Employees in elements of Europe and South America have gotten more and more profitable in securing offers linking wages to inflation, a development intently monitored by financial policymakers as they search to maintain value rises underneath management.

Linking folks’s pay to inflation stays a lot much less commonplace than through the Seventies, when it was widespread in a number of economies — together with the US and UK. However offers that embody indexation clauses by no means went away in some international locations and there are indicators of a resurgence in locations reminiscent of Spain and Brazil.

Claudio Borio, head of the financial and financial division on the Financial institution for Worldwide Settlements, usually dubbed the central bankers’ financial institution, stated that by distorting market indicators, indexation made inflation tougher to shift.

“Choices will not be going to be the fitting ones,” Borio stated. “With indexation [inflation] is embedded, it’s what occurs [automatically].”

In Spain, the place annual inflation in August was 10.5 per cent and electrical energy payments are up by 70 per cent over the identical interval, unions are profitable negotiations for extra of their members’ contracts to be listed to costs.

Such contracts already cowl nearly a 3rd of Spanish collective wage agreements, up from lower than a fifth on the finish of 2021, and are anticipated to achieve half subsequent yr, in line with the nation’s central financial institution.

Financial institution of Spain governor Pablo Hernández de Cos warned earlier this yr in regards to the threat of a dreaded “wage-price suggestions loop”, the place inflation turns into tougher for central banks to regulate and feeds by into much more stress for greater wages.

Defending the offers, the UGT, one among Spain’s greatest unions with 960,000 members, stated staff shouldn’t be “as soon as once more those to pay the price of a disaster.”

To this point, Spanish wages are rising properly under inflation, like these of most staff throughout Europe. Spanish financial institution CaixaBank has constructed a wage tracker based mostly on clients’ payslips, which confirmed they rose 2.5 per cent within the yr to June, up from 2.4 per cent in Could.

On Thursday, economists anticipate information on eurozone hourly wages to indicate a 1.8 per cent year-on-year rise within the second quarter, down from 3.3 per cent within the first quarter, leaving many staff with large pay cuts in actual phrases.

But when the development in the direction of indexation continues, it’s prone to develop into a mounting concern for this era’s financial policymakers.

The European Central Financial institution, which itself rejected calls from its workers union for inflation-linked pay rises earlier this yr, mentioned the indicators of indexation turning into extra widespread at its July assembly.

In some international locations — together with eurozone members reminiscent of Luxembourg, Cyprus, Malta and Belgium — indexation by no means fully went away. However Luxembourg this yr suspended pay rises due underneath its indexation rule and gave staff tax credit as a substitute.

In Belgium, there’s a debate brewing over guidelines that robotically regulate the pay of most private and non-private sector staff’ pay in keeping with a “well being index” of inflation that excludes gasoline, alcohol and tobacco costs.

The rule means hourly wage prices in Belgium are set to rise 12 per cent in whole over the following two years, the nation’s central financial institution has forecast, 4.8 share factors greater than in France, Germany and the Netherlands, the place indexation is much less widespread.

The nation’s Unizo employers’ affiliation said wage development at that degree can be “devastating for our economic system and employment” and known as for an “index skip” by the federal government to decrease anticipated wage rises this yr.

That concept has been rejected by Lars Vande Keybus, financial adviser at ABVV, Belgium’s largest union with 1.5mn members. “Buying energy is extraordinarily necessary if we don’t need to fall right into a deeper recession subsequent yr,” he stated.

The observe additionally provides a method to guard essentially the most weak from value of residing crises — in lots of economies minimal wages and pensions have lengthy been listed to costs.

However in Brazil and Argentina, economists say the observe is turning into an more and more necessary cause why the latest surge in inflation is turning into entrenched.

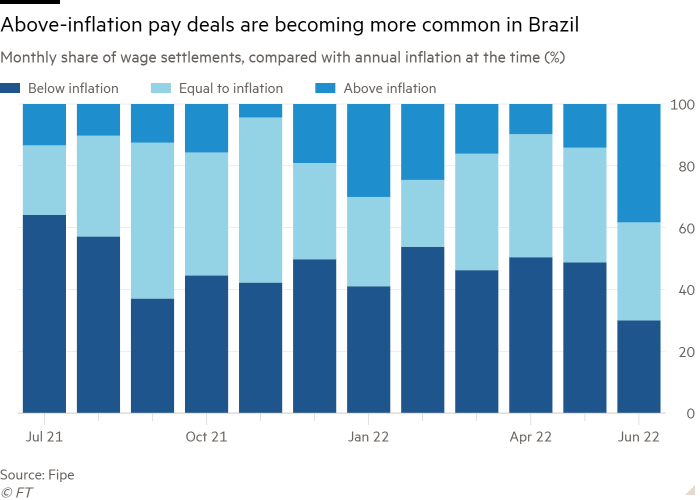

After years of getting to accept meagre wage development, greater than 70 per cent of pay rises awarded to Brazilian staff in June have been at or above the speed of client value inflation.

Alessandra Ribeiro, an economist at consultancy Tendências in São Paulo, stated that till 2019 indexation accounted for 32-35 per cent of the rise in client costs. At the moment, it accounts for 40 per cent, she stated, including: “It’s a big drawback. It creates huge difficulties for the central financial institution to deliver inflation underneath management.”

Brazil’s minimal wage was elevated 10 per cent on the finish of final yr to regulate for value development.

In neighbouring Argentina, the place inflation is expected to achieve 90 per cent this yr, indexation can be turning into extra entrenched, spreading to non-public healthcare prices this yr.

Surging costs have meant annual pay rounds are being changed by semi-annual and even quarterly negotiations in Argentina. “The sooner unfold of shocks [encouraged by indexation] may cause a sequence of dangerous outcomes,” stated Santiago Manoukian, chief economist at consultancy Ecolatina in Buenos Aires.