In instances of hassle, the greenback is the world’s refuge and energy. That is true even when the US is the supply of the difficulty, as occurred within the monetary disaster of 2007-09. It’s true once more now. A collection of shocks, together with excessive inflation within the US, has triggered a well-recognized upward motion within the greenback. Furthermore, this has not been simply towards the currencies of rising economies, but in addition towards these of different high-income nations. In the meantime, the final story of the greenback cycle underlies some particular ones. Messing up one’s macroeconomic insurance policies, particularly fiscal administration, proves significantly harmful when the greenback is robust, rates of interest are rising and traders search security. Kwasi Kwarteng, please observe.

JPMorgan’s estimate of the nominal efficient alternate charge of the US greenback appreciated by 12 per cent between the tip of final 12 months and Monday. Over the identical interval, the yen’s efficient charge depreciated by 12 per cent, the pound’s by 9 per cent and the euro’s by 3 per cent. In opposition to the greenback alone, actions are bigger: sterling has depreciated by 21 per cent, the yen by 20 per cent and the euro by 16 per cent. The greenback is king of the citadel.

So why has this occurred? Does it matter? What may be finished about it?

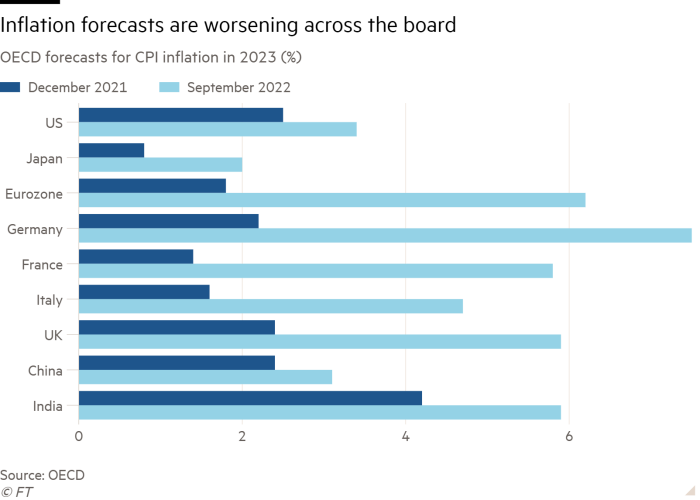

As to the why, the reply is that the world financial system has suffered 4 linked shocks since 2020: the pandemic; an enormous fiscal and financial enlargement; to post-pandemic provide aspect, through which pent-up (and lopsided) demand hit provide constraints in industrial inputs and commodities; and, lastly, Russia’s invasion of Ukraine, which hit vitality, significantly for Europe.

