By Philip Wegmann for RealClearPolitics

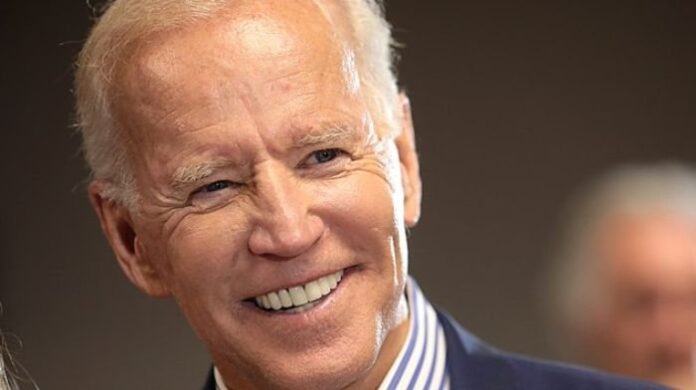

After asserting government motion to unilaterally and retroactively wipe away $300 billion in federal pupil debt, President Biden seemed over his shoulder to reply a query: Was this debt forgiveness honest to those that had sacrificed and saved to pay their method by means of faculty? Biden deflected.

“Is it honest to individuals who, in truth, don’t personal multibillion greenback companies,” he replied. “A few of these guys need to give all of them tax breaks,” he stated, seemingly referring to unrelated Republican tax proposals. “Is that honest?” he requested the reporter. “What do you suppose?”

Then, the president left. The elemental query of equity, nonetheless, stays as hundreds of thousands of People now search the Division of Training’s web site for steering to see in the event that they qualify for mortgage forgiveness. Or if they might have certified had they not repaid their loans earlier.

In line with the plan, the White Home will cancel $10,000 in federal pupil debt loans for any particular person making lower than $125,000 a yr and $20,000 for these with Pell grants. Republicans rapidly complained that the debt amnesty was “a slap within the face to working People.” For a lot of working in Washington, D.C., nonetheless, it was a sigh of reduction.

Pupil debt forgiveness is private for the Biden administration. About one in 5 of the White Home aides required to file a monetary disclosure, as Bloomberg Information previously noted, reported owing pupil debt. Collectively, these 30 senior White Home staffers owe as a lot as $4.7 million. These private funds usually are not uncommon within the nation’s capital.

There’s extra excellent pupil debt in Washington than in some other metropolis within the nation. The typical debtor in D.C., in accordance with a 2021 breakdown by the small enterprise analyst, AdvisorSmith, owes $54,982 in unpaid student loans. This consists of many political staffers on the Division of Training, senior advisors in addition to junior aides who moved to that company from the Biden marketing campaign.

Evaluation of monetary disclosures by the conservative-leaning American Accountability Basis discovered that the political employees on the company that oversees the coed mortgage program stand to profit. The excellent pupil mortgage debt steadiness amongst 41 training staffers evaluated may quantity to between $2.8 and $6.5 million. In line with the AAF estimate obtained by RealClearPolitics, the president could have wiped away as a lot as $512,646 of their debt.

Assist Conservative Voices!

Signal as much as obtain the newest political information, perception, and commentary delivered on to your inbox.

Greater than 45 million People owe $1.6 trillion in federal pupil debt, a steadiness that the New York Occasions reviews dwarfs what they owe in automobile loans, bank cards, and different shopper debt. The White Home insists that the administration’s plan will goal low- to middle-income debtors particularly, with 90% of reduction going to earners who make lower than $75,000 a yr. As many as 43 million individuals can profit, in accordance with an administration infographic, and 20 million individuals “can have their loans totally cancelled.”

It’s exactly the sort of reduction, Biden stated, that the nation wants post-pandemic. “All of this implies individuals can begin lastly to climb out from beneath that mountain of debt,” the president stated. “To lastly take into consideration shopping for a house or beginning a household or beginning a enterprise. And by the way in which, when this occurs the entire economic system is best off.”

RELATED: Teachers Union Dumps Seniority Rules, Will Instead Decide Layoffs Based On Skin Color

Mitch McConnell known as it “pupil mortgage socialism.” The Republican Senate minority chief accused the president of delivering “a slap within the face to each household who sacrificed to avoid wasting for school, each graduate who paid their debt, and each American who selected a sure profession path or volunteered to serve in our Armed Forces as a way to keep away from taking over debt. This coverage is astonishingly unfair.”

Tom Jones echoed that criticism. The founding father of AAF pointed to the “windfall” that political staff on the Training Division had been set to obtain, calling it “shameful” proof of “the hole between the individuals and the ruling class in Washington, D.C.” Press spokesmen for the division didn’t reply to RCP requests for remark.

Susan Rice dismissed gripes about equity as “inaccurate” and a part of a “double commonplace.” The director of the White Home home coverage council, previously a visiting fellow at Harvard, an establishment with an untaxed $53 billion endowment, instructed reporters that “Republicans didn’t complain when sure small companies through the pandemic obtained extraordinary monetary reduction with out having to pay again these loans.” The forgiven federal loans in query, from pupil loans and from the pandemic, had been a part of the identical precept.

Rice stated it “is implausible” that some people had been in a position to repay their loans already, however “that doesn’t imply that as a result of some individuals had been ready to take action, no person ought to assist people who weren’t. By that logic, we wouldn’t assist anyone on this nation.”

Democrats repeatedly met Republican criticism with the identical rebuttal: What in regards to the GOP tax reduce? However criticism wasn’t simply coming from the suitable. Jason Furman, the chairman of Barack Obama’s White Home Council of Financial Advisors, accused Biden of “recklessly” pouring “gasoline on the inflationary hearth that’s already burning.”

“Doing it whereas going effectively past one marketing campaign promise ($10K of pupil mortgage reduction) and breaking one other (all proposals paid for) is even worse,” Furman tweeted.

The White Home was keen to focus on the sympathetic instances on Wednesday, the “typical nurse” who brings dwelling $77,000 a yr and the “typical construction worker” who makes $38,000. “However then why design a coverage that would supply as much as $40,000 to a married couple making $249,000,” Furman requested.

When RealClearPolitics requested Bharat Ramamurti if forgiving a portion of the federal debt owed by regulation faculty and enterprise faculty graduates was actually constructing from “the bottom-up and middle-out,” the deputy director of the president’s Nationwide Financial Council replied, “Yeah, it is.”

RELATED: The Master of Politicizing Schools Says Education is Too Politicized

“As we’ve made clear, no person within the high 5% of incomes goes to get a single greenback beneath this proposal,” he stated, including that the administration had “good information” that top earners “close to the highest of the revenue cutoff are more likely to be experiencing misery after reimbursement begins.”

Ramamurti once more in contrast Democrat debt amnesty to the Republican tax reduce. “It’s principally the reverse,” he told RCP, the place “15% of the advantages went to individuals making beneath $75,000 a yr, and 85% went to individuals making over $75,000 a yr.”

Training Secretary Miguel Cardona insisted that the goal of Biden’s government motion was to offer pandemic reduction. “Chatting with the equity query,” he instructed Fox Information, pupil debt reduction was no completely different than pandemic small enterprise loans. “It’s about ensuring we’re taking good care of People and investing in our economic system and in our individuals.”

“However the people who already paid their pupil loans, they don’t get something out of this deal,” requested Peter Doocy.

Syndicated with permission from Actual Clear Wire.

The opinions expressed by contributors and/or content material companions are their very own and don’t essentially replicate the views of The Political Insider.