Stuart Hignell, who runs Bristol Fuel Provides, has recognized a lot of his clients within the English metropolis of Bristol for years — he has a Polaroid photograph of one in every of his aged purchasers on the corkboard behind his desk — and is acutely aware that many are on mounted incomes.

However as petrol costs rise and the prices of delivering gasoline canisters across the metropolis develop, Hignell is being compelled to make a tough selection: put up the costs for his clients or defend them by absorbing ever rising prices.

“How can I flip round to those individuals and inform them their costs are going up?” he requested. “However one thing’s obtained to provide — you may’t simply preserve sucking it in and sucking it in”.

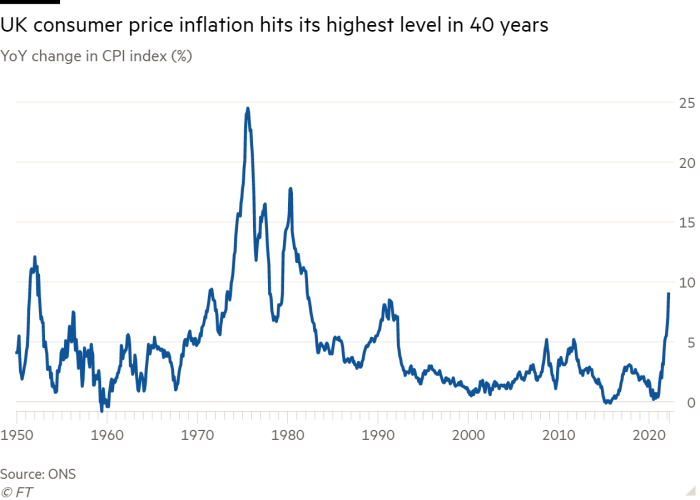

Many small enterprise homeowners are, like Hignell, struggling to soak up the impression of spiralling costs as UK inflation hits a 40 12 months excessive. Rising prices for vitality and items and companies have grow to be the highest two issues of companies all through the UK.

In June final 12 months, solely 30 per cent of UK companies with 10-49 staff reported above regular enter costs to the Workplace for Nationwide Statistics. By March of this 12 months, the proportion had jumped to 57 per cent.

Many can not maintain off passing these will increase on to clients. Aleksis Gailans, who runs a fancy dress rent firm on the outskirts of Bristol, struggled to consider any services or products that his enterprise makes use of which hasn’t gone up in worth. Whereas his firm has “tried to carry off for so long as we are able to”, he stated, it has needed to start passing on prices.

Gailans just isn’t alone: round 41 per cent of UK companies with between 10 and 50 staff indicated in late April that they’ve already begun rising costs.

Matt Griffith, director of coverage at Enterprise West, the chamber of commerce for England’s western area, is in shut contact with many enterprises within the space and is evident that they should begin recouping prices. Rising costs is “the one route left” for a lot of, he stated. “Financially they’ve nowhere else to go.”

Vicky Lee, who heads the Bristol Metropolis Centre Enterprise Enchancment District, agreed. Most of the corporations that she works with within the metropolis centre can not preserve their prices down. They don’t have “the shopping for energy, the energy to scale back value per unit by buying on a bigger scale”, she stated.

She added that the shadow of the pandemic continues to have an effect on many small companies within the space. Whereas they’ve managed to “bounce again shortly”, they needed to borrow to maintain going throughout the disaster. Debt repayments on these loans have additional tightened margins and pushed companies to boost costs.

Passing the elevated prices on to clients has not been a simple choice for a lot of small enterprise homeowners, regardless of the challenges of the present surroundings, stated Chris Jenkins, who has labored in Bristol’s wholesale fruit marketplace for most of his life. Within the face of steep transport prices, his firm tried to grow to be extra environment friendly.

“We’ve obtained no extra employees in anyway. All of us are working flat out on a regular basis. And, we’ve simply obtained no fats. It’s simply been minimize, minimize, minimize in all places we are able to go to try to minimise prices”, he stated, including that there was “nothing else they’ll do” to maintain costs down.

The knock-on impact of rising costs on shopper spending is one other fear. Jeremy Kynaston managing director of No1 Harbourside, a bar, restaurant and dwell music venue located on Bristol’s historic harbour, and two different venues within the metropolis, acknowledged that persons are simply starting to really feel the rise in costs, however is hoping that they are going to proceed to eat out.

“When individuals exit, they understand it’s going to value a bit bit extra, and it’s as much as us to ensure we’re intelligent about our high quality and requirements”, he stated.

Nonetheless, Kynaston is fearful concerning the impression the rise within the vitality worth cap within the autumn could have on his enterprise. Ofgem predicts that family vitality costs will enhance by round 42 per cent in October, after a 54 per cent rise in April.

“It’s daunting — the October worth rises. However we do have a plan a minimum of. It’s higher than having no plan in any respect,” stated Kynaston.

To deal with the impression of spiralling vitality costs on the price of dwelling, UK chancellor Rishi Sunak final week launched a £15bn package of support. It included a one-off fee of £650 to round 8mn households in receipt of welfare funds.

However these additional up the provision chain, equivalent to Jenkins, are nervous that even with the additional authorities assist, rising vitality costs will suck demand out of the native economic system.

“Come November, December, they’re [households] actually going to really feel it,” he stated. He added that the stress on family budgets within the coming months may even see the fruit he sells to retailers grow to be “extra of a luxurious”.

Most economists acknowledge that worth pressures might worsen earlier than they get higher, however predict that the vitality shock, pandemic provide chain impacts and better rates of interest will taper off fairly quickly from the beginning of subsequent 12 months onwards.

Nonetheless, for Jenkins hope {that a} brighter interval might lie forward is difficult to seek out.

“I’ve been within the job for all my life. I used to be born into it,” he stated. “In all that point, you’ve all the time been capable of see the sunshine on the finish of the tunnel. You possibly can’t appear to see it now.”