There isn’t a believable method to sugarcoat the impression of an 80 per cent rise in vitality payments for UK financial prospects or family funds.

With the vitality value cap, which impacts 85 per cent of households, rising from an annual common of £1,971 to £3,549 for the October to December interval, and additional massive will increase anticipated in January, the strain on the brand new prime minister for complete motion is overwhelming.

However economists on Friday warned that any coverage response will contain troublesome trade-offs. They had been additionally clear that it was inconceivable to discover a government-led resolution that was inexpensive, non-inflationary and well-targeted whereas additionally preserving incentives to preserve vitality this winter.

“There are massive trade-offs and selections that must be made however are at the moment being ignored,” mentioned Torsten Bell, director of the Decision Basis think-tank.

The underlying drawback for the UK and virtually all European international locations is that they’re web importers of pure gasoline and when wholesale costs rise, they develop into poorer and governments can solely distribute the losses. Final 12 months UK web imports of gasoline accounted for almost 60 per cent of family and industrial gasoline consumption.

Increased wholesale gasoline costs — that are at the moment 15 instances regular ranges — improve inflation and minimize disposable incomes as a result of wages don’t totally preserve tempo with costs.

Alarming inflation forecasts have multiplied for the reason that Financial institution of England predicted value rises of 13 per cent later this 12 months in its newest quarterly forecasts. This month’s improve in wholesale gasoline costs has many of the current forecasts of inflation peaking at 14 to fifteen per cent, though Citigroup expects a peak of greater than 18 per cent in January.

The differing predictions come right down to questions on how a lot economists count on meals costs to rise this autumn and the way a lot they count on the statistical authorities to extend the burden of meals, gas and vitality in inflation measures subsequent January.

Regardless of the precise peak in inflation, the impact of a better price of residing not matched by pay will increase has already led the BoE to count on the worst squeeze in living standards for the previous 60 years and a recession beginning this autumn and lasting for greater than a 12 months.

Added to that is the troublesome financial message that if all households had been merely bailed out, the extra authorities borrowing and spending would lead to even larger inflation as a result of the economic system is already working with no spare capability.

Even with out extra authorities spending, the Nationwide Institute of Financial and Social Analysis think-tank mentioned that the BoE was now more likely to should cope with a worse inflationary image within the quick time period and must elevate rates of interest quickly to cease a short lived spike in inflation changing into everlasting.

“The Financial Coverage Committee will now have to tighten financial coverage quicker and by greater than we had beforehand thought. We now count on the coverage charge to rise to 4.25 per cent by Might of subsequent 12 months,” mentioned Stephen Millard, a deputy director at Niesr.

Whoever wins the Tory management race will subsequently be enjoying whack-a-mole with financial coverage in the course of the first few weeks in workplace. Beneficiant common assist will lead to larger budgetary prices, inflationary strain and better rates of interest; extra focused insurance policies will assist households much less.

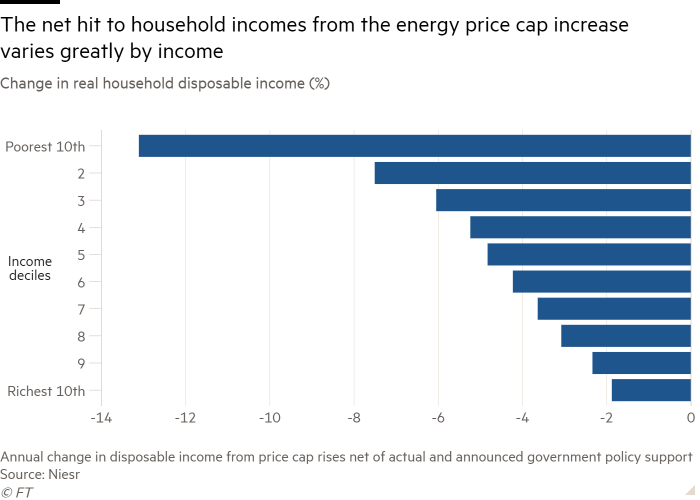

Even with focused assist the ache for households will probably be excessive, particularly amongst these with low incomes who already dedicate way more of their budgets to vitality than middle-income or richer individuals.

The Institute for Fiscal Research, a think-tank, estimates that inflation for the poorest 20 per cent of individuals will probably be 17.6 per cent in October in contrast with 10.9 per cent for the richest fifth.

Niesr predicts that the brand new value cap will go away actual disposable earnings among the many poorest fifth round 10 per cent decrease, even after the assist already supplied.

An extra focused assist package deal is one choice accessible to the brand new prime minister. The IFS calculated on Friday that the federal government would want to spend one other £14bn to match the generosity of the plan Tory management candidate and former chancellor Rishi Sunak put in place in Might, when payments had been anticipated to rise solely to £2,800.

Whereas Sunak has recommended that this may be near his most popular choice ought to he develop into prime minister, Liz Truss, the present frontrunner has been way more imprecise. She has recommended a £13bn reversal of April’s nationwide insurance coverage improve, which might largely assist richer households, and a short lived pause on inexperienced levies in electrical energy payments.

Truss has additionally mentioned she could be inclined to not “bung more cash” on the drawback however the plans she has introduced up to now would “have solely a modest impact on family payments”, based on Isaac Delestre, an economist on the IFS.

An extra drawback, highlighted by the Decision Basis, is that vitality payments range enormously between households on related earnings ranges, so concentrating on assist purely by earnings would depart some individuals flush with cash and others nonetheless missing funds.

The think-tank mentioned assist additionally wanted to “mirror households’ differing ranges of vitality utilization”. In line with Bell, the one package deal that might do that, whereas conserving prices down and inflation in test could be direct authorities subsidies to scale back payments alongside larger “solidarity” taxation to fund the prices, one thing that might in all probability be an anathema to Truss, the possible new chief of the Conservative celebration.

“Huge invoice reductions mixed with solidarity taxes, or throwing the kitchen sink at a brand-new social tariff scheme, must be the main target for whoever turns into the following prime minister,” mentioned Bell.