The Financial institution of England on Thursday lived as much as its promise to behave “forcefully” to curb surging inflation, by saying the largest improve in rates of interest for greater than 1 / 4 of a century.

However whereas the rise in borrowing prices was not more than analysts had anticipated, the central financial institution’s intensely gloomy view of the speedy financial outlook got here as a shock.

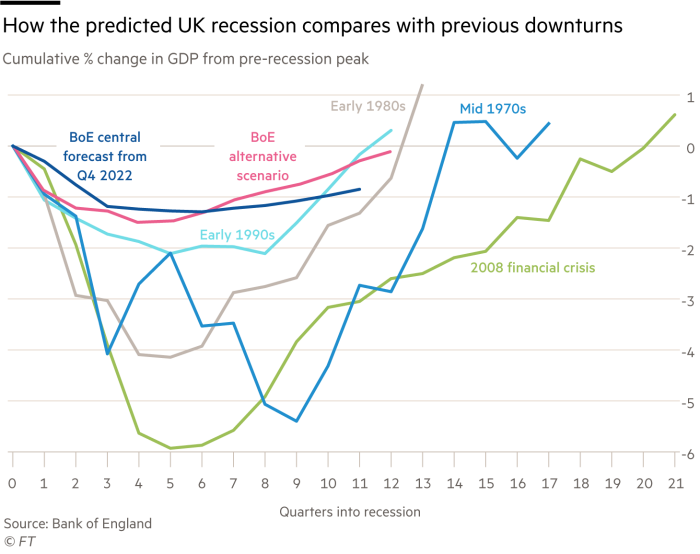

BoE policymakers have stepped up the tempo of financial tightening regardless of predicting a recession set to match that of the early Nineties, and the largest fall in family incomes for greater than 60 years.

Andrew Bailey, BoE governor, argued this painful squeeze on dwelling requirements was now inevitable and essential to deliver inflation beneath management and keep away from a harsher financial downturn later.

“Inflation hits the least well-off hardest. If we don’t act now . . . the results later will probably be worse,” he mentioned at a press convention after the BoE Financial Coverage Committee’s choice to boost rates of interest by 0.5 share factors to 1.75 per cent.

He added that regardless of the “very uncomfortable place” through which policymakers discovered themselves, “there are not any ifs or buts in our dedication to the two per cent inflation goal”. Client worth inflation hit a contemporary 40-year excessive of 9.4 per cent in June.

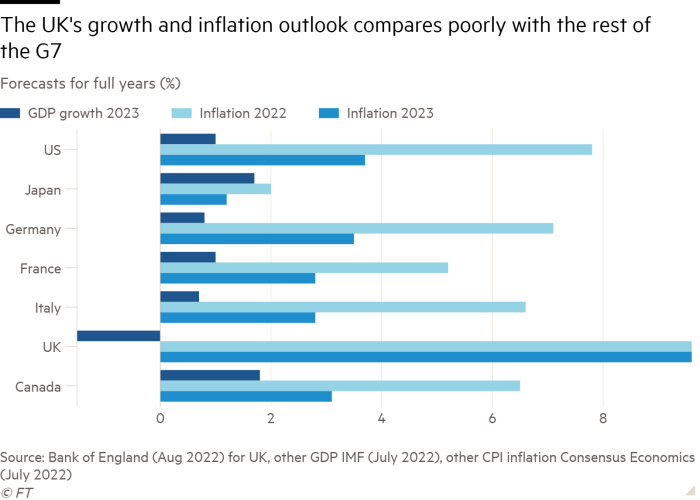

Huge downgrades to the BoE’s progress forecasts are nearly completely due to the renewed surge in wholesale fuel costs stemming from Russia’s restriction of provides. Analysts mentioned this might hit the UK financial system tougher than others in Europe, the place governments have finished extra to protect customers.

