This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

The UN said a 1.5C rise in global temperature was “more likely than not” in the near-term, with the risk greater than previously thought. It also concluded that the lack of political commitment was a key barrier to progress in what was a “rapidly closing window”.

-

Chinese president Xi Jinping met Russian counterpart Vladimir Putin in his first state visit to Moscow for four years.

-

Police and soldiers in South Africa were deployed to quell a threatened “national shutdown” by the radical opposition Economic Freedom Fighters who are demanding the removal of president Cyril Ramaphosa.

For up-to-the-minute news updates, visit our live blog

Good evening.

“Banking is a massive, complicated and delicate confidence trick. Normally it works fine. But as soon as people worry that it could fall apart, it often does, sometimes spectacularly.”

That was the view of Frankfurt bureau chief Martin Arnold after Credit Suisse was taken over by larger rival UBS at the weekend. The $3.25bn deal was finalised yesterday after Swiss regulators rushed to safeguard the country’s banking sector and prevent the crisis spreading across global markets.

Ever since the current turmoil began with the collapse of lenders in the US (see Business section below), investors have worried about which other banks could be vulnerable. Credit Suisse was already in serious trouble after a series of scandals and management shake-ups and the shotgun wedding with UBS follows a $54bn failed lifeline from the Swiss central bank last week.

Although the deal cements UBS’s position as the world’s largest wealth manager, with invested assets of $5tn, CS bondholders are in uproar and contemplating legal action after $17bn of the bank’s debt was wiped out. Bondholders with additional tier 1 (AT1) bonds — a form of debt introduced after the global financial crisis to make banks increase their capital levels — will receive nothing, while shareholders will get some SFr3bn ($3.2bn). EU authorities have also expressed concern. CS staff will however still collect their bonuses.

As Arnold points out, Europe’s institutions, although in a stronger position than in the previous crisis, are not immune to the current turmoil. Lenders are also likely to become more cautious, reducing the flow of credit, increasing the risk of a recession and raising stress in already vulnerable areas such as commercial property — none of which is good for banks, he notes.

European Central Bank chief Christine Lagarde today welcomed the Credit Suisse takeover and said the ECB was “ready to respond as necessary” to preserve price and financial stability. She stressed that the eurozone banking system was “resilient, with strong capital and liquidity positions”.

Although the bank failures in Europe and the US have different circumstances, one thing they have in common is the effect of sharp rises in global interest rates, with the current tumult potentially acting as a brake on central banks’ plans, starting with decisions from the Federal Reserve on Wednesday and the Bank of England on Thursday.

The other major development of the weekend was a co-ordinated plan from the Fed and five other central banks to improve access to US dollars “to ease strains in global funding markets”.

The big question however remains: are banks on the edge of a 2008-style meltdown?

FT deputy editor Patrick Jenkins, writing before the CS deal, said that even if the chances of another full-blown financial meltdown were low, our ability to deal with it might be less.

“Back in 2008, policymakers were able to slash interest rates, launch quantitative easing and flood the banks with rescue capital and liquidity,” he writes. “With government balance sheets today far more stretched, and interest rates needing to rise to combat inflation, the weaponry at their disposal is dangerously diminished.”

Need to know: UK and Europe economy

The DUP, Northern Ireland’s biggest unionist party, will vote against Rishi Sunak’s deal on the province’s post-Brexit trading arrangements, dealing a blow to the prime minister and the chances of any imminent return of its power-sharing government.

One part of the UK’s rail disputes has ended, after RMT union members accepted a pay offer from infrastructure owner Network Rail. The union is still in dispute with a group of train operating companies, while drivers remain in talks with train companies in their own dispute over pay.

A think-tank chaired by former chancellor George Osborne recommended council tax, stamp duty and business rates in England should be replaced with a devolved land-value tax as part of a radical overhaul of local government funding.

A Bank of England plan to revamp bank capital rules risked a 25 per cent cut in lending to small businesses, according to a new report.

Need to know: Global economy

Our latest Big Read looks at how Singapore and Hong Kong, two of Asia’s biggest financial centres, are vying to rival offshore locations such as the Cayman Islands and shift the global centre of gravity for hedge funds and the world’s richest families.

India’s high-growth economy — forecast by the IMF to expand 6.1 per cent this year — is failing to create enough jobs, especially for young people, leaving many without work or toiling in labour that does not match their skills.

Companies are replanting millions of hectares of trees and generating revenue through carbon credit sales as Brazil gears up to reforest the Amazon.

