The author is head of Japan FX Technique at JPMorgan

The Japanese yen has been an surprising casualty of a world lurch in direction of increased rates of interest. The foreign money is down about 15 per cent towards the greenback this 12 months, and relative to a broader basket of currencies, the yen is monitoring lows not seen because the Seventies.

Forex merchants in Tokyo are fast to focus on the proximate trigger for the yen’s slide as a easy story of financial coverage divergence: excessive US yields, low Japan yields. Whereas the US Federal Reserve has launched into what seems set to be its quickest tempo of financial coverage tightening because the Nineteen Nineties, the Financial institution of Japan has been resolute in its defence of sustained coverage easing.

Governor Haruhiko Kuroda’s argument has been as simple because it has been unwavering. Low Japanese inflation doesn’t necessitate an increase in home rates of interest on anyplace close to the size of the Fed — no less than not but. With yields pinned down by a central financial institution that already owns half of the federal government bond market, the yen has discovered itself because the principal launch valve for a widening hole between US and Japanese rates of interest.

As foreign money weak spot accelerates, so is the refrain of contrarian suggestions to purchase the yen turning into louder. What higher than an inexpensive haven foreign money to hedge towards an more and more unsure world outlook? And that is the place the controversy lies. The yen is actually weak. However is it additionally low-cost?

Traders must be cautious of arguments that suggest the yen is grossly undervalued. These fail to take note of structural adjustments in Japan’s economic system which have essentially altered the buying and selling backdrop for the yen. By far an important of those is a multiyear shift in Japan’s import and export stability.

Japan registered its second-widest month-to-month commerce deficit on document in Could, partly due to surging vitality and commodity imports. However the economic system’s long-term flip from commerce surplus in direction of deficits displays broader forces at work. A decade of Japanese company offshoring of factories has knocked the wind out of exports.

Not all that way back Japan offered the template of high-tech export-led progress to its neighbouring economies — the Asian Tigers. However Japan now imports extra electronics items from the remainder of Asia than it exports again to the area. Put merely, Japan Inc wants extra overseas foreign money to pay for imports than it earns through exports: a essentially destructive dynamic for the yen.

Equally, traders must be sceptical of claims that the yen is a dependable hedge towards rising market volatility. Main US fairness indices are already in bear market territory. And but the yen has traded materially weaker.

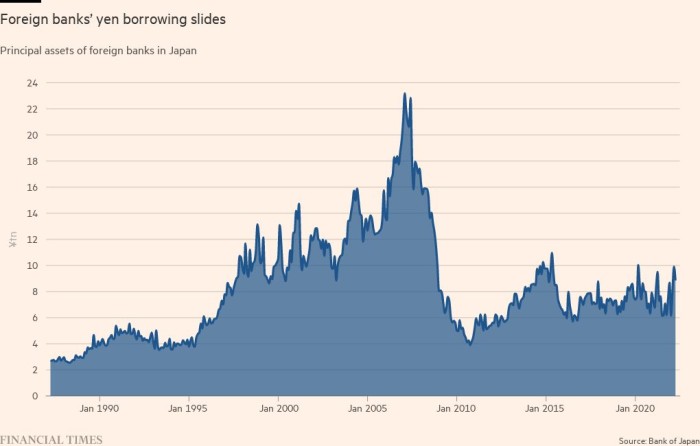

The yen’s failure to reside as much as its haven credentials to this point is partly due to a decline within the reputation of the yen “carry commerce” — utilizing the foreign money to fund purchases of higher-yielding property elsewhere. Confronted with a plethora of low-to-negative yielding currencies over the previous decade, merchants merely haven’t borrowed the yen on anyplace close to the identical scale as they did earlier than the monetary disaster. BoJ knowledge recommend that overseas banks’ yen borrowing from their Tokyo subsidiaries — a measure of overseas demand for funding within the foreign money — is barely 40 per cent of its pre-financial disaster peak.

The monetary disaster prompted a rush to dump dangerous property, catalysing a speedy unwinding of yen-funded trades, and fuelling a stellar 19 per cent transfer increased within the foreign money towards the greenback by way of early 2008. Now, in instances of market stress, there isn’t a longer a rush to purchase again the yen to “cowl” positions.

What can save the yen? Forex intervention is actually not the reply, as a result of yen weak spot displays elementary forces, not speculative exercise. A capitulation from the BoJ to permit home authorities bond yields to rise would chop the differential between the US and Japan rates of interest. This would supply the yen with a short-term tailwind, as would indicators of a peak in US yields. A reopening of Japanese borders to vacationers would additionally assist.

However moderately than signalling a long-term inflection for the Japanese foreign money, these elements recommend its volatility will stay excessive. A return to a sustainable interval of yen appreciation will finally require a elementary shift within the composition of Japanese commerce flows. A restart of idle nuclear energy vegetation that would scale back vitality import demand may very well be one driver, maybe; longer-term, a re-onshoring of factories again to Japan, undoubtedly, would paint a rosier image for the foreign money. However these would additionally want vital coverage shifts that transcend pure financial issues.