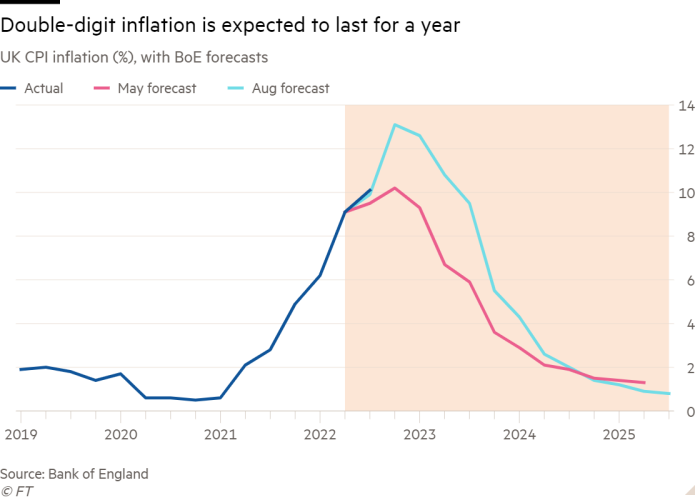

The BoE estimates a typical UK family’s annual gasoline invoice might now rise from slightly below £2,000 to about £3,500 when regulators reset their cap on costs in October — driving shopper worth inflation above 13 per cent by the tip of the yr and preserving it in double digits for a lot of 2023.

“The speedy inflation outlook is now so dire that the Financial Coverage Committee feels it has no choice however to engineer a extra extreme financial downturn,” mentioned Ross Walker, economist at NatWest Markets, calling it a “deeply sobering shift in coverage”.

However this near-term surge in inflation will not be policymakers’ principal concern — regardless of criticism levelled on the BoE by some Conservative MPs for failing to behave sooner to curb worth rises.

Policymakers mentioned the inflation spike was largely due to international pressures which can be already easing, with commodity costs edging down and provide chains beginning to run extra easily.

Ben Broadbent, BoE deputy governor, mentioned the central financial institution couldn’t have foreseen the warfare in Ukraine and couldn’t realistically have countered its results, even with “extraordinary perception”, given the size of the response wanted to offset such an unprecedented set of shocks.

The MPC’s greater fear is that inflation will stay above the BoE’s 2 per cent goal as soon as these international pressures subside, if companies and households change into accustomed to costs rising quickly and alter their behaviour because of this.

“We’ve seen issues which do concern us, frankly,” mentioned Bailey, pointing to survey proof that wage progress had accelerated since Might, towards a backdrop of ongoing labour shortages, whereas companies nonetheless felt assured of passing on greater prices to customers.

However the BoE thinks the looming recession will quickly take the warmth out of the labour market, with unemployment set to rise from the center of subsequent yr and exceed 6 per cent by the center of 2025.

The central financial institution’s forecasts recommend inflation might fall under its 2 per cent goal by the tip of 2024, even when power costs remained excessive for longer than markets at the moment anticipate and if the BoE took no additional coverage motion, with rates of interest fixed on the new stage of 1.75 per cent.

Bailey mentioned the uncertainty round these forecasts was exceptionally excessive, particularly when it got here to power costs, and made it clear that the BoE’s aggressive motion on Thursday shouldn’t be taken as a sign that it will now embark on a pre-determined collection of speedy charge rises.

“Coverage will not be on a preset path, and what we do that time doesn’t inform you what we’re going to do subsequent time,” he mentioned. “All choices are on the desk at our September assembly and past.”

One step the BoE does plan to absorb September is to start out month-to-month gross sales of the £875bn of property amassed beneath its quantitative easing programmes — with regular disposals geared toward decreasing the inventory by about £80bn over the primary 12 months. However the BoE made it clear that rates of interest would stay its principal device for adjusting financial coverage.

Analysts mentioned the BoE’s forecasts instructed rates of interest may must fall over the long term, even when the MPC thought it essential to tighten coverage additional within the close to time period to deliver inflation in examine.

“Total the financial institution is forecasting stagflation and suggesting that within the close to time period, the medication is the robust love of upper rates of interest and that additional forward the consolation blanket of rate of interest cuts could also be wanted,” mentioned Paul Dales on the consultancy Capital Economics.

However Sandra Horsfield, economist at Investec, famous the BoE’s forecasts didn’t consider any of the fiscal stimulus each candidates for the Conservative celebration management had proposed — and that tax cuts, or different political selections, might have an effect on the outlook “materially”.