The author is president of Yardeni Analysis and writer of Fed Anticipating Enjoyable & Revenue

Most Fed watchers appear to spend extra time criticising the US Federal Reserve than watching it. It’s straightforward to do. Anybody can play the sport and attacking the Fed is like capturing at sitting geese: officers on the central financial institution can’t reply instantly given their public position.

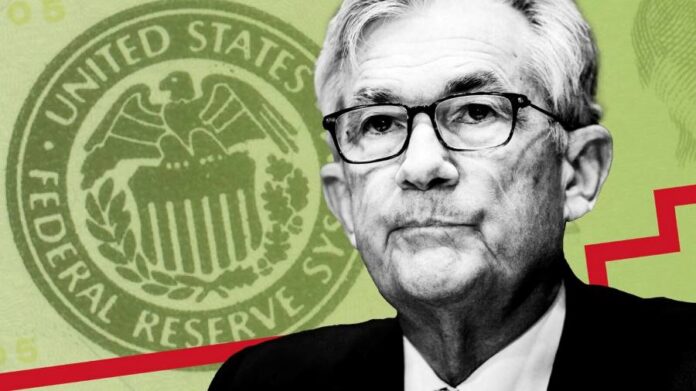

Not too long ago, Fed chair Jay Powell has been skewered by his critics for claiming that the federal funds price was now at “impartial” at his July 27 press conference simply after the policy-setting Federal Open Market Committee had voted unanimously to lift its benchmark federal funds price vary by 0.75 share factors to 2.25 to 2.50 per cent.

His suggestion that the Fed is on the borderline of restrictive territory and subsequently nearer to being achieved tightening was nicely obtained by each bond and inventory buyers, however not by the Fed’s critics.

Former Federal Reserve Financial institution of New York president William Dudley said on Wednesday that, given the extent of uncertainty, “I’d be a bit extra sceptical” in saying policymakers had reached impartial.

Two days later, former treasury secretary Lawrence Summers was extra important. He accused Powell of participating in “wishful pondering” just like the Fed’s delusion final 12 months that inflation could be transitory. He accused Powell of claiming issues “that, to be blunt, have been analytically indefensible”. He added, “There isn’t any conceivable approach {that a} 2.5 per cent rate of interest, in an financial system inflating like this, is wherever close to impartial.”

In reality, there’s a conceivable approach that Powell could be proper in any case. The Fed’s critics are ignoring that the central financial institution has been extra hawkish in phrases and deeds than the European Central Financial institution and the Financial institution of Japan. Each of their official rates of interest are nonetheless at or close to zero.

In consequence, the worth of the greenback has soared by 10 per cent this 12 months. For my part, that’s equal to no less than a 50-basis-point rise within the federal funds price. Moreover, the Fed has simply began its quantitative tightening programme to unwind its huge asset purchases to help markets and the financial system lately.

Throughout June via August, the Fed will reduce its steadiness sheet by operating off maturing securities, which is able to drop its holdings of Treasury securities by $30bn a month and its holdings of presidency company debt and mortgage-backed securities by $17.5bn a month. In order that’s a decline of $142.5bn over these first three months of QT.

Beginning in September, the runoff shall be set at $60bn for Treasury holdings and $35bn for company debt and MBS. That’s $95bn a month, or $1.14tn via August 2023. There’s no quantity set or termination date specified for QT.

For my part, QT is equal to no less than a 0.50 share level improve within the federal funds price too. Moreover, within the December 2021 minutes of the FOMC, launched on January 5 of this 12 months, buyers realized that “some members” on the committee favoured getting out of the mortgage financing enterprise solely.

That might occur by swapping the Fed’s MBS for Treasuries along with letting them run off as they matured underneath QT. This is able to have additional elevated the availability of MBS for the market to soak up including upward stress on mortgage charges relative to Treasuries. No marvel that the 30-year mortgage price jumped from 3.30 per cent in the beginning of this 12 months to a excessive of 6.00 per cent on July 15, and 5.46 per cent at present.

I conclude that the height within the federal funds price through the present financial tightening cycle shall be decrease than in any other case as a result of the mixture of QT and the robust greenback are equal to no less than a 1 share level improve within the federal funds price.

As well as, the extraordinary soar in each short-term and long-term rates of interest within the fastened earnings markets has already completed a lot of the tightening for the Fed. For my part, the markets have already discounted a peak federal funds price of three to three.25 per cent — which is the place it quickly shall be assuming that the Fed raises the speed by 0.75 share factors once more on the finish of September as extensively anticipated.

By the best way, on October 1 2020, Dudley, when he was on the Fed, justified a second spherical of quantitative easing amounting to $500bn of securities purchases saying that it was equal to a 0.50 to 0.75 share level lower within the federal funds price.

The Fed undoubtedly has some estimates from its in-house fashions on the equal price rises represented by the robust greenback and QT. If that’s the case, they need to share that info with the general public.