Have you ever wondered why wealthy people are more willing to invest in hedge funds, venture capital, venture debt, private equity, and specialty funds? These are all actively-run funds that mostly have a history of underperforming the S&P 500. Yet, billions of dollars still pour in each year.

Some of these active funds are also considered alternative assets. Alternative assets tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market inefficiencies through active management. Alternative assets include venture capital, leveraged buyouts, oil and gas, timber, and real estate.

After investing in various actively-run funds with a portion of my capital since 1999, let me share with you the main reasons why I do so by age range. After a reader asked me for reasons in my post on how I’d invest $1 million, I realized my reasons have changed over time.

Why People Invest In Active Funds By Age Range

Our attitudes about money change over time. Let’s be aware of them and adjust accordingly.

1) Reasons to invest in active funds in your 20s: curiosity, naivety, access

I first invested in a hedge fund called Andor Capital in 1999. The offering was part of Goldman Sachs’ 401(k). At the time, Andor Capital had a good track record investing in technology and I wanted in, despite the higher fees.

I was a first-year financial analyst with a $40,000 base salary who couldn’t invest in Andor Capital otherwise. Hence, I seized the opportunity. In other words, I invested in an active fund because I had access. It felt good to be a part of a club – like skipping a long line at a popular night club because you know the bouncer.

I didn’t care about the higher fees because I wasn’t investing a lot in the first place. In 1999, the maximum contribution to a 401(k) was $10,000 and $10,500 in 2000. I was curious to know what this hedge fund could do.

Andor Capital outperformed during the 2000 an 2001 Dotcom bubble bust as it shorted a lot of tech stocks. As a result, I walked away with a positive impression of hedge funds back then.

Further, hedge funds were also some of Wall Street’s biggest clients. My boss would often refer to them as “smart money.” When you’re young, your limited experiences shape your entire world outlook. If you want to get rich, it’s better to be a hedge fund manager than to invest in one.

2) Reasons to invest in active funds in your 30s: hopes and dreams

As you gain more wealth a decade plus after school, you start dreaming of what it would like to be really rich. On a yearly basis, you get bombarded with stories of so-and-so fund manager crushing his returns, e.g. John Paulson netting $20 billion shorting mortgage-backed securities in 2008.

You realize that those who get extraordinarily wealthy in a relatively short period of time did not do so by investing in index funds. Every rich investor you hear about got rich by making concentrated bets. Therefore, your natural inclination is to follow their lead with some of your capital.

After ten years of active investing, you will finally start to realize some significant gains and losses. For most people, their active investments will underperform the S&P 500 or whatever passive index benchmark. Therefore, disillusionment about allocating more capital to active funds will creep in over time.

However, for those who’ve experienced greater wins than losses, the enthusiasm for active investing will continue. There might be a situation where an active investor earns a massive percentage return, but a relatively small absolute l dollar return. In such a scenario, the 30-something-year-old you might start thinking, I wish I had invested more!

Your 30s is a time where you long to earn as much money as possible. Investing in active funds or actively investing your money is consistent with your hopes and dreams of one day hitting the big time.

3) Reasons to invest in an active fund in your 40s+: security and capital preservation

After potentially twenty years of actively investing, you clearly realize there’s a 70%+ chance your active investments will underperform passive index investments. As a result, your exposure to active funds is congruent with reality.

Check out the percentage of institutional managers underperforming over ten years.

The good thing about investing in active funds in your 40s is that you should have more experience, wealth, and wisdom. You have a better idea of where to allocate your private capital. You may also have better access to historically better-performing funds.

In my 40s, I appreciate a fund manager dedicating their profession to looking after my capital. The more experienced the fund manager and the better the track record, the more comfort I feel. Because I already have enough capital to generate a livable passive income stream, I optimize more for peace of mind rather than returns.

If you invest in an index fund, the fund manager has no say in the fund’s investments. Instead, the fund manager simply buys and sells whatever company is added or subtracted from the index. But with an actively-run fund, the fund managers have the flexibility to protect its investors if they deem it necessary.

Given you also realize that active funds can also blow themselves up in any given year, you invest accordingly. For example, few invested in Melvin Capital (-39.3% in 2021, shut down in 2022 after being down 20%+ in 1Q2022) for capital preservation. Rather, most of its limited partners invested in the fund in hopes for maximum returns.

Hedging And Diversifying Against Financial Catastrophe

Most people who get wealthier eventually go into capital preservation mode. As the saying goes, “once you’ve won the game, there’s no need to continue playing.” But we all continue to play due to the desire for more. At the very least, we want to keep up with inflation.

We all know too many stories of people who became multi-millionaires overnight and lost it all and then some during a crash. For example, my breakfast sandwich maker made over $2 million during the 2000 Dotcom bubble. Today, he’s still making sandwiches (at a store he owns) partially because he didn’t sell.

