US client costs rose greater than forecast in June, hitting an annual tempo of 9.1 per cent, a recent 40-year excessive that cements expectations of one other traditionally giant 0.75 share level Federal Reserve rate of interest rise this month.

The buyer worth index revealed by the Bureau of Labor Statistics on Wednesday additional accelerated final month, above economists’ estimates for an 8.8 per cent improve. It marked the quickest year-on-year improve since November 1981.

Costs jumped one other 1.3 per cent month on month in June, following a 1 per cent rise in Might.

As soon as risky objects akin to meals and vitality are stripped out, “core” inflation elevated 0.7 per cent, in contrast with Might’s 0.6 per cent advance. That translated to an annual improve of 5.9 per cent, roughly in step with the 6 per cent tempo reported the month earlier.

“There’s not a lot solace right here,” stated Michael Pond, head of world inflation-linked analysis at Barclays.

The info will spur the US central financial institution’s efforts to revive worth stability, which intensified last month after officers deserted previously-laid plans to ship a half-point charge rise and as an alternative applied the primary 0.75 share level improve since 1994.

Policymakers have additionally signalled their intent to lift charges to a stage — estimated to be about 3.5 per cent — that begins to restrain economic activity by the top of the 12 months. They’re in search of to take care of an aggressive method to tightening financial coverage till there’s proof that month-to-month inflation readings are decelerating in direction of a tempo extra in keeping with the Fed’s 2 per cent goal.

Following the report, futures markets priced in a roughly 30 per cent probability of a 1 share level improve in July. However the consensus stays that the Fed will increase charges by 0.75 share factors, the identical sized improve as in June.

Treasury yields jumped because of this, with the yield on the two-year notice, which strikes with rate of interest expectations, reaching its highest stage since late June. It steadied at 3.2 per cent.

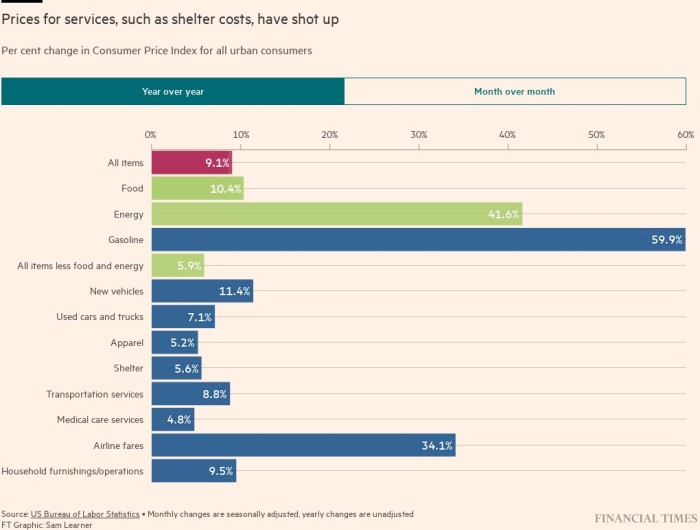

The month-to-month inflation features have been “broad-based”, in line with the BLS, however a 7.5 per cent improve within the vitality index contributed to virtually half of the bounce in headline inflation. Petrol costs alone rose 11.2 per cent in June, whereas meals costs have been up 1 per cent. Costs for brand spanking new and used autos continued their ascent, rising 0.7 per cent and 1.6 per cent, respectively.

In a worrying signal, providers inflation, excluding vitality, climbed 0.7 per cent on a month-to-month foundation and was up 5.5 per cent in contrast with the identical time final 12 months. Shelter-related prices drove a big portion of the rise, rising 0.6 per cent for the month or 5.6 per cent on a year-over-year foundation. That’s the largest annual improve since February 1991. Costs for transportation providers and medical care additionally elevated.

One outlier was airline fares, which slid 1.6 per cent following two months of double-digit development.

The Biden administration, whose recognition has plummeted towards the backdrop of hovering inflation, this week sought to get forward of June’s excessive determine and performed down the acceleration, emphasising that the information lined a interval earlier than a pointy drop in costs for vitality and different commodities.

“Whereas at the moment’s headline inflation studying is unacceptably excessive, it’s also old-fashioned,” President Joe Biden echoed in a press release launched on Wednesday which additionally emphasised that worth pressures have been a worldwide phenomenon. “Tackling inflation is my high precedence — we have to make extra progress, extra rapidly, in getting worth will increase below management.”

Brent crude, the worldwide oil benchmark which had climbed to virtually $140 a barrel in early March following Russia’s invasion of Ukraine, this month slumped below $100 a barrel. Meals costs globally have additionally moderated from historic highs.

Ought to the Fed increase charges by one other three-quarters of a share level at its July assembly, as anticipated, the goal vary of the federal funds charge will rise to 2.25 to 2.50 per cent.

“It is a report which the Fed might need dismissed in cycles previous as a result of up to now it centered on its forecast of inflation and never a lot on realised inflation prints themselves,” stated Pond. “Nonetheless, due to elevated inflation uncertainty . . . coverage is being pushed by realised inflation prints.”

He added that June’s report raised the chance of a “very hawkish response”.

Alongside its actions to tighten financial coverage, which embrace shrinking its $9tn stability sheet, the Fed has stepped up its rhetoric about not solely its “unconditional” dedication to reducing inflation, but in addition what it’s keen to threat when it comes to the financial restoration to take action.

The Fed has already begun to acknowledge unemployment might want to rise, with officers most lately forecasting joblessness to inch up from the present traditionally low stage of three.6 per cent to simply above 4 per cent by the top of 2024.

Many economists consider a extra correct estimate is within the neighborhood of 5 per cent, translating to considerably extra job losses.

Extra reporting by Kate Duguid in New York