Removed from retirement at what they suppose may be age 60, they should embody a whole lot of wiggle room of their monetary plan

Critiques and proposals are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by way of hyperlinks on this web page.

Article content material

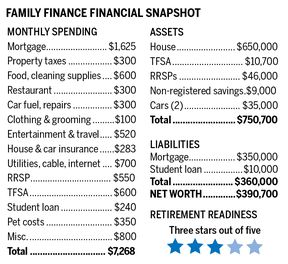

A pair we’ll name Tyler and Ellie, each 33, reside in B.C. Tyler is in development, Ellie within the grocery trade. Collectively, they gross $13,000 monthly from their jobs earlier than taxes and deductions for advantages. Their internet after deductions is $7,268 monthly. They’ve a $650,000 home, $65,700 in monetary belongings and $360,000 in money owed. Their internet value is $390,700. Wanting ahead, Ellie has simply acquired a promotion and can earn $102,000 per 12 months earlier than tax. They lease out a basement residence for as a lot as $1,700 monthly or $20,400 per 12 months.

Commercial 2

Article content material

Removed from retirement at what they suppose may be age 60, they’re weighing the deserves of debt paydown and investing in RRSPs and TFSAs.

Household Finance requested Derek Moran, head of Smarter Monetary Planning Ltd. of Kelowna, B.C., to work with Tyler and Ellie. The problem and the chance with doing monetary predictions three many years earlier than retirement is, after all, uncertainty. Nevertheless, he notes, “they’ve created a powerful basis to construct internet value.”

Article content material

E-mail [email protected] for a free Household Finance evaluation.

They’ve $46,000 in Ellie’s RRSP, $10,700 in her TFSA, $9,000 in money evenly divided and a $350,000 mortgage with a 2.01 per cent rate of interest. They’ve a $10,000 excellent scholar mortgage.

Commercial 3

Article content material

A financial savings technique

Their drawback is how you can save in a tax-efficient method. Ellie is the primary breadwinner. Her month-to-month revenue, base $8,580 plus bonuses, averages $9,413.

One fast possibility to avoid wasting tax can be to maneuver the $10,700 in her TFSA into her RRSP. The funding belongings needn’t change, however she’s going to get a tax refund of 28.2 per cent — the marginal tax bracket wherein she falls — occasions $10,700. That equals $3,017. The financial savings could be reinvested or used to pay down debt.

We’ll assume she does this, and that they use the RRSP as their main retirement financial savings automobile, because of Ellie’s comparatively excessive revenue, which is able to presumably rise with time.

Tyler has a $10,000 excellent scholar mortgage. He’s paying six per cent now however might decrease that charge to half, three per cent, by way of a secured House Fairness Line of Credit score mortgage. The scholar mortgage is eligible for a tax credit score that works out to a one-fifth low cost on the curiosity he’s paying, however the HELOC would nonetheless be cheaper.

Commercial 4

Article content material

The couple’s RRSPs at present complete $46,000. In the event that they roll within the TFSA steadiness, $10,700, it’ll change into $56,700. Ellie’s new annual revenue, $102,000, will assist RRSP contributions of 18 per cent of her base gross or $18,360. If added to the RRSP and if the sum grows at three per cent above inflation for 27 years to her age 60, it’ll change into $895,800. That sum, spent over the next 30 years to Ellie’s age 90, would assist an revenue of $44,375 in present {dollars}. We’ll break up the revenue for tax functions.

We’ll assume that the couple amasses no taxable investments. All cash in extra of every day dwelling prices will likely be saved in RRSPs or used to pay down scholar loans and the mortgage.

Tyler and Ellie must wait for 3 many years to change into eligible for CPP. We’ll assume Ellie qualifies for 90 per cent of CPP advantages, at present $14,445, and thus receives $13,000 per 12 months at 65. We’ll assume that Tyler qualifies for 80 per cent of CPP at 65 and thus receives $11,556 per 12 months.

Commercial 5

Article content material

At age 65, every will qualify for max Previous Age Safety, at present $7,707 per 12 months.

Including up revenue from retirement at 60 and assuming splits of eligible revenue, they’d have two RRSP payouts totalling $22,187 every for complete revenue of $44,375 plus $10,200 every lease from an residence of their basement, complete $64,775 earlier than tax. After splits of eligible revenue and 12 per cent common tax, they’d have $4,750 monthly to spend. Assuming their current 22-year mortgage is paid off they usually haven’t any different money owed, their current price of dwelling, $7,268 monthly, and that every one RRSP and different financial savings have ended, their price of dwelling would drop to $4,253 monthly. They might have $500 monthly or $6,000 per 12 months to spare.

Commercial 6

Article content material

Retirement

At age 65, they’d have two annual RRSP payouts at $22,187 every, $10,200 every lease from their basement residence, CPP advantages of $13,000 and $11,556 per 12 months, and two OAS advantages of $7,707 every. Their complete revenue can be $89,330. After splits of eligible revenue and 14 per cent common tax, they’d have $6,400 monthly to spend. With RRSP and different financial savings ended and all loans paid, they’d have $2,147 monthly to spare.

This projection of a retirement which may begin in three many years is extra speculative than definitive. Neither accomplice has a job pension. One or each would possibly die or change into disabled within the 30-year interval. It might be useful for Tyler and Ellie to buy $500,000 of the only time period insurance coverage they’ll discover. It might cowl excellent debt and assist a survivor till she or he will get again on his or her toes. At their ages, plain time period protection may very well be had for $242 per 12 months for Tyler and $185 for Ellie.

Commercial 7

Article content material

-

Spectre of inflation adds to early retirement risk for this young B.C. couple

-

This couple wants to retire at 60, but needs to speed up their savings to get there

-

B.C. couple has significant mortgage debt heading into retirement, but risk should diminish with time

-

Pensions and cash from a cottage sale put this Ontario couple’s retirement on solid ground

A thirty-year projection to the beginning of retirement wants wiggle room. They plan to have youngsters, and Ellie contemplates taking greater than a 12 months off work to spend time with the kid. That might lead to a six-figure revenue loss — one thing that will severely pressure their monetary plan. It might be higher for Tyler, who has a decrease revenue, to remain residence with the kid in order that Ellie can get again to work when doable. Higher, Moran suggests, rent a nanny. The nanny might use their basement residence as a part of her compensation. Ellie’s job revenue and potential promotions can be preserved, Moran suggests.

Commercial 8

Article content material

The unknowns

These projections have some worth, regardless that they’re distant and topic to alter if tax charges, CPP payouts, OAS payouts and quite a few different authorities tax and profit applications change. In the perfect case, with their home paid off and kids grown and gone, the couple will have the ability to obtain our pre- and post-65 revenue estimates.

There are unmentioned and unknown variations in revenue: Prices of a kid or youngsters to be, medical prices not coated by insurance coverage — the record of potentialities is lengthy. We assume that every one additional money will go to Tyler’s RRSP, RESPs for youths, TFSAs and the mortgage.

Retirement stars: 3 *** out of 5

E-mail [email protected] for a free Household Finance evaluation

Monetary Put up