Step one for Amy is to enhance her tax effectivity, professional says

Critiques and proposals are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by hyperlinks on this web page.

Article content material

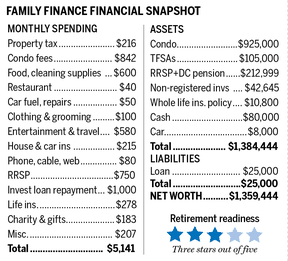

In Ontario, a lady we’ll name Amy, 57, works for a neighborhood group. She has no dependents and only one debt of $25,000 used to purchase an funding. Her monetary purpose is a sustainable $40,000 per yr — or $3,333 per thirty days — in after-tax earnings when she retires at age 60. That’s roughly her current spending minus financial savings and mortgage compensation.

Commercial 2

Article content material

Household Finance requested Derek Moran, head of Smarter Monetary Planning Ltd. in Kelowna, B.C., to work with Amy. He notes that she has $1,384,444 of whole belongings together with her condominium. That sum consists of $451,444 of economic belongings together with $80,000 money. Her web price is $1,359,444. Her funding portfolio is basically an inventory of high-fee, largely fixed-income mutual funds.

Article content material

E-mail [email protected] for a free Household Finance evaluation

A decade in the past, Amy made a big funding in an RRSP-eligible mortgage firm that inspired savers to dip deeply into their financial savings. She made an enormous guess on the enterprise and misplaced $211,000, which was 70 per cent of her RRSP’s worth on the time.

“I knew property was hovering and it appeared like a option to get in on it,” she recollects. She gambled on what she believed to be a certain factor. The one certain factor was the fats incomes for funding managers and salespeople. Her response has been to spend money on low-return belongings that don’t tempo inflation.

Commercial 3

Article content material

Present investments

Right this moment, Amy has a month-to-month finances of $5,141, of which $1,750 goes to financial savings and the compensation for an funding mortgage. That leaves true spending at $3,391 per thirty days or $40,692 per yr. To generate that quantity after tax, Amy would wish $48,000 per yr earlier than tax.

Step one for Amy is to enhance her tax effectivity. She has $104,954 of RRSP contribution area. She generates an additional 18 per cent of wage for RRSP area, which works out to $17,159 per yr. For 4 years, that provides as much as $68,636. Mixed together with her current RRSP room, she will add as a lot as $173,590 with out over-contributing. She will get a 30 per cent tax refund for any RRSP contributions she makes whereas working however will in all probability must pay tax at not more than 15 per cent when she takes the cash out in retirement.

Commercial 4

Article content material

She additionally has a supply of cash in an entire life insurance coverage coverage with $50,000 face worth and $10,800 of money worth. She has no youngsters to whom to depart cash, so she might money out the coverage and use the money worth for the RRSP or donate the coverage to a charity for a tax profit. Her current spending consists of $278 month-to-month for entire life protection.

Sources of retirement earnings

We’ll estimate that Amy will get 90 per cent of the current most CPP profit $15,043, web $13,500 per yr. She may even get full Outdated Age Safety, presently $7,707 per yr.

Her TFSA has a gift steadiness of $105,000. The TFSA steadiness rising at three per cent per yr after inflation will probably be $118,178 in 2022 {dollars} when she is 60. Spent over the next 30 years to her age 90, that sum would help spending of $5,979 per yr.

Commercial 5

Article content material

Amy’s RRSP and LIRA, together with her work-based defined-contribution plan, whole $212,999.

Amy’s purpose ought to be to make use of the RRSP to convey her taxable earnings all the way down to $49,020 which is the highest of the primary federal tax bracket. That means, she’s going to optimize her tax refund. A number of the contribution could be deferred and deducted subsequent yr, Moran explains. Refunds can return to her financial savings.

-

A kitchen reno put a dent in this Alberta teacher’s TFSA. Now she has to play catch up for retirement

-

Father awarded more than $675,000 in costs after epic five-year fight over kids

-

This Ontario woman should shed real estate and debt to meet her retirement income goal

If Amy diverts all month-to-month financial savings, $1,750 plus $397 from her employer, for a complete of $2,147 per thirty days or $25,764 per yr over 4 years, plus contributes $70,000 from her present money holdings, the RRSP could have have risen to about $430,000. If she additionally contributes the $66,000 in tax refunds she generates over that interval, it can go away her with near $500,000.

Commercial 6

Article content material

These funds rising at three per cent per yr for the next 30 years will help a taxable earnings of $25,096 per yr.

Earlier than age 65, Amy could have TFSA money movement of $5,979 per yr and RRSP earnings of $25,096, whole $31,075. After 12 per cent common tax excluding TFSA earnings, she could have $28,060 per yr to spend. She would come up considerably wanting her after-tax goal earnings. Choices to shut the hole included part-time work or downsizing from her $1-million condominium to a $500,000 unit and utilizing money, say $12,000 for 5 years to age 65, to remain within the black. It will permit her so as to add to her monetary belongings and their income-producing potential.

Swapping property for earnings

Rebalancing to make her dwelling, a smaller condominium maybe, only a third of whole belongings would liberate worth for funding, notably shares that pay strong dividends of three per cent to 4 per cent a yr issued by firms which have a historical past of elevating payouts. Lists of those dividend aristocrats are available on-line.

Commercial 7

Article content material

The condominium sale yield could be diminished by preparation and promoting prices at 5 per cent of worth, however the remaining steadiness $878,750 much less $500,000 for brand spanking new digs, would go away $378,750 for bills and funding. Invested at three per cent after inflation, that capital’s everlasting earnings could be $11,362 per yr or $947 per thirty days. Her whole annual earnings would rise to about $42,400 earlier than tax. After 13 per cent tax that would go away her about $37,675 per yr or $3,140 per thirty days to spend. She would nonetheless be beneath goal. Half-time work would shut the hole to her $40,000 after tax goal.

As soon as she is 65, Amy can add $13,500 CPP per yr and $7,707 OAS for whole estimated annual earnings of $52,282. After 15 per cent, she would have $45,337 to spend every year. That’s $3,780 per thirty days. Amy would exceed her after tax money month-to-month retirement goal of $3,333.

3 Retirement Stars***out of 5

e-mail [email protected] for a free Household Finance evaluation