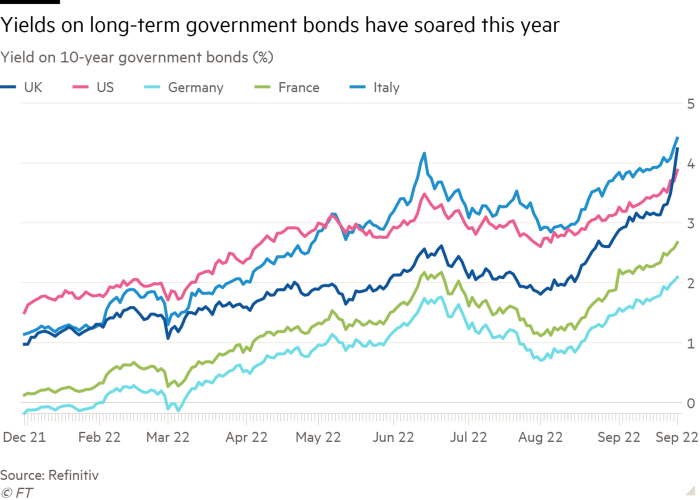

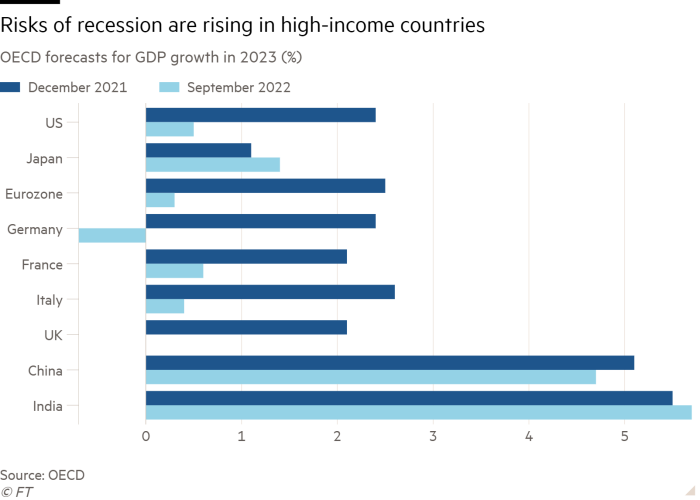

The outcomes have included enhanced uncertainty, sturdy inflationary strain within the US, a necessity for financial coverage, significantly that of the Federal Reserve, to catch up, and highly effective recessionary forces, particularly in Europe. With the Fed’s tightening forward of that of its friends within the high-income nations, the greenback has strengthened. In the meantime, the divergent outcomes of rising economies are decided by how effectively their economies are managed, whether or not they export commodities and their indebtedness.

Inside the G20, surprisingly, currencies of many rising nations have fared higher than these of the high-income ones. Russia’s rouble has appreciated sharply. On the backside are sterling, the Turkish lira and Argentine peso. What firm the pound now retains!

Does the greenback’s energy matter?

Sure, it does, as a result of, as a current paper co-authored by Maurice Obstfeld, former chief economist of the IMF, notes, it tends to impose contractionary strain on the world financial system. The roles of US capital markets and the greenback are far larger than the relative measurement of its financial system suggests. Its capital markets are these of the world and its forex is the world’s protected haven. Thus, every time monetary flows change course from or to the US, all people is affected. One motive is that almost all nations care about their alternate charges, significantly when inflation is a fear: solely the Financial institution of Japan may be blissful about its weak forex. The hazard is larger for these with heavy liabilities to foreigners, much more so if denominated in {dollars}. Smart nations keep away from this vulnerability. However many creating nations will now need assistance.

These recessionary forces emanating from the US and the rising greenback come on high of these created by the massive actual shocks. In Europe, above all, there may be the best way through which larger vitality costs are concurrently elevating inflation and weakening actual demand. In the meantime, the willpower of China’s chief to remove a virus circulating freely in the remainder of the world is hitting its financial system. The Chinese language Communist occasion might management the Chinese language folks. But it surely can’t hope to regulate the forces of nature on this method indefinitely.

What may be finished? Not that a lot.

There may be some discuss of co-ordinated forex intervention, as occurred within the Nineteen Eighties, with the Plaza after which Louvre accords, first to weaken the greenback after which to stabilise it. The distinction is that the previous, particularly, suited what the US then wanted. This made intervention credibly in line with its home objectives. Till the Fed is content material with the place inflation goes, that can not be the case this time. Forex intervention geared toward weakening the greenback by only one and even a number of nations is unlikely to realize that a lot.

A extra essential query is whether or not financial tightening goes too far and, particularly, whether or not the principal central banks are ignoring the cumulative influence of their simultaneous shift in direction of tightening. An apparent vulnerability is within the eurozone, the place home inflationary strain is weak and a big recession is possible subsequent 12 months. Nonetheless, as Christine Lagarde, ECB president, underlined final week: “We is not going to let this part of excessive inflation feed into financial behaviour and create an enduring inflation downside. Our financial coverage will probably be set with one objective in thoughts: to ship on our worth stability mandate.” This may occasionally certainly become overkill. However central banks have little choice: they need to do “no matter it takes” to curb inflation expectations.

Nobody is aware of how a lot tightening that may want. Nobody is aware of both how far the debt overhang will assist, by performing as a strong transmission belt, or hurt, by inflicting a monetary meltdown. What is understood is that the central banks’ capacity to help the markets and financial system are for some time gone. In such a time the perceived sobriety of debtors issues as soon as once more. That is true for households, companies and, not least, governments. Even beforehand credible G7 governments, such because the UK’s, are studying this reality. The monetary tide goes out: solely now can we discover who has been swimming bare.