Need to know: business

The banking crisis on the other side of the Atlantic continues too. The bid deadline for failed Silicon Valley Bank has been extended as buyers hold back; shares in First Republic plunged again today after its credit rating was cut for the second time in the space of a week; and New York Community Bank agreed to buy most of the operations of collapsed Signature Bank. The failures of Signature and Silicon Valley Bank have thrown the spotlight on smaller and regional lenders, shaking the post 2008-view that the biggest systemic dangers lay with losses at the Wall Street giants.

Hollywood is bracing for a strike as screenwriters and movie studios begin contract negotiations that are expected to be the most contentious since 2007, when the film and television industry ground to a halt for 100 days. The Writers Guild of America is targeting compensation practices that have taken root in the streaming era — including how royalties are paid.

Big Pharma wants the US government to extend chip industry tax breaks to the biotech sector. President Joe Biden announced a national biotechnology and biomanufacturing strategy in September to strengthen supply chains, create American jobs and ward off competition, particularly from China.

Poul Weihrauch, the head of consumer group Mars, hit out at “nonsense” attacks on corporate ESG (environmental, social, and governance) commitments: “We don’t believe that purpose and profit are enemies.”

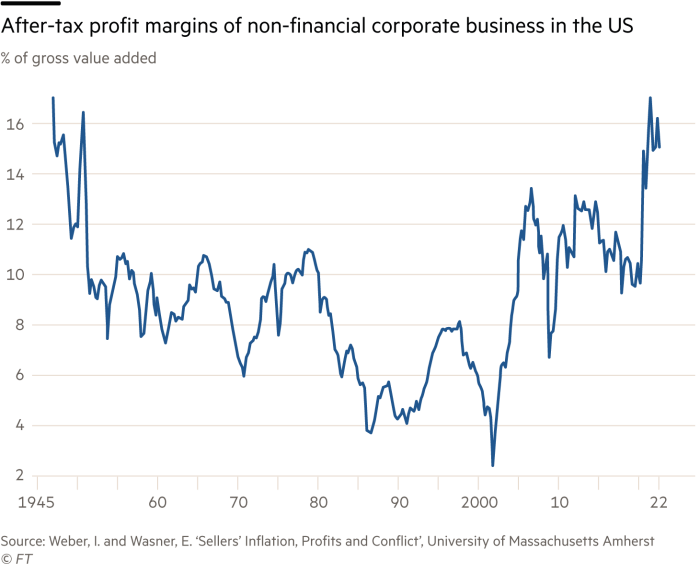

One of our charts of the week: Profit margins of US companies have reached levels not seen since the aftermath of the second world war.

The World of Work

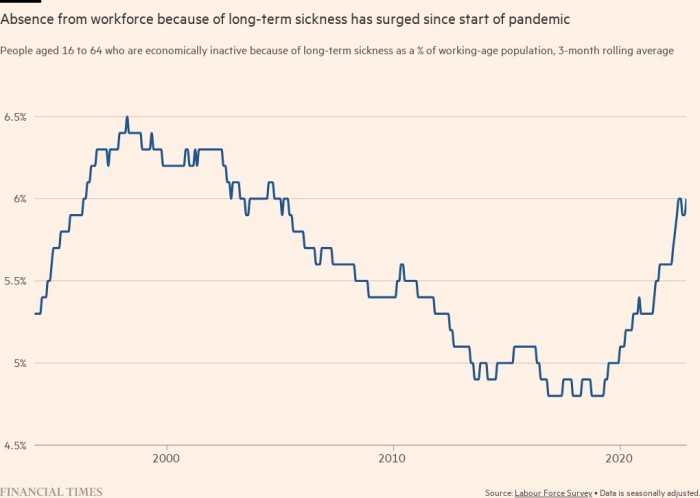

About 6 per cent of the UK’s working age population is currently “inactive” — not seeking or available for work — due to long-term sickness, the highest rate in almost 18 years.

Consumer editor Claer Barrett welcomes new UK plans to improve childcare but says the government’s “gross neglect and chronic underfunding” of the early years sector means it will take years before women truly benefit from the changes.

Columnist Jemima Kelly skewers the new workplace buzzword: “mattering”. The concept is not about honouring working hours, or making sure employees are achieving a proper work-life balance, but rather cultivating the belief that you are important to others in your workplace.

Columnist Simon Kuper argues the higher paid should work longer than their lower paid counterparts who suffer miserable conditions and a shorter lifespan.

Some good news

Successful cataract surgeries on king penguins in a Singaporean wildlife park mark a milestone in veterinary medicine. “While intraocular lens implants are common for humans and some domestic mammals, it is likely the first time they have been successfully used on penguins,” the park says.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you