Joe Biden is dealing with a dilemma: on the one hand, he’s beneath strain to assist People fighting rising costs and a slowing financial system, however on the opposite, any unilateral measures he may take threat making the inflation drawback even worse.

On Wednesday, the US president is travelling to Cleveland, Ohio, as he refocuses his consideration on the financial system after his journey to Europe for the G7 and Nato summits and forward of a deliberate go to to the Center East subsequent week.

The journey to the center of business America comes as Biden tries to regain his political footing. His approval rankings have been caught on the lowest ranges of his presidency for weeks, and voters are extensively dissatisfied by his dealing with of the financial system — and the financial image for the White Home has solely grown extra sophisticated and tough in latest weeks.

With inflation nonetheless stubbornly excessive, the Federal Reserve has launched into an aggressive cycle of rate of interest will increase, fuelling issues that the financial system could also be headed for a big deceleration or perhaps a recession as shoppers in the reduction of on spending and companies scale back funding.

In the meantime, with the midterm elections simply 4 months away, Democratic lawmakers are rising more and more impatient with the persistence of inflation and the monetary ache it’s inflicting.

FT survey: How are you dealing with increased inflation?

We’re exploring the impression of rising dwelling prices on individuals around the globe and need to hear from readers about what you might be doing to fight prices. Inform us through a short survey.

“The Fed is a sledgehammer: stopping the financial system from rising or contracting the financial system has a vastly unfavorable impression on the working class and the center class,” stated Ro Khanna, a Democratic congressman from California. “We should always attempt every part we are able to to decrease meals and gasoline costs to stave off extra draconian motion by the Fed.”

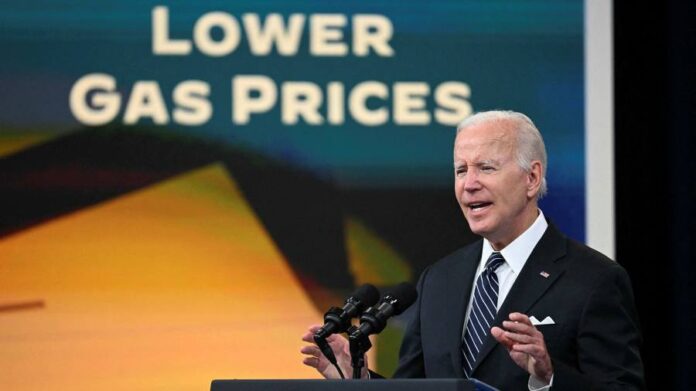

Biden has stated that addressing inflation is his highest precedence given its significance to many citizens. The administration has been looking for methods to help households and companies struggling beneath elevated prices, together with a proposed petrol tax vacation, a doable transfer to cancel some scholar loans and the removing of tariffs on some Chinese language imports.

However some economists have warned that these measures may very well be counterproductive. “I feel we now have to watch out once we take into consideration potential options to the issue,” stated Gregory Daco, chief economist at EY-Parthenon. The White Home doesn’t need to be “probably including gas to the hearth by suggesting insurance policies that truly stimulate demand as a substitute of stimulating provide”, he added.

Jean Boivin, head of the BlackRock Funding Institute, stated: “I feel they may work initially to alleviate a few of the strain however I feel they are going to be storing up extra inflation worries down the highway.”

The White Home’s battle to provide you with a decisive inflation-fighting plan is a results of the truth that its powers to curb costs are restricted in contrast with the Fed’s. Lots of the components driving inflation are additionally outdoors of its management, together with the struggle in Ukraine and Opec’s willingness to provide extra oil.

The Biden administration’s aim is for the financial system to chill sufficient to deliver down prices, although not on the expense of a giant chunk of the labour market good points — by way of jobs and wages — which have occurred because the begin of final yr.

To some economists, there’s not far more that Biden can do to alter the dynamic, apart from let the impact of final yr’s $1.9tn stimulus fade and attempt to sort out supply-side bottlenecks as aggressively as he can.

“Far and away a very powerful factor that fiscal coverage is doing to dampen inflationary pressures is permitting fiscal help to wane,” stated Wendy Edelberg, director of the Hamilton Undertaking, an financial think-tank in Washington. “Anything that we’re going to discuss by way of what fiscal policymakers can do with respect to inflation is second and third order.”

“A number of the insurance policies the administration has been speaking about have a side of actually rising demand at a time the place we’re attempting to rein it in some,” stated Claudia Sahm, a former Fed economist. “However they don’t have good instruments.”

The White Home is hoping that Congress will go laws within the coming weeks that can enhance voters’ perceptions of its dealing with of the financial system. Lawmakers are debating a invoice to fund home manufacturing of semiconductors and enhance America’s competitiveness with China. Whereas it has bipartisan help, it stays stalled on Capitol Hill after Mitch McConnell, the Republican chief within the Senate, threatened to carry it up.

The White Home can be hoping that Democrats will go a slimmed-down model of Biden’s failed Construct Again Higher plan. It might embrace measures aimed toward decreasing the price of pharmaceuticals, which might additionally assist relieve some monetary strain on US households, in addition to clear power tax credit and better taxes on the rich and huge firms.

In California, Khanna would moderately see a windfall tax on oil income than a gasoline tax vacation, however he stated he does help scholar mortgage aid and is advocating for extra aggressive steps by the White Home to spice up provide by selling home manufacturing.

It’s essential for the administration and Democrats in Congress to supply solutions to voters, he added. “It’s the value of gasoline, it’s the value of meals — we now have to be laser-focused on having an initiative on it. When my constituents speak to me that’s central on their minds.”