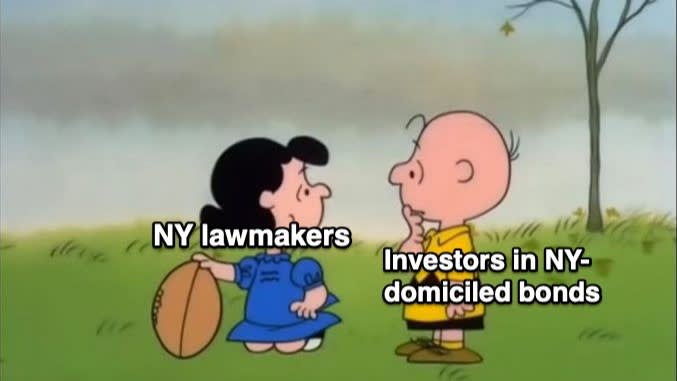

William S. Burroughs could have been thinking of sovereign debt investors when he quipped that “sometimes paranoia’s just having all the facts.” The antics of the New York State legislature are a case in point.

Out of nowhere, a package of proposed bills that would dramatically undermine the enforceability of sovereign debt contracts governed by New York law are wending their way through the New York State Assembly and Senate.

This mischief appears in three draft laws. First, the so-called “orderly restructuring” bill (A2970, S4747) would cap creditor recoveries at an (indeterminate) amount equal to what the US federal government might have received had it been a creditor — and retroactively reduce existing judgments. Here is the ostensible purpose:

. . . The legislature finds that it is a longstanding policy of the United States and the state of New York, as the world’s leading financial center, to support orderly, collaborative and effective international debt relief for developing countries with unsustainable levels of debt. Debt distress, debt crises, and disorderly default are associated with unacceptable human suffering, economic decline, and financial market and payment systems disruption. Moreover, debt restructuring is ineffective and does not lead to sustainable outcomes when it is not perceived as equitable or legitimate by stakeholders in borrowing and lending countries. Additionally, public creditors are unlikely to participate in debt restructuring initiatives unless there is fair burden sharing among all public and private creditors, which is essential to the legitimacy and effectiveness of debt relief initiatives. . . .

Second, the Assembly is considering a comprehensive regulatory scheme that would empower New York state courts to supervise sovereign debt restructurings (A2102) while giving debtors the exclusive power to propose a restructuring plan. For good measure, that law would affect the entire existing sovereign debt stock, since it would apply retroactively and explicitly override the bond contract.

Third, Assembly bill A9317 (which has not yet been reintroduced in this session), would reinvigorate the antiquated, discredited notion of champerty by requiring courts to determine a creditor’s subjective intent and creating a presumption of wrongful purpose when a bondholder has any history of purchasing sovereign debt at a discount or declining to participate in a sovereign restructuring.

The stated motivations make little sense. One sponsor objects to so-called “vulture funds” buying Puerto Rican debt. But the bill applies much more broadly: not only to unincorporated territories, but also to foreign countries, provinces, and states (perhaps anticipating debt problems that New York might experience if current trends continue).

Putting aside serious questions of state and federal constitutionality — and the risible notion that New York state courts are competent to oversee sovereign debt restructurings — the threat that these proposals might be signed into law needs to be taken seriously. Constitutional challenges take years (and cost millions of dollars in legal fees) to resolve. If anything like these bills is enacted, the damage will long since have been done.

Since over half of all sovereign bond contracts expressly rely on New York law and New York courts, with the stroke of a pen, the proposed changes would make it impossible to enforce those contracts in accordance with their terms — upending both the primary and the secondary markets for New York law bonds.

For decades, borrowers and lenders have expressly chosen to have their agreements adjudicated in New York, under New York law, because New York has been the gold standard: unequivocally protecting property rights, recognising the sanctity of contract, and ensuring impartial, predictable, and consistent administration of justice. If those foundational principals change, underwriters, bond buyers, and issuers will flee. It won’t take long for more attractive jurisdictions, like London, to pick up the slack, causing New York to lose business — and tax revenue.

In addition, New York politicians can expect a wide range of unintended consequences: US pension funds and individual investors will suffer losses, and New York’s status as one of the world’s foremost commercial centres will be eroded. It’s not a stretch to foresee a negative impact on the attractiveness of the US dollar as a reserve currency — a level of instability that is particularly ill-advised given the willingness of China to wield sovereign debt as a coercive tool of foreign policy.

Given that these dramatic changes seem palpably absurd, you’d be forgiven for wondering what’s happening behind the curtain of lobbying, influence peddling, and political contributions. Since New York state would be a certain loser, who would benefit? Who really wins? Perversely, the biggest beneficiaries of the degradation of America’s premier financial and commercial centre as a bastion of contractual and property rights will not be sovereign borrowers, much less their citizens.

Rather, the biggest beneficiaries would be America’s enemies. China, Russia, Iran, Cuba, and North Korea are intent on degrading America’s status as a bulwark of the rule of law and undermining the dollar as a reserve currency. That all fits neatly with a movement — already well under way — to develop alternatives to the US dollar for settlement of international financial transactions and trade.

And China, a major creditor to the world’s poorest countries, has a strong interest in undercutting the value of claims owed to other lenders. It’s enough to be suspicious of who is really driving this change. Sovereign lending is risky enough without officious meddling that upends longstanding legal frameworks and expectations.