Investing in active funds gives you the potential for better protecting yourself against losing lots of money. But the best way to truly protect yourself from big losses is to diversify your investments. Investing in active funds is just one part of the larger move.

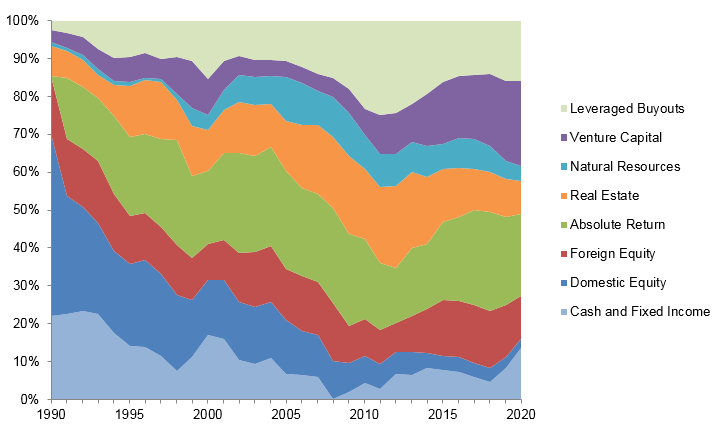

Below is Yale’s endowment asset allocation over time. Notice the small percentage allocated toward domestic equity and the large percentage allocated towards various active funds.

Let’s Say You Are A Deca-Millionaire

Pretend for a moment you have $10 million in investable assets, the threshold where most believe generational wealth begins. Based on a large Financial Samurai survey, $10 million is also the ideal net worth amount to have at retirement.

Let’s also assume your household spends $300,000 a year after-tax, which is enough to live a best life. Finally, let’s assume your household has no active income. The couple decided to negotiate severance packages and become starving authors because writing is what they love to do.

Based on long-term capital gains tax rates, earning a 5% return each year is enough to pay for the household’s entire annual living expenses. Therefore, there’s no need to invest the majority of the $10 million in the S&P 500, to hopefully earn the historical average return of 10%.

Diversifying For Capital Preservation And Lower Volatility

Instead, the household might cut up the $10 million into 40% real estate, 30% into public equities, 20% into active funds, and 10% into risk-free investments.

Real estate is less volatile and has historically paid the household a 7% annual return. The active funds consist of market-neutral funds and venture funds with 10-year vesting periods and historical 6 – 12% returns.

I could easily see this investment asset allocation generating 5% a year with low volatility. Heck, if there were no tax consequences, the household should be happy investing $10 million in a one-year Treasury bond yielding 5.2%.

Because when you have $10+ million, the last thing you want is it to experience a 19.6% drop in value, like we saw in the S&P 500 in 2022. That’s a $1.96 million paper loss, or more than eight times the household’s annual expenses. This type of volatility creates anxiety and stress.

Diversifying your risk exposure by investing in actively-run funds provides both protection and hope. Here’s my recommended split between active and passive investing. I invest about 25% of my investable capital in active funds and individual securities.

Peaceful Living Is What I Want

One Thursday in May, I took my three-and-a-half-year-old daughter to the San Francisco Zoo. She only goes to preschool Monday, Wednesday, Friday, so we spent the entire day together.

First we said hello to the giraffes eating their leaves. Then we visited Norman, her favorite gorilla. On the way to Little Puffer, the steam train, we waived hello to Mr. Wolverine.

She had so much fun waiving to everyone she passed by on the train as the wind made her hair dance. Without a time limit, we decided to ride the train again. I wanted to hear her squeals of joy once more!

As I put my left arm around her shoulder to ensure that she was safe, I felt love and tranquility. At that moment in time, I wasn’t on my phone or worrying about my investments. All I thought about was how lucky I am to be here with her on a weekday afternoon.

The feelings of peace, love, and tranquility are priceless. They dwarf the feeling of making a higher rate of return on some investment. Given these feelings are priceless, I don’t mind paying active management fees to people I trust who might better protect my money.

I’m under no illusion that my active investments or active funds will outperform the S&P 500 index a majority of the time. But I do know that whenever there is a big drawdown in the S&P 500, it will feel great if I don’t lose as much money.

As you get wealthier, you may also be more willing to pay for greater peace of mind as well.

Reader Questions And Suggestions

If you are an active investor, have your reasons for actively investing changed as you’ve gotten older? Have your views on investing in index funds changed as you’ve gotten wealthier?

Sign up with Empower, the best free tool to help you become a better investor. With Empower, you can track your investments, see your asset allocation, x-ray your portfolios for excessive fees, and more. Staying on top of your investments during times of uncertainty is a must.

Pick up a copy of Buy This, Not That, my instant Wall Street Journal bestseller. The book helps you make more optimal investment decisions so you can live a better, more fulfilling life